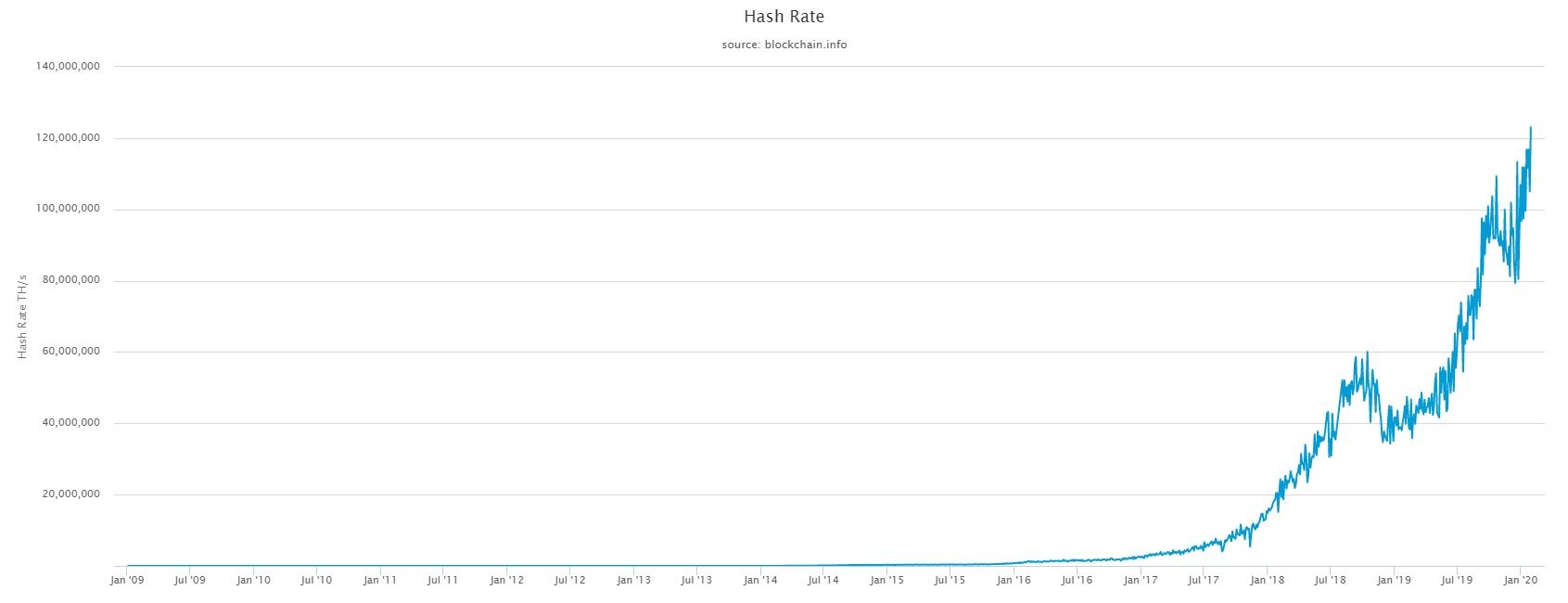

Bitcoin’s hash rate just hit another all-time high. The collective computing power supporting the network now stands at more than 123,011,832 terahashes per second.

Although the hash rate has dropped a few times in Bitcoin’s history, the upwards trend is more pronounced — even than the price of the leading cryptocurrency.

Bitcoin’s hash rate is a measure of the number of guesses a system can make at a cryptographic hash every second. Correctly guessing the hash of a block of transactions allows a mining unit to add that block to the blockchain. The miner receives a reward for their work. This consists of both transaction fees and a fixed amount of new Bitcoin unlocked with every block.

Each individual Bitcoin mining unit has its own hash rate. The network hash rate, which just reached its all-time high, is a collective measure of the hash rate of all Bitcoin miners mining the network.

The fixed amount of Bitcoin miners receive, known as a block reward, halves about every four years. BeInCrypto has reported many times before on analysts that believe this constriction of supply will result in higher Bitcoin prices. Rising hash rate going into the halving suggests that those operating mining equipment also believe this to be the case.

We can attribute the rapid growth in hash rate over Bitcoin’s existence to two main factors:

Bitcoin’s hash rate is a measure of the number of guesses a system can make at a cryptographic hash every second. Correctly guessing the hash of a block of transactions allows a mining unit to add that block to the blockchain. The miner receives a reward for their work. This consists of both transaction fees and a fixed amount of new Bitcoin unlocked with every block.

Each individual Bitcoin mining unit has its own hash rate. The network hash rate, which just reached its all-time high, is a collective measure of the hash rate of all Bitcoin miners mining the network.

The fixed amount of Bitcoin miners receive, known as a block reward, halves about every four years. BeInCrypto has reported many times before on analysts that believe this constriction of supply will result in higher Bitcoin prices. Rising hash rate going into the halving suggests that those operating mining equipment also believe this to be the case.

We can attribute the rapid growth in hash rate over Bitcoin’s existence to two main factors:

- Firstly, the hardware used to mine the network is constantly increasing in sophistication. The likes of Bitmain now produce hardware units capable of more than 50 TH/s. To put this into perspective, Blockchain.com reports the entire network’s hash rate as being around 10 TH/s in Bitcoin’s early days.

- Another factor behind the surging hash rate is the proliferation of mining operations deploying this new high tech hardware. The rising Bitcoin price over the years has encouraged more firms to deploy hardware on the network. New announcements of mining operations these days, as BeInCrypto has previously reported, are made by massive commercial entities and cost millions to set up. It’s clear from the sheer outlay that those behind such operations are bullish for Bitcoin’s future.

For many cryptocurrency analysts, the rising hash rate represents a significant increase in Bitcoin’s fundamental value. Leading into the Bitcoin halving, they interpret the network’s increased computational power as a sign of an impending bull run.The #Bitcoin hash rate JUST HIT a new ALL-TIME-HIGH!

— The Moon 🌙 (@TheMoonCarl) January 30, 2020

A whopping 123,011,832 TH/s!!!

The $BTC fundamentals are screaming for a huge bull run leading into the halving! 🚀

BULLISH!! pic.twitter.com/HB6JLSy6V0

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rick D.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

READ FULL BIO

Sponsored

Sponsored