Bitcoin Cash (BCH) price has rebounded above $100 after briefly dropping below the milestone support level on June 10. On-chain data shows that the media and concerned stakeholders still appear focused on capital flowing from altcoins to BTC and ETH. Will the ongoing BCH price recovery enter a new gear when FOMO sets in?

The altcoin market has struggled to attract investor attention in recent weeks. The industry-wide Fear, Uncertainty, and Doubt (FUD) was triggered mainly by the SEC’s lawsuit against Binance and Coinbase.

Despite the drop-off in the media spotlight, Bitcoin Cash (BCH) price has continued its recovery under the radar. Can the bulls push for the $120 BCH price target?

The Media Spotlight Has Turned Away from Bitcoin Cash

After the industry-wide price correction in early June, the media spotlight veered away from BitconCash as many crypto investors turned to Stablecoins, Bitcoin, and Ethereum for refuge. Others turned towards some of the ‘troubled’ altcoins to buy the dip.

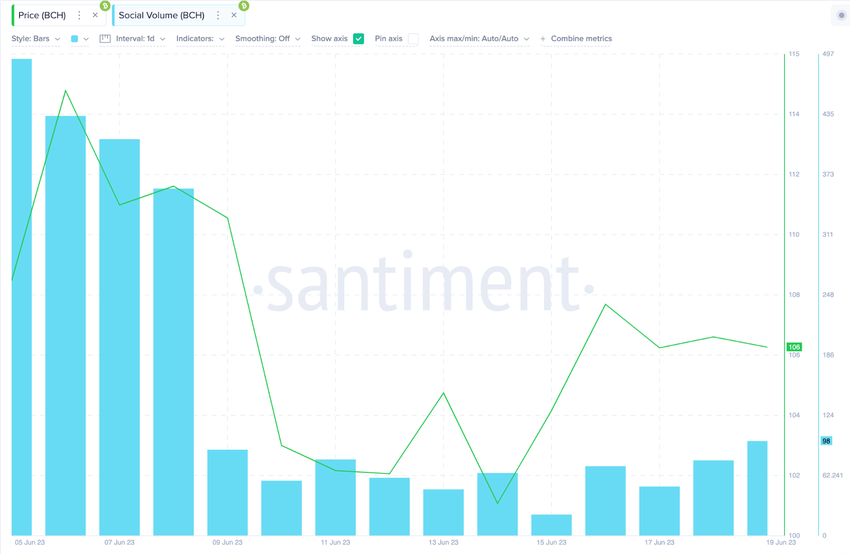

Indicatively, BCH’s Social Volume score dropped 400% from 493 on June 5 to a lowly 98 at the close of June 19.

The Social Volume metric evaluates the number of times a project is mentioned across relevant crypto media channels.

When it declines during a price recovery, as seen above, it indicates that BCH is flying under the radar of many investors.

Price often increases when a project begins to attract media attention. If this holds true, BCH holders can expect the ongoing price recovery to enter second gear once the FOMO sets in the coming weeks.

More From BeInCrypto: Crypto signals: What Are They and How to Use Them

Bitcoin Cash Network Traction is Increasing Despite Media Blackout

Despite the recent decline in BCH price and media clout, Bitcoin Cash has continued to attract solid demand for its core on-chain products and services.

The Santiment chart below shows that users actively utilizing BCH daily have increased significantly over the past two weeks.

While BCH price is down 7% since June 1, the Daily Active Addresses (DAA 7d) has increased by 21% within the same period. This Indicates a positive divergence between network demand and price.

In concise terms, the Daily Active Addresses (7d) sums up the number of unique addresses that carry out transactions over a seven-day period. When it increases during a price correction, as seen above, it indicates an organic growth in the underlying network value.

If the trend continues, it is only a matter of time before the growing demand powers BCH above the $120 price target.

Read More: Top 11 Crypto Communities To Join in 2023

BCH Price Prediction: The Price Recovery Could Reach $120

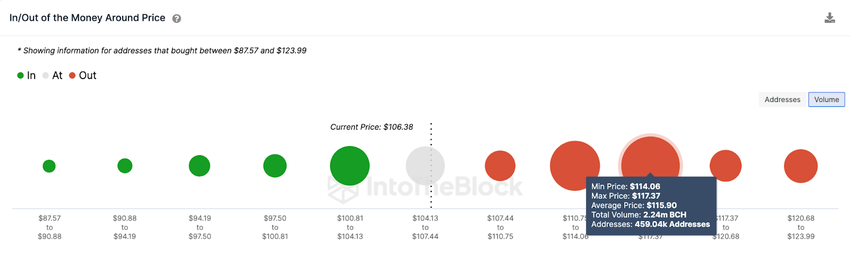

Given the steady Bitcoin Cash Network Value growth, BCH will likely rebound toward $120 in the coming weeks. However, BCH must first break above the initial resistance at $115.

According to IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data, 459,000 investors that bought 2.24 million BCH at the average price of $115.90 could cause a pullback.

But if Bitcoin Cash can scale that resistance zone, it could reach the $120 price target.

Still, the bears could invalidate the Bitcoin Cash price recovery if it unexpectedly drops below the critical $100 support zone. Although, the 171,670 investors that purchased 752,000 BCH coins at the minimum price of $100 will likely prevent the drop.

However, if that support level cannot hold, the Bitcoin Cash price could still retrace toward $90.