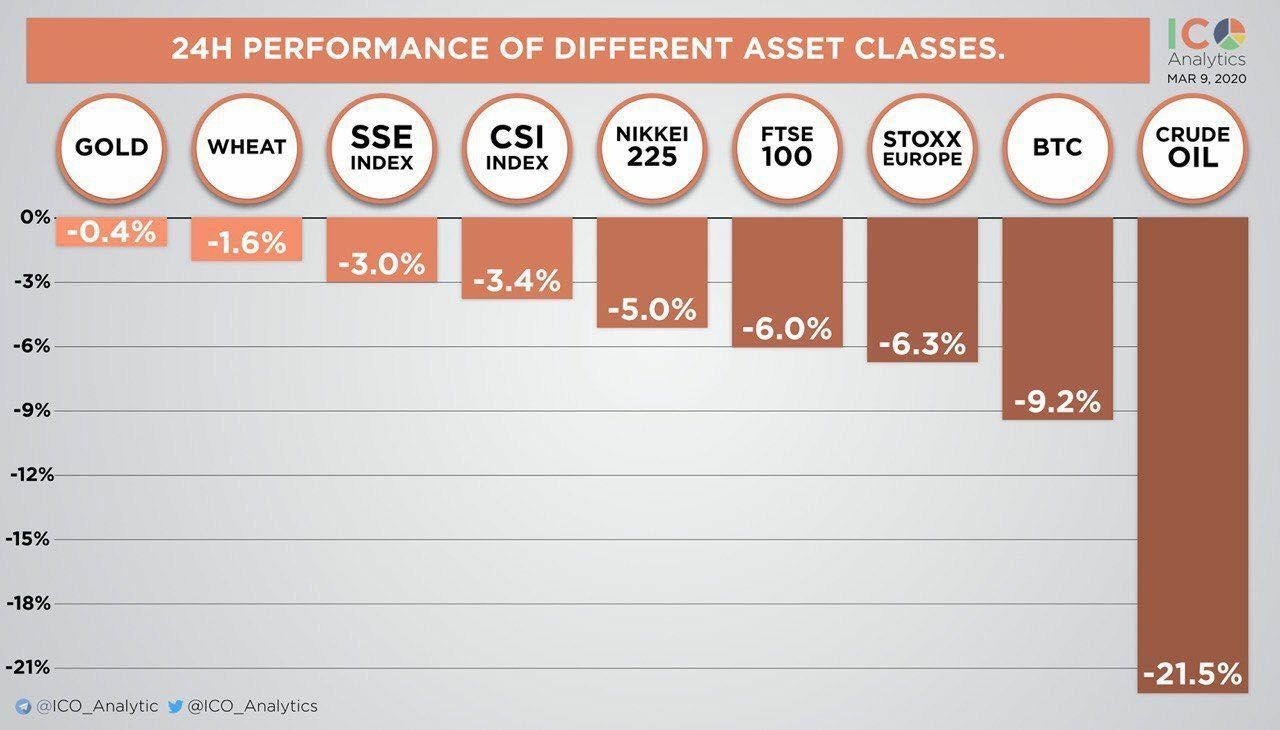

In the last 24 hours, Bitcoin is the second worst-performing asset class, behind crude oil. It is currently down some -10.50 percent, at the time of writing.

Given Bitcoin’s drastic drop in the last 24 hours amid the oil price war, the leading cryptocurrency does not seem mature enough to be treated as a global hedge against uncertainty just yet.

The last 24-hour performance of major asset classes is telling on what the market thinks of the still-small cryptocurrency market. It seems that institutions and major investors have not given in to claims that Bitcoin is the ‘perfect hedge.’

At the moment where Bitcoin (BTC) should shine, it has quickly dropped along with the rest of the global market — in fact, it has fallen much worse than practically anything else today, aside from crude oil.

According to ICO Analytics (@ICO_Analytics), the losses are staggering across the board. With crude oil being down some -21 percent, Bitcoin is not far behind. Gold remains the most stable but still posted minor losses. Since this chart was first posted, Bitcoin has actually fallen further and is now down -10.50 percent on the daily.

The losses have sparked fears of a possible recession. The last three days for the Dow Jones, so far, has mirrored the crash of 1929 — if this trend holds up.

Although many in the cryptocurrency world have been pushing the narrative that Bitcoin is the best hedge, we have to be reminded that it is still a young asset in the greater scheme of things. It also possesses a tiny fraction of global trading volume, when compared to more proven hedges like gold.

Perhaps Bitcoin could someday be a hedge. In 2019, when the markets were relatively tame by comparison, it proved to be a useful indicator. Now that we are amid a more serious economic crisis, along with the global pandemic, market faith in Bitcoin as an indicator is slipping. Investors are opting for more traditional options to say safe or, in many cases, preferring the sit the market out entirely with U.S. dollars.

We must keep in mind that Bitcoin has never experienced an actual recession, so it is currently unknown how it will respond. In trying times like these, however, it has so far demonstrated that the leading cryptocurrency is not yet ready.

The losses have sparked fears of a possible recession. The last three days for the Dow Jones, so far, has mirrored the crash of 1929 — if this trend holds up.

Although many in the cryptocurrency world have been pushing the narrative that Bitcoin is the best hedge, we have to be reminded that it is still a young asset in the greater scheme of things. It also possesses a tiny fraction of global trading volume, when compared to more proven hedges like gold.

Perhaps Bitcoin could someday be a hedge. In 2019, when the markets were relatively tame by comparison, it proved to be a useful indicator. Now that we are amid a more serious economic crisis, along with the global pandemic, market faith in Bitcoin as an indicator is slipping. Investors are opting for more traditional options to say safe or, in many cases, preferring the sit the market out entirely with U.S. dollars.

We must keep in mind that Bitcoin has never experienced an actual recession, so it is currently unknown how it will respond. In trying times like these, however, it has so far demonstrated that the leading cryptocurrency is not yet ready.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored