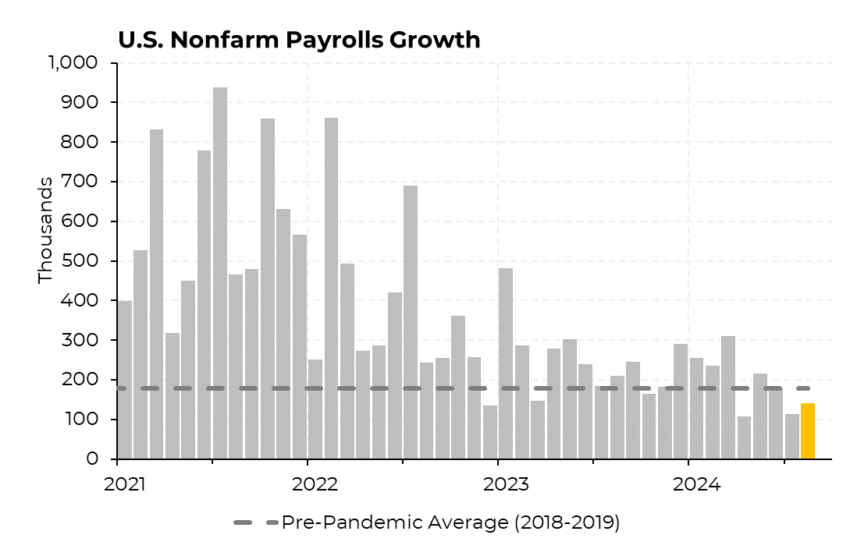

Markets anticipate a 50 basis point (bp) rate cut in September amid deteriorating US Job data. According to the US Non-farm Payrolls (NFP) data released on Friday, the US economy added 142,000 jobs in August, below the expected 164,000.

Due to this anticipation, Bitcoin shot up over 2% within 30 minutes.

Bitcoin Approaches $57,000

At the time of writing, Bitcoin (BTC) is trading for $56,821, swiftly moving towards the $57,000 mark.

The August unemployment rate hit expectations, coming in at 4.2%. It means unemployment is back on the decline, after the 4.3% recorded in July.

“Big decline in “temporary layoffs” in August. That’s a key reason the unemployment rate went back to 4.2%. It looks like July’s big unemployment rate spike was mostly a fluke. But it’s undeniable the labor market is cooling off a lot (and could easily get worse),” Heather Long, Economic Columnist at the Washington Post, said.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

While these data show that the US job market has cooled off, they also indicate that there are clear warning signs. Nevertheless, a “soft landing” remains possible. In the immediate aftermath of the report, risk-on assets like Bitcoin jumped briefly, testing $57,000 in response to the greenback’s weakening over weak US job data.

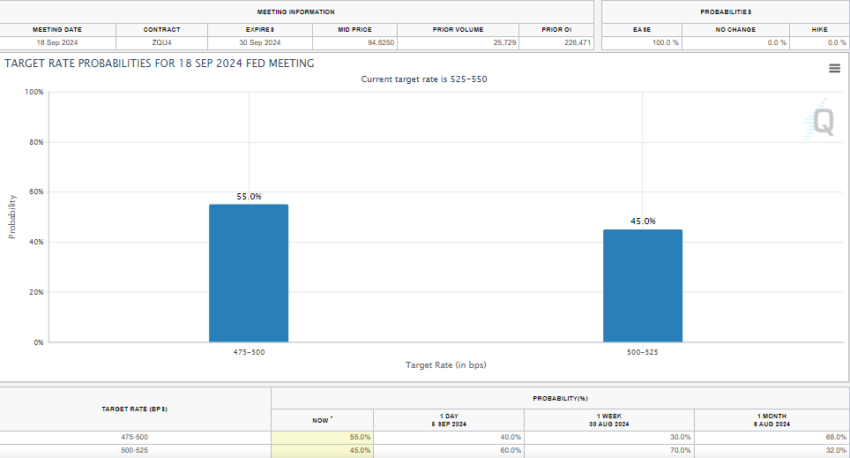

Based on the Fed’s CME Watchtool, markets are pricing in a 50bp cut in September, as probabilities jump from 30.5% to 55%. Meanwhile, the probability of a 25bp rate cut has since shrunk to 45%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.