As another week in the world of DeFi commences, more new projects that aim to further decentralize and democratize the world of finance emerge. Today’s focus is on a project called Bee2 which wants to move DeFi away from the clutches of the whales, and into the hands of the masses.

The current state of decentralized finance is highly stacked in favor of those with heavy collateral bags. Astronomical gas prices make smaller transactions on Ethereum virtually impossible. In the current state of things, many users end up losing money just by making a transfer.

Add to that the trading fees such as those imposed by Uniswap on each trade, or Yearn Finance’s fees for withdrawals, and it becomes clear that the rich get richer with most DeFi dealings.

A new incentive called Bee2 Finance has started an experiment using quadratic mining to try and make DeFi a fairer form of finance for everyone.

Busy Bees Building DeFi

The Bee2 project is taking a different approach to DeFi. The standard this year has been issuing rewards for liquidity providers, which only really benefits those with a lot of liquidity to provide, i.e. the whales:

Our team thinks that DeFi’s liquidity mining is falling into the Matthew trap. It makes the rich richer and the poor poorer, and many investors can’t even afford high gas fees on Ethereum.

Bee2 is building on the concepts from a book called Radical Markets by Eric A. Posner and E. Glen Weyl, taking specifically from a portion that deals with ‘Radical Democracy.’ DeFi project governance decisions and voting mechanisms have been weighted towards those with the most tokens so, as previously reported by BeInCrypto, most aren’t really that democratic.

The experimental project aims to use an innovative voting method called quadratic voting (QV) and take it a step further with quadratic mining. The quadratic mechanism has recently been applied to a number of consensus and funding operations such as Gitcoin Grants. Ethereum co-founder Vitalik Buterin was also very positive about the mechanism in an article he penned in December 2019.

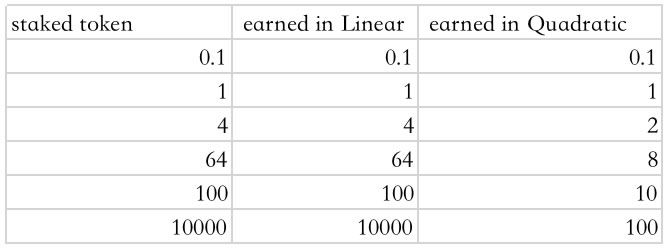

The Bee2 project will use a quadrating mining function in combination with the liquidity farming incentive that most DeFi protocols are based upon. In current DeFi liquidity mining methods, earnings and costs increase linearly. That is, the more tokens staked, the more the reward, which is good for the whales, but not so good for the average user that doesn’t have tens of thousands of dollars in crypto collateral to throw at experimental projects.

With a quadratic mining mechanism, rewards and costs increase exponentially, which balances the power and is of greater benefit to those with smaller stakes.

Countdown to Launch

According to the Bee2 blog post and protocol dashboard, the project will go live on Sept 9 at 09.00 UTC. There will be two types of tokens distributed, BEE and HONEY. The former being the primary use token and the latter a bonus reward token.

There will be a total supply of 5 million BEE tokens, distributed across four liquidity pools of wETH, LINK, ANT, and YAMv2.

According to Etherescan, ANT has a market cap of $154 million and a circulating suppling of just over 33 million. The YAMv2 pool is the second iteration of the Yam Finance project which launched in mid-August.

The project has allocated 10% of all BEE tokens to go back into a development fund for future iterations and contract audits.

The second token, HONEY, is determined by how much BEE is generated by the liquidity pools and has no fixed supply. HONEY can be produced if the maximum number of staked tokens in the pools is greater than the constant value set by the protocol. The constant values of the four staking pools are 10,000 WETH, 500,000 LINK, 500,000 YAMv2, and 1 million ANT.

The second condition for HONEY generation is that the pools must be running for at least two days with a minimum of 69,120 BEE mined. The blog post added that HONEY tokens are worthless and there are no further mechanisms designed:

After multiple quadratic mechanisms, it will become more distributed, and the whale’s effect will be further weakened.

It also said that there is no pre-mine, no founder shares, and no VC interests, similar to that of Yearn Finance.

BEE will be used as the governance voting token, based upon the quadratic voting mechanism. The Bee2 team noted that this is not a perfect solution—but it does increase the cost of cheating the system.

https://twitter.com/bee2_finance/status/1302507089701421056

DeFi Markets Cooling Down (For Now)

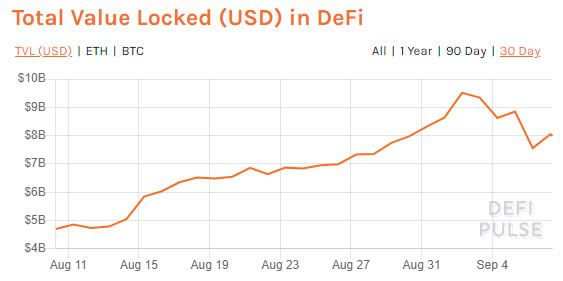

The $70 billion crypto crash over the past few days has taken its toll on DeFi markets with collateral being pulled out over the weekend.

Total value locked across all markets has dropped $2 billion from its all-time high of over $9.5 billion on Sept 2, to $7.5 billion on Sunday according to DeFi Pulse.

That value has crept up a little as Monday trading begins in Asia and is currently sitting around $8 billion. It has still been an epic month for decentralized finance with TVL gaining 70% over the past 30 days.

In terms of the most popular platforms, Uniswap is still at the top of the table with a market share of 19% and a TVL of $1.51 billion, up 36% on the day. According to Uniswap.info, volumes on the token swapping protocol have fallen from almost a billion dollars last week to around $620k on Sunday.

Aave is the second-most popular platform at the time of press with a TVL of $1.38 billion, while Maker sits comfortably in third with a TVL of $1.26 billion.

Curve Finance and Yearn Finance, which had a successful launch of its yETH vault, have both seen their collateral shrink by double digits over the weekend. Synthetix, Balancer, Flexa, and Nexus Mutual are performing well today with decent gains in total value locked.