US Securities and Exchange Commission (SEC) chair Gary Gensler predicts artificial intelligence will cause the next financial collapse.

He argued that AI muddies accountability for financial decisions, despite it being a ‘transformative technology.’

SEC Chair: AI Could Destabilize Markets Through Deep Learning

Gensler’s concerns revolve around the opacity of AI’s decision-making rather than the technology itself, warning that multiple firms jockeying for the best client returns using algorithms could create market instability and volatility.

Interested in the latest developments around trading algorithms? Review our comprehensive guide here.

The SEC chairman first encountered AI after witnessing a computer beating a Russian chess champion in 1997. He later revived his interest in the topic while teaching at the Massachusetts Institute of Technology in 2019.

The chairman’s interest came to a head in a 2020 joint-research paper, ‘Deep Learning and Financial Stability.’

In the paper, Gensler argued that present financial laws cannot address the dangers posed by deep learning, a class of algorithms used in AI. In his view, developers have unrestricted freedom in curating ‘objective’ AI functions to work against fair market ethics.

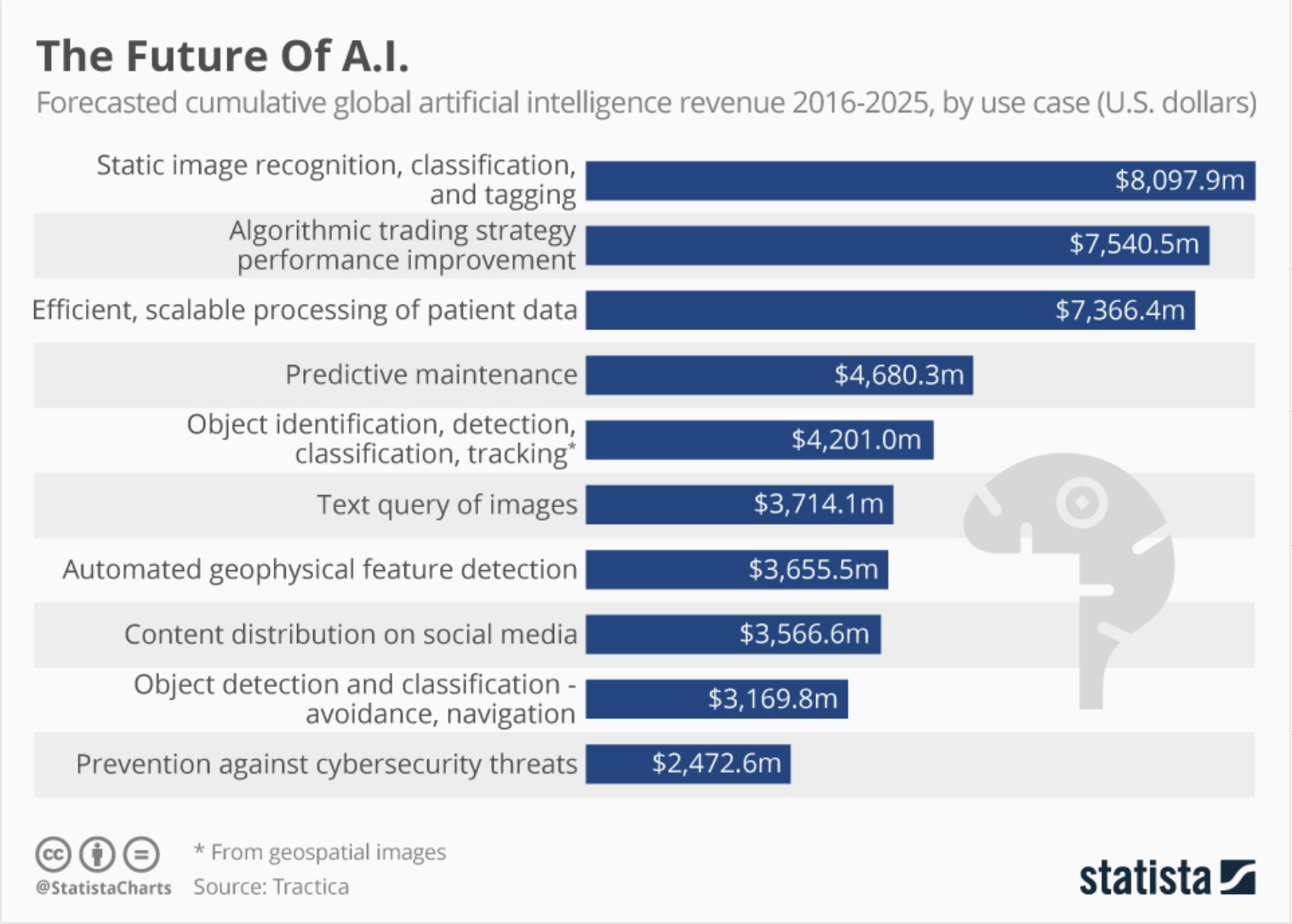

Gensler’s warnings aside, Goldman Sachs says that AI investments could grow to 2.5% to 4% of US GDP in the long term. In addition, the bank thinks the technology could boost economic productivity by 1% annually in the decade after going mainstream.

Gensler’s Concerns Largely Theoretical

According to San Francisco-based attorney Mark Perlow, Gensler’s concerns address speculative problems at best. Similar to crypto, the industry will likely lead the AI regulation debate.

OpenAI’s Sam Altman has already engaged US lawmakers on the potential of super AI’s future threat to human existence. Both the ChatGPT owner and top brass at Google recently signed an agreement to foster responsible AI development ahead of the Biden administration’s proposed framework.

The crypto industry has followed a similar path, with the SEC’s recent crypto enforcement blitz preceded by industry attempts to bring regulatory clarity.

Several years ago, Coinbase offered rules for finding out whether a crypto asset is a security. Later, several industry executives lobbied Congress to develop new laws. Spotting gaps in existing rules, Custodia Bank CEO Caitlin Long helped draft laws defining crypto ownership and decentralized autonomous organizations in Wyoming.

Presently, several crypto bills await Congressional debate.

Got something to say about how artificial intelligence will collapse financial markets or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.