Apple has announced a new savings account linked to its Apple Card. The yields are impressive, but how do they compare with DeFi savings and other payment providers?

On April 17, Apple, the world’s largest tech corporation, announced a new savings account for its cardholders.

Furthermore, it claimed that yields were “more than 10 times the national average.”

“Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent.”

Users will get access to a savings dashboard in their wallet on their iPhones or other Apple devices. This enables them to track balances and interest accrued over time.

The move comes at a time when interest offered by high street banks remains woefully low.

How Does Apple Compare?

According to Bankrate’s weekly survey of banks, the national average APY for U.S. savings accounts is 0.26%. However, it noted that some online banks, such as UFB Direct, CIT Bank, and Bask Bank, offer yields above 4.5%.

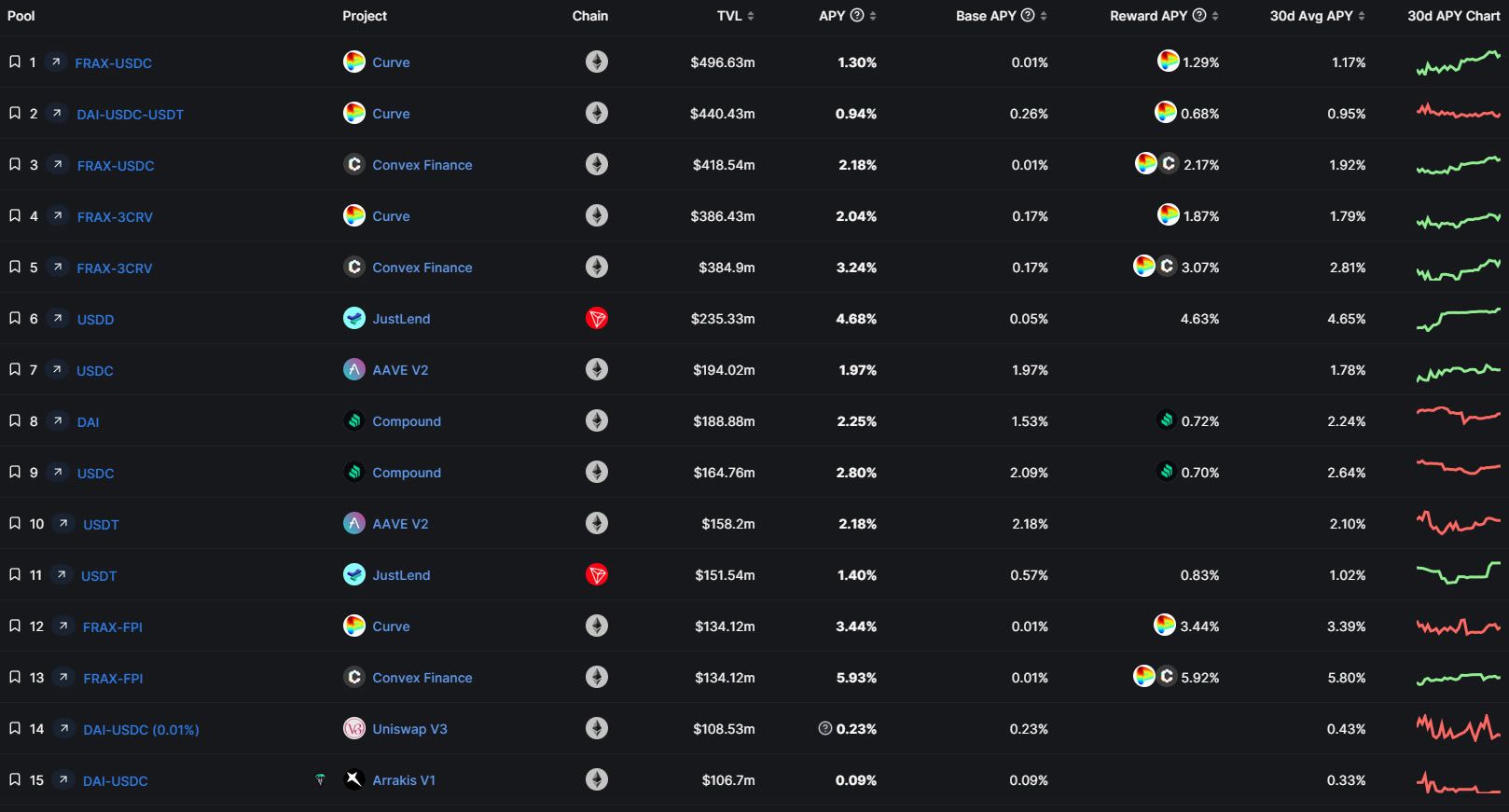

Nevertheless, DeFiLlama shows many top DeFi stablecoin pools can’t match this. The top three stablecoin pools on Curve Finance currently offer between a miserly 0.94% and 2.04%.

Furthermore, Aave’s USDT and USDC pool yields were just 2.18% and 1.97%, respectively. Convex Finance was offering between 2.18% and 3.24% for its Frax stablecoin pools.

The only stablecoin yield provider in the top ten DeFi protocols that could beat Apple was JustLend. However, the 4.68% was on savings for the currently de-pegged USDD.

Additionally, the interest available on MakerDAO’s Dai Savings Rate (DSR) is a paltry 1% at the moment for holding DAI.

Yields were slightly better on centralized exchanges for stablecoins. The Binance Earn program (blocked for certain geographic locations) offered 3.19% on flexible USDT savings.

The top DeFi yields were on the Beefy exchange, which touted between 67.9% and 87.9%. However, the caveat was that the pool was USDC and an obscure stablecoin called WUSDR (wrapped Real USD).

DeFi Yields Back to Reality

The insane three-figure yields offered in DeFi during the bull market were unsustainable. These were partly responsible for the over-leveraging and greed that caused its collapse in 2022.

Now there are calmer waters in DeFi circles, savings rates are closer to reality.

Nevertheless, Apple appears to be a winner with its savings account by comparison. Unfortunately for non-Appleheads, the caveat is that you have to be fully integrated into the tech giant’s all-consuming ecosystem to enjoy it.