Binance announced it would close positions on its Terra Classic (LUNC) perpetual futures contract before delisting it upon settlement completion.

As prosecutors vie for Do Kwon’s extradition, Binance will adjust the leverage and margin tiers of its LUNC Perpetual Futures Contract on June 1 before delisting it on June 8.

Binance Tapers Ties With Terra Ecosystem

Binance will close and automatically settle all open positions on its USD-M 1000LUNCBUSD Perpetual Contract at 09:00UTC on June 8.

Traders are advised to pare back their margin positions according to Binance’s revised tiers before noon UTC Thursday to avoid liquidations.

Crypto perpetual futures are derivative instruments borrowed from traditional finance settled in cash. This settlement differs from a futures contract settled through the delivery of an asset at a predetermined price and date.

Traders must supply a maintenance margin to indefinitely hold a long or short position in a perpetual futures contract. Investors can also borrow money from a broker to create leveraged positions.

Click here for a detailed run-through of perpetual features contracts.

Binance’s move comes roughly a year and three weeks after it suspended LUNC/BUSD spot trading pairs. It recently agreed to reduce the percentage of LUNC margin and trading fees it regularly burns.

LUNC is the native cryptocurrency of the Terra Classic blockchain, which Korean programmer Do Kwon created.

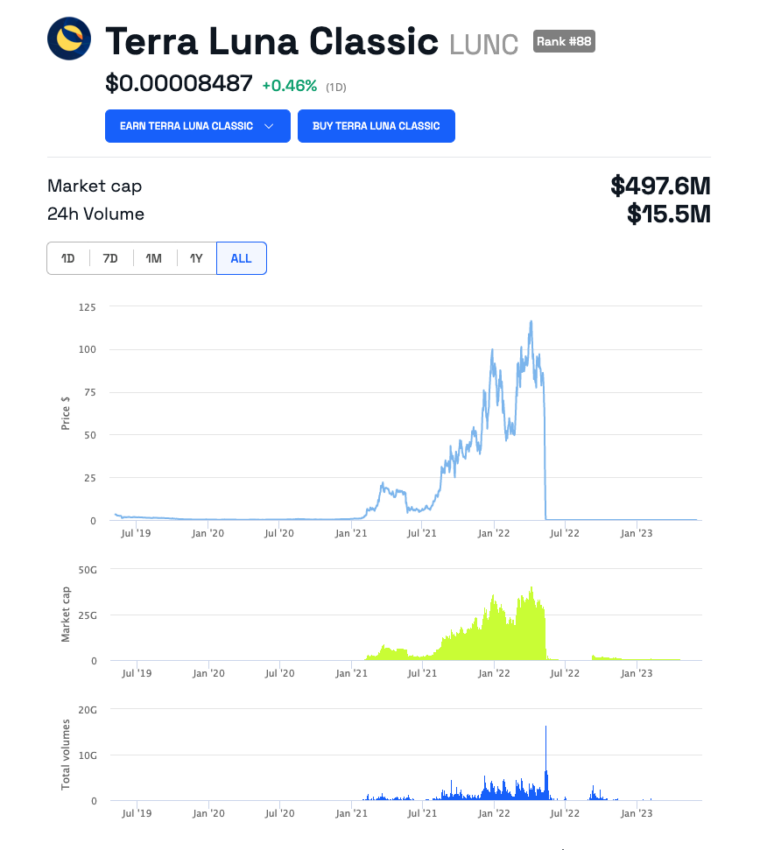

Once one of the largest cryptocurrencies with a peak value of $119, LUNC started tanking after large withdrawals of its sister stablecoin TerraUSD from Curve 4Pool rattled investor confidence in the ecosystem.

As it crashed and UST redemptions increased, an algorithm perpetually minted more LUNC, causing its price to fall to almost zero.

Founder and CEO of Binance Changpeng Zhao said at the time,

” I’m very disappointed with how this UST/LUNA incident was handled (or not handled) by the Terra team.”

Binance and rivals Huobi, Coinbase, and OKX invested in the Terra ecosystem. The collapse of Terra and several other entities prompted Binance to create a fund to help ailing crypto businesses.

LUNC Flaws Are Now Obvious

Zhao recently commented on a Bankless podcast that several industry participants fruitlessly sounded the alarm on Terra before its collapse.

Bankless host Ryan Sean Adams pointed out TerraUSD’s flawed relationship with LUNC is now obvious, even though it wasn’t previously noticed.

Read more on algorithmic stablecoins and Terra (LUNA) here.

Among the project’s early detractors was Paxos CEO Charles Cascarilla. Paxos issued the Binance-branded BUSD stablecoin before a clampdown by New York regulators.

Hedge fund manager Kevin Zhou likened his Terra warnings at the start of 2022 to “Rome” fighting Kwon’s “Carthage.”

The Montenegrin high court denied Kwon bail while he awaits trial for passport fraud in Montenegro. South Korean and U.S. prosecutors want him for defrauding Terra investors, although it is not clear who will win the extradition rights.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.