Ripple (XRP) price dropped below the $0.50 support level on Monday as weekly losses increased closer to 9%. Key on-chain indicators provide insights into how XRP price could trend in the coming weeks.

Binance Exchange announced the delisting of its XRP/BUSD in a blog post today. The news comes just days after XRP recorded its lowest transactional activity for 2023.

XRP Price Hits a Wall as Transactions Decline to 2023 Low

On Tuesday, Binance announced the delisting of XRP/BUSD liquidity pools and 11 other select trading pairs slated for October 17. This is part of its ongoing strategy to discontinue the BUSD stablecoin offering and expand support for the replacement XRP/FDUSD pool.

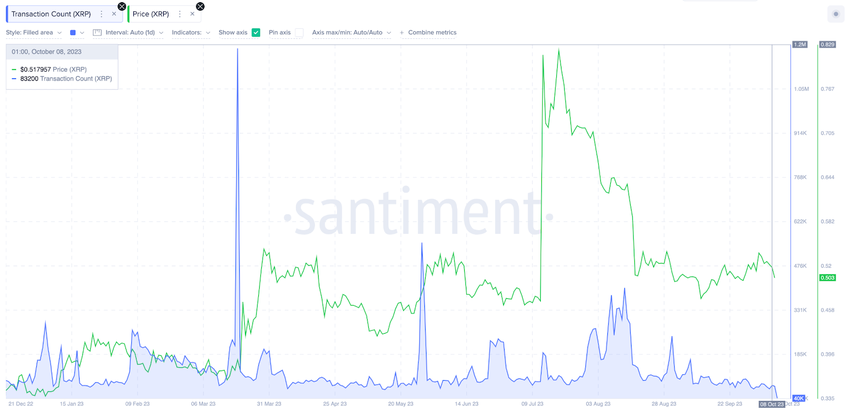

However, a few days before this notable news event, daily XRP transactions had declined to a yearly low. On October 7, the XRP ledger network processed 71,820 transactions. December 2022 was the last time XRP transactional activity dropped that low, as depicted in the Santiment chart below.

XRP Transaction Count refers to the total number of transactions conducted on the XRP Ledger within a specific timeframe. A decline in transaction count might suggest reduced network usage or bearish changes in market dynamics.

Unsurprisingly, the XRP price has retraced 10% from $0.54 to $0.49 over the past week. The upcoming delisting and changes in XRP trading pools on Binance could further impact transaction count negatively.

Crypto Whales Acquire 50 Million Coins to Fund Rebound Mission

Amid the ongoing downtrend in XRP price and transactional activity, a resilient group of crypto whales has been spotted buying millions of coins.

Between October 3 and October 10, the whales with balances between 100,000 to 1 million XRP increased their holdings from 3.77 billion to 3.82 billion XRP coins. This fresh acquisition of 50 million coins over the past week brings their cumulative balances to a 3-month high.

With current prices at $0.50, these newly acquired 50 million XRP are worth approximately $25 million. For several reasons, such a large crypto whale demand during a price downtrend can be bullish for the asset price.

Firstly, the large demand can help slow down the XRP price slump. Secondly, it could boost other strategic retail traders’ confidence.

In summary, while XRP transaction count is down in the dumps amid the upcoming Binance delisting, crypto whales could save the day if they maintain their positive disposition.

Read More: How To Make Money in a Bear Market

XRP Price Prediction: Likely Consolidation Above $0.45

If the whale demand for XRP remains steady, the price will likely rebound toward $0.55 in the weeks ahead rather than drop below $0.45.

XRP is currently trading at $0.50 and has been on a downtrend. The technical analysis in the daily timeframe shows that the immediate support level to monitor is at $0.49, which is close to the 30-day Simple Moving Average (SMA-30)

On the upside, the key resistance level is the Exponential Moving Average of $0.53 (EMA-50). Breaking above that key resistance could signal an imminent bullish trend reversal toward $0.55.

However, caution is advised, as the sentiment in the broader crypto market remains sensitive to macro events.

Read More: Ripple (XRP) Price Prediction