Investment management firm VanEck announced plans to close its Ethereum futures ETF after a thorough evaluation. The Board of Trustees at VanEck ETF Trust made the decision on Thursday.

Ethereum-based ETFs have consistently underperformed, in contrast to their Bitcoin (BTC) counterparts.

VanEck to Terminate Ethereum Futures ETF

VanEck will shut down its Ethereum Strategy ETF, which trades on the Chicago Board Options Exchange (Cboe) under the ticker symbol EFUT, after a thorough evaluation. The firm assessed factors such as performance, liquidity, assets under management (AUM), and investor interest before deciding to liquidate the fund.

VanEck has urged EFUT shareholders to sell their shares on the Cboe before the market closes on September 16. After this date, EFUT will no longer be listed on the exchange. The fund will be fully liquidated on September 23, with the proceeds distributed to shareholders.

“Wasn’t going to be very successful considering how the ETH ETFs have been doing,” one user on X said.

Read more: How to Invest in Ethereum ETFs?

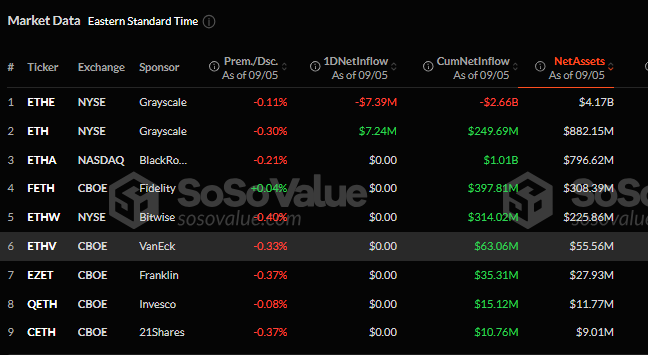

Spot Ethereum ETFs have been struggling since their launch, with poor performance across the board. Data from Farside Investors shows that VanEck’s spot ETH ETF, ETHV, which carries a 0.20% fee, has recorded inflows on only two of the last 13 trading days. This underperformance isn’t limited to VanEck; many issuers face similar or worse outcomes, including Grayscale’s ETHE.

BeInCrypto highlighted that Ethereum spot ETFs have shown dismal results, with just one week of inflows recorded over 30 trading days as of August 22. According to SoSoValue, only BlackRock’s ETHA ETF has surpassed the $1 billion mark in cumulative net inflows, followed by Fidelity with $397 million.

BlackRock’s ETHA ETF, which has outperformed its peers, has even expanded to Brazil, trading under the ETHA39 ticker through Brazilian Depositary Receipts (BDRs) on the B3 stock exchange. However, as of September 5, cumulative total net inflows for Ethereum ETFs remain negative at -$562 million, according to SoSoValue.

Read more: Ethereum ETF Explained: What It Is and How It Works

In contrast, spot Bitcoin ETFs have fared significantly better, recording a cumulative total net inflow of $17.06 billion. Since its introduction to Wall Street in January, the financial instrument has also contributed to increased crypto adoption in Australia.

“Bitcoin ETFs are likely to boost crypto adoption across both institutional and retail segments in Australia. Institutional investors are already increasingly accessing crypto through partnerships between exchanges and traditional asset management firms and banks. With the launch of Bitcoin ETFs, more retail users are expected to add cryptocurrencies to their investment portfolios. Retail investors are seeking a regulated, hassle-free way to invest in Bitcoin without dealing with the complexities of managing private keys or navigating crypto wallets. The ease of access is expected to drive further adoption among retail investors, contributing to the mainstream acceptance of cryptocurrencies in Australia,” Bitget COO Vugar Usi Zade told BeInCrypto, citing Bloomberg Intelligence Senior ETF Analyst Rebecca Sin.

VanEck did not respond to BeInCrypto’s request for comment. The firm humorously noted that the approval of its spot Ethereum ETP played a role in its decision.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.