Bitcoin prices have dipped below the psychological $40,000 level as the crypto market correction deepens. However, the downsides may be limited due to a number of factors according to financial ratings firm Weiss.

On January 23, Bitcoin prices tumbled below $40,000 hitting an intraday low of $39,494 during the Tuesday morning Asian trading session.

Bitcoin Correction Continues

However, on January 22, Weiss Crypto stated that even if Bitcoin continues to slide for the rest of this month, the downside will be limited by three things.

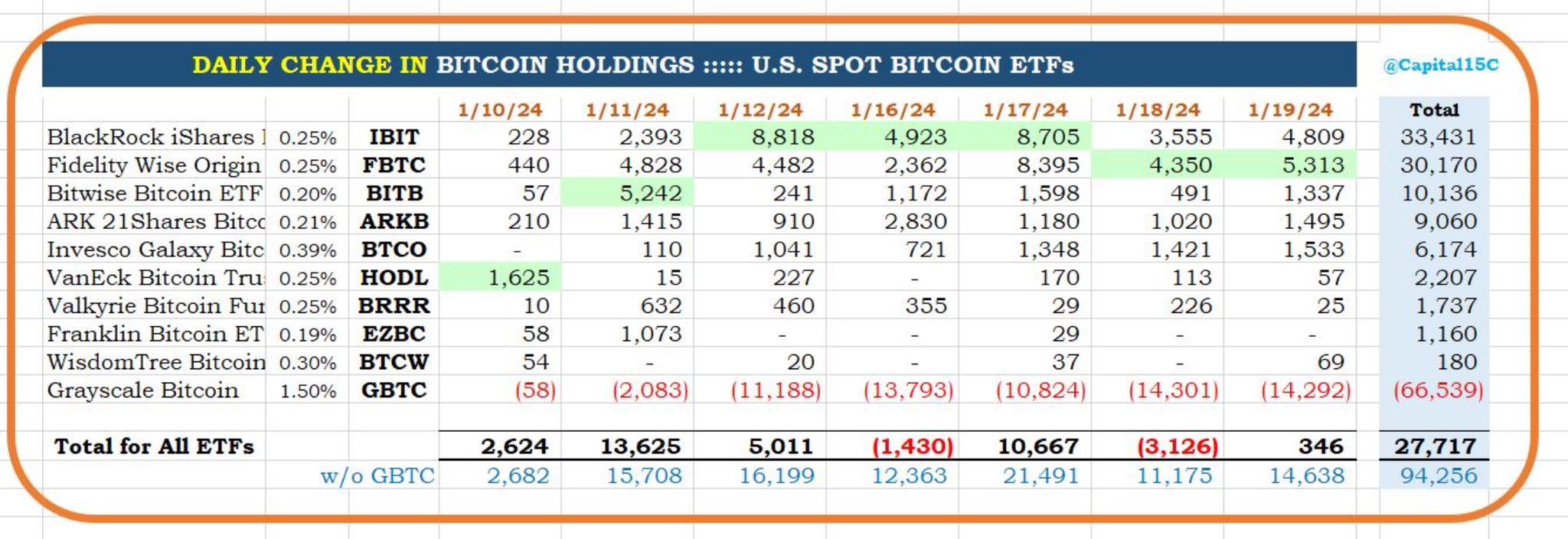

Firstly, the influx of institutional investment via spot Bitcoin ETFs will limit downsides, it stated.

“The tremendous power of new capital flowing into crypto from traditional investors who can now access Bitcoin via the 11 new ETFs issued by the biggest players on Wall Street.”

Despite the outflows from the Grayscale Bitcoin Trust (GBTC), 27,717 BTC has been bought since ETF launches on a net basis, reported CC15Capital on Jan. 23. That equates to around $1.1 billion at current prices.

Secondly, the halving event in late April or early May, which will cut already limited new supplies of BTC by half, will limit downsides, said Weiss.

With 19.6 million BTC already circulating this will create a supply shock. Nevertheless, prices usually move six months after the halving so there may not be an immediate rally.

Read more: Who Owns the Most Bitcoin in 2024?

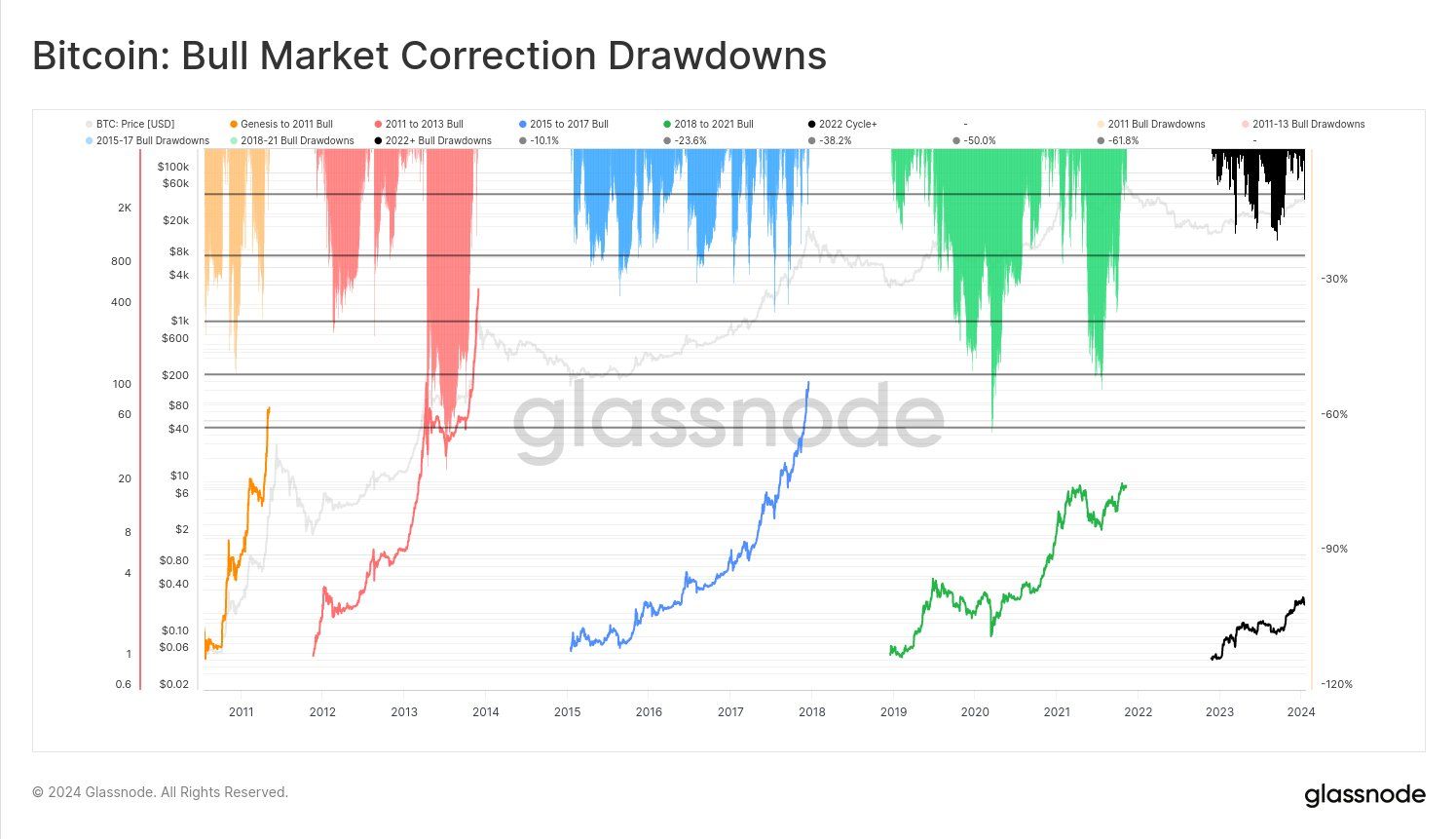

Crypto market cycles were the third reason Weiss cited for limited Bitcoin price downsides.

“The crypto four-year cycle itself, which has historically come with a major new price explosion precisely around this time.”

There are usually mid-cycle tops between major cycle peaks which appears to have occurred on Jan. 10 when BTC hit $48,500.

Moreover, a 30% correction has been predicted which could send Bitcoin prices back to around $34,000.

On Jan. 23, Glassnode analyst “Checkɱate” posted a chart showing previous cycle correction drawdowns so there could be more pain before the gains.

Crypto Market Outlook

Total market capitalization has fallen 3.3% on the day to $1.65 trillion at the time of writing. BTC had reclaimed the $40,000 price level but the short-term trend was still down.

Ethereum was changing hands for $2,337 after losing 4.1% on the day as it continues to correct.

The altcoins were a sea of red with larger losses for Solana, Avalanche, Chainlink, Polkadot, and Litecoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.