Financial regulators and the U.S. government may want to kill crypto, but investors are still hungry for the asset class. Family offices and institutions plan to continue investing despite increasing hostility from the Securities and Exchange Commission.

According to recent research from UBS, more than a third of family offices in America plan to increase their exposure to digital assets.

Crypto Investing to Increase

A family office is defined as a privately held company that handles investment and wealth management for a prosperous family. They generally have at least $50 million to $100 million in investable assets. Their primary goal is to effectively grow and transfer wealth across generations.

On June 16, Bitcoin chart guru Willy Woo said:

“If you think crypto is dead under the current US regulatory FUD, here’s some perspective,”

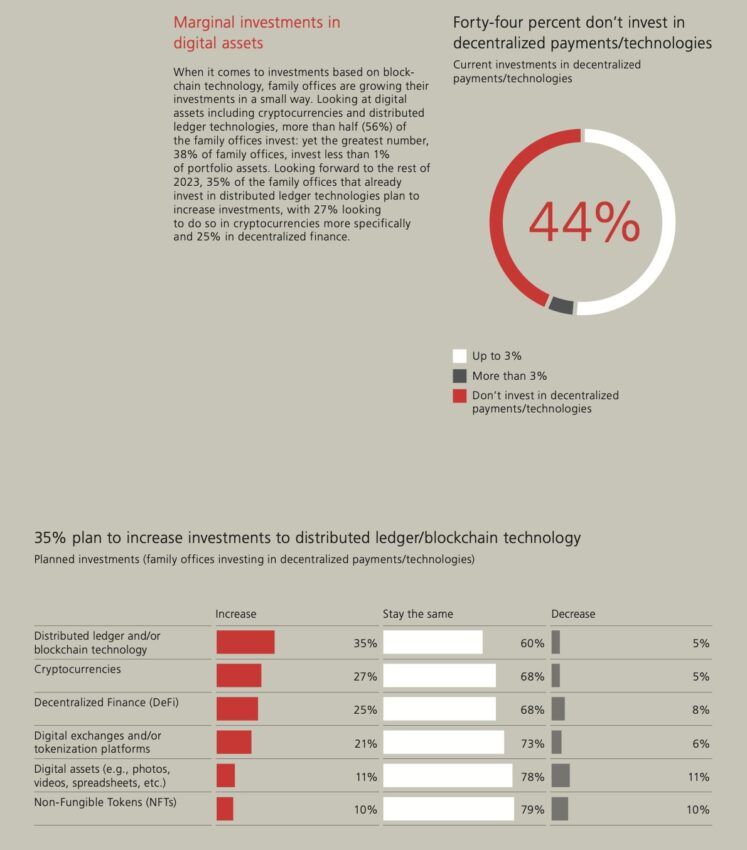

He noted a statistic from the report that revealed that 35% of family offices plan to increase digital asset exposure.

UBS Global Family Office Report 2023 was published on May 31. It noted that this investor class was seeing “the biggest shift in strategic asset allocation for several years.”

Moreover, the survey polled 230 family offices around the world, with an average total net worth of $2.2 billion.

Furthermore, 27% of family offices plan on investing specifically in cryptocurrencies this year. Around a quarter of them said they were looking into decentralized finance (DeFi) investments, according to the report.

Digital exchanges or tokenization platforms are preferred investment opportunities for 21% of the family offices polled.

Learn the difference between TradFi and DeFi with this simple, easy guide:

The institutional investment narrative has been bolstered this week with the BlackRock ETF filing. The world’s largest asset manager plans to launch a spot Bitcoin exchange-traded fund.

A related survey by Japanese banking giant Nomura revealed a whopping 96% of professional investors regarded digital assets as “representing an investment diversification opportunity.” This was in addition to traditional asset classes such as fixed income, cash, equities, and commodities.

One-Third of Family Offices Already Into Crypto Investing

In early May, BeInCrypto reported that 32% of family offices are currently investing in digital assets, according to Goldman Sachs.

In addition to crypto, family offices also showed interest in stablecoins, non-fungible tokens (NFTs), decentralized finance (DeFi), and blockchain-focused funds.

Crypto markets remain down 65% from their peak levels in November 2021, weighed down by Uncle Sam’s war on crypto. However, spring could be just around the corner if these surveys are anything to go by.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.