US President Joe Biden has introduced a new plan to alleviate student debt and encourage saving in an effort to control the country’s debt crisis. A crypto-savvy younger generation with potentially more savings could be beneficial for markets in dire need of fresh capital inflows.

The Biden administration launched a student loan repayment plan on Aug. 22 that it describes as the “most affordable” option yet for reducing student debts.

SAVE Student Loan Relief and Reprieve

The Saving on A Valuable Education (SAVE) plan aims to provide student loan relief. The new initiative could cut borrowers’ payments in half and reduce some balances to zero.

Enrollment began on Tuesday, and it will be an automated process for those under the previous REPAYE plan, according to reports.

White House Domestic Policy Advisor Neera Tanden commented:

“This plan is a game changer for millions of Americans, many of whom are putting off having children, buying their first home or even starting a business because they can’t get out from under their student loans,”

Under the new plan, monthly payments are based on income and family size, not the total loan balance. For students who have undergraduate loans only, their payments will now be capped at 5% of their discretionary income.

Moreover, discretionary income is the “difference between one’s adjusted gross income and 225% of the federal poverty line,” determined by the size of a family.

Furthermore, no interest will accumulate beyond the income-based payment, and loans under $12,000 will be forgiven after 10 years of payments.

The government claims that low and middle-income borrowers will benefit most, and it could put more money back into savings accounts.

Having savings is now a luxury in the United States. Therefore, the plan could pave the way for more investment into riskier assets such as crypto.

Dire State of US Savings

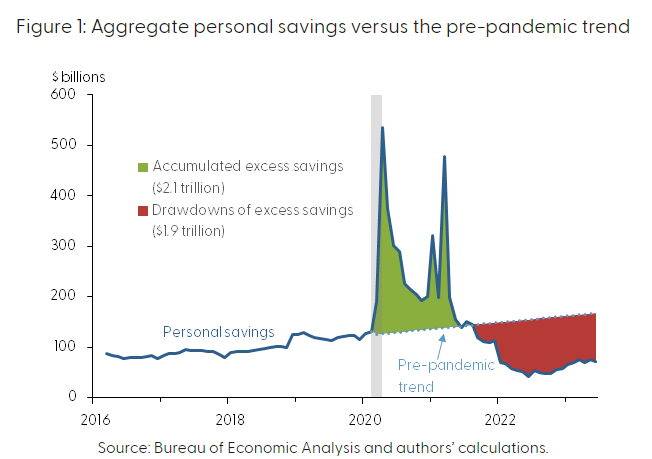

The state of savings in the US is dire, to say the least. According to the macroeconomics outlet, The Kobeissi Letter, household savings have declined by $100 billion per month on average since the start of 2022.

Moreover, since 2021, people have depleted a total of $1.9 trillion in savings, leaving just $190 billion remaining.

“It is forecasted that the remaining excess savings will be depleted this quarter,” it stated before predicting:

“Americans are living off savings that will soon no longer exist. This is why debt levels are skyrocketing.”

Credit card debt recently hit $1 trillion for the first time ever. Additionally, total household debt is at a record $17 trillion.

Biden’s latest plan will hopefully ease the student debt burden which may free up capital for longer-term investments.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.