Friday is here again and that means Bitcoin options are about to expire. Moreover, crypto markets are ending the week strong with big gains among the altcoins, but will Bitcoin be boosted by the expiring derivatives?

Around 25,000 Bitcoin options contracts are set to expire on December 22. However, this batch is slightly less than last week’s expiry event. It is also tiny compared to the huge end-of-year expiry due next Friday.

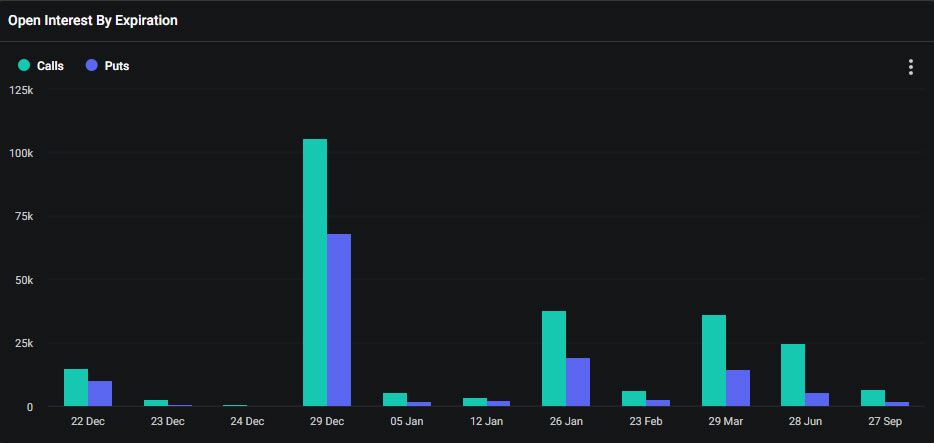

Bitcoin Options Expiry

The notional value of today’s expiring batch of Bitcoin options contracts is $1.11 billion. Furthermore, the put/call ratio is 0.70, meaning more longs (calls) are expiring than shorts (puts).

There is a lot of interest at strike prices of $40,000 and $45,000, and around 22,400 calls are waiting for $50,000, according to Deribit.

On December 21, Greeks Live noted that the options market is showing mixed signals, with BTC hovering around $44,000.

“Both the BTC and ETH block trades were dominated by put buying and more than half of the block trades, $13 million and $88 million respectively, totaling $100 million.”

“The giant whales are adding to their bearish positions at a time of high market sentiment, and traders need to be wary of downside risk,” it added.

Deribit also reported a total open interest notional value of $16.4 billion. Open interest (OI) is the number of contracts that have yet to be settled or expire.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

In addition to today’s Bitcoin options expiries, around 217,000 Ethereum options contacts will expire today. Their notional value is around $491 million, and the put/call ratio is 0.60.

Strike prices with the most interest for ETH derivatives traders are $2,400 and $2,500.

Crypto Market Outlook

It is unlikely that today’s expiring options will impact spot markets. They have gained 2.5% on the day, pushing total capitalization to $1.74 trillion, its highest since early May 2022.

Bitcoin has gained 1.4% in a return to resistance at $44,135 at the time of writing. Moreover, the asset is up 3.6% since the same time last week.

Ethereum is up almost 3% to trade at $2,259 at the time of writing.

However, it is the altcoins leading markets today with big gains for Solana, Cardano, Avalanche, Polkadot, and Chainlink. Solana even temporarily flipped BNB to take fourth place on the market cap table but has returned to fifth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.