Talk of altseason is still dominating the crypto community despite a market pullback. However, most analysts are in agreement that it is not here yet so is this the last opportunity to buy the dip?

Altcoins are in retreat at the moment which may provide more opportunities to load up before altseason.

Altcoins on The Cusp

Analysts are eyeing altcoins again following the recent rally which drove the total market cap to an 18-month high of $1.5 trillion.

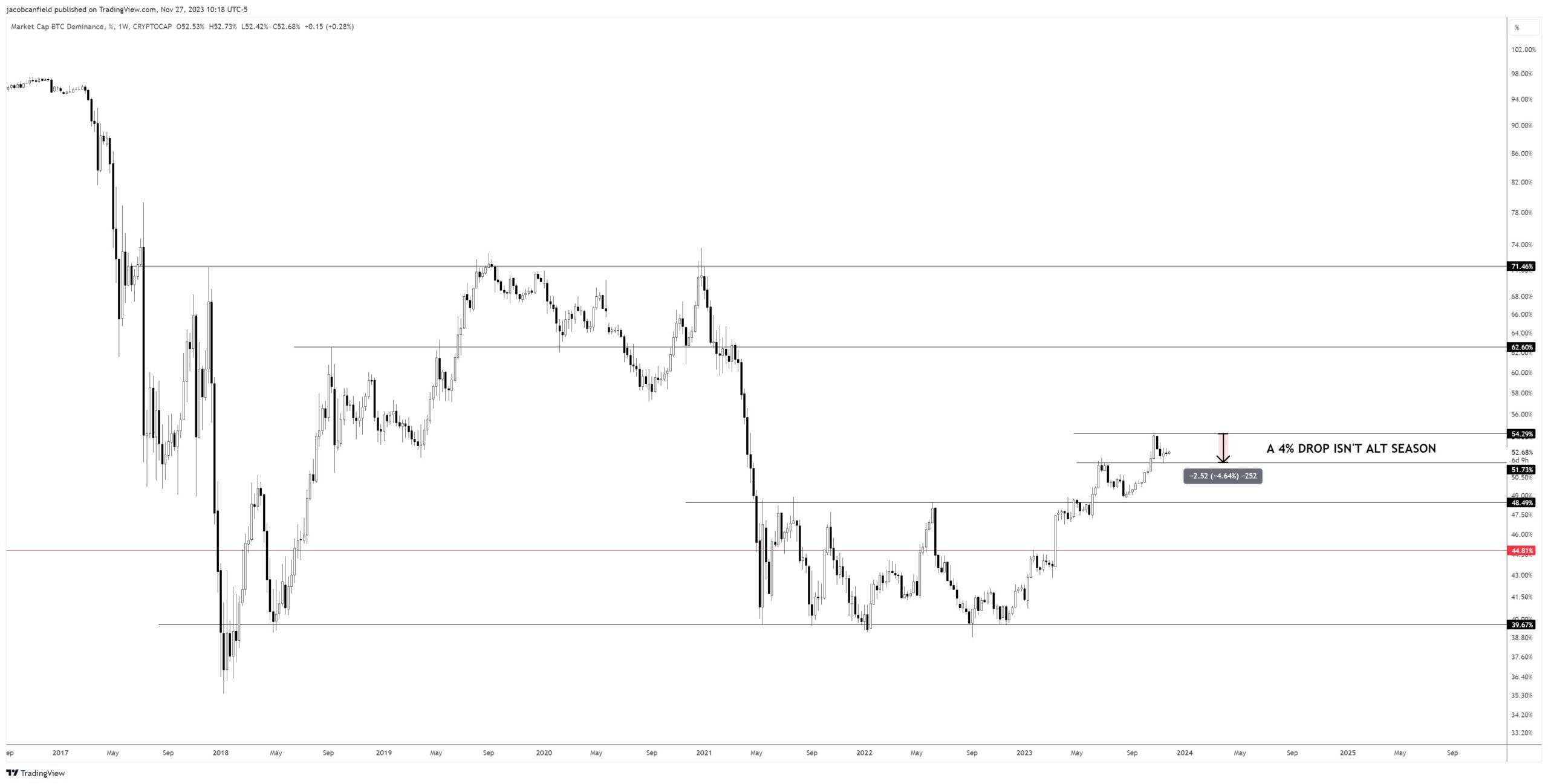

On Nov. 27 crypto trader Jacob Canfield said “This isn’t altseason… yet.” He noted the fall in Bitcoin dominance adding that it is too small at the moment. “Most altcoins are bleeding against Bitcoin, but are way up in USD,” he said.

“The real altseason starts when the bitcoin dominance market structure turns bearish.”

Bitcoin dominance is currently 52.8% according to Tradingview and it has fallen this month as altcoins have gained.

Nevertheless, altseason could be just around the corner when considering the total cap minus Bitcoin chart. Earlier this month, BeInCrypto reported that altcoin markets were about to break out of their accumulation zone.

Moreover, a seldom-seen technical indicator for altcoins was about to flash up with a golden cross on the monthly timeframe.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

On Nov. 28 analyst “Muro” said there was a bit more of a correction to go, especially for Ethereum.

In the past few weeks, altcoins rallied nicely but are currently facing resistance which is bad short term, he said. “However, the good news is that support is near and a bullish breakout seems imminent after a bit of correction,” he added.

Crypto trader “Jelle” added, “After a couple of weeks of consolidation, altcoins are starting to look good again.”

Today’s Gainers and Losers

Crypto markets are moving deeper into the red again today as the pullback from weekend highs continues. Total cap is down 1% or so to $1.45 trillion but remains sideways where it has been for November.

The majority of the high-cap altcoins were in the red at the time of writing. These included Solana (SOL), Cardano (ADA), Dogecoin (DOGE), and Tron (TRX) dropping 3-5% on the day.

Larger losses were seen on Chainlink (LINK), Cosmos (ATOM), Lido DAO (LDO), and Aptos (APT).

Only Toncoin (TON) and Uniswap (UNI) were bucking the trend posting gains of 2.5% and 3.3% respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.