Bitcoin Cash (BCH) price continues to hit new lows in July since dropping from its recent 2023 high of $320 on June 30. Amid mounting losses, BCH investors are now looking to make one final push to avoid a prolonged bearish reversal.

Bitcoin Cash (BCH) hit a new high in 2023 with a price of $320 on June 30, following renewed interest from institutional investors. With the recent whale accumulation frenzy now cooling off, long-term BCH investors are struggling to soak up the rising selling pressure.

Losses are Mounting for Bitcoin Cash Holders

The Bitcoin Cash price has been in a downtrend for the better part of July so far. Even last week’s altcoin market rally triggered by XRP’s victory against the SEC seems to have exacerbated the losses even further.

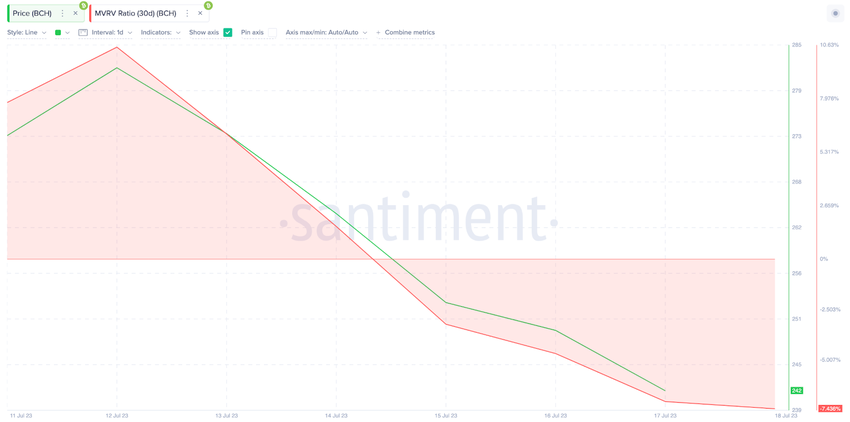

The current Market Value to Realized Value (MVRV) ratio clearly shows the growing level of losses among BCH holders. After weeks of the downtrend, the Bitcoin Cash MVRV ratio has dropped into negative values this week.

The chart below shows the BCH MVRV (30d) ratio dropping from 10% profits to -8% losses between July 12 and July 18.

The MVRV ratio analyses holders’ net-financial position by comparing the current market prices to the average price at which coins last moved.

Hence, the chart above depicts that most holders that acquired BCH in the last 30-days are now 8% underwater.

As they desperately look to avoid hitting the 10% loss mark, Bitcoin Cash investors could make one last push to offer some bullish support.

Read More: How To Make Money in a Bear Market

Long-term Investors are Cooling the Selling Pressure

Furthermore, on-chain data shows that long-term BCH holders have also made last-ditch efforts to avert a prolonged bearish reversal. According to data compiled by Santiment, the long-term holders began to cool their selling pressure last week when BCH dropped below $275.

As depicted in the chart below, BCH Age Consumed between July 13 and July 17 has dropped by 73% from 21.57 million to 5.72 million.

Age Consumed metric is derived by multiplying coins in circulation by the number of days spent in current wallet addresses. This evaluates network-wide selling pressure by tracking long current holders have held their tokens.

A drop in Age Consumed is considered a bullish signal, indicating that holders are keeping their tokens longer on average.

In summary, the mounting unrealized losses and the drop in Age Consumed values mean that many BCH holders are unwilling to sell at the current prices.

In a bid to hold out for higher prices, they could trigger one last attempt at rekindling the BCH price rally.

Read More: Top 11 Crypto Communities To Join in 2023

BCH Price Prediction: Potential Rebound to $270

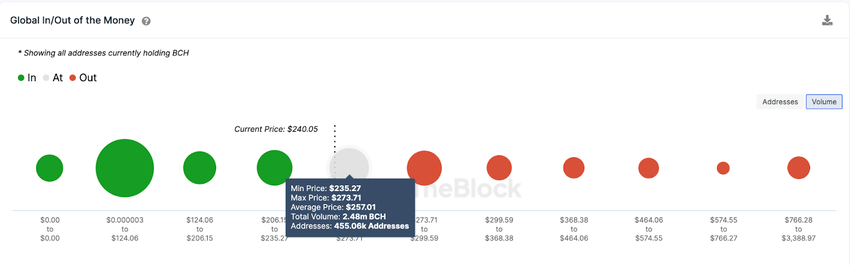

Considering the factors highlighted above, BCH will likely rebound toward $270 before entering another reversal. However, the bulls will face significant resistance at the $257 territory.

IntoTheBlock’s GIOM data shows that 455,000 investors had bought 2.48 million BCH coins at an average price of $257. If they chose to exit their positions, Bitcoin Cash could enter another round of losses.

However, if the bulls could push that resistance aside, BCH could hit $280 once gain.

Still, the bears could stay in control if they can flip the $230 support level. However, the 353,000 investors that bought 1.95 million BCH at the maximum price of $235 will offer considerable support.

But if BCH loses that support level, many holders could panic and trigger a larger downswing toward $200.