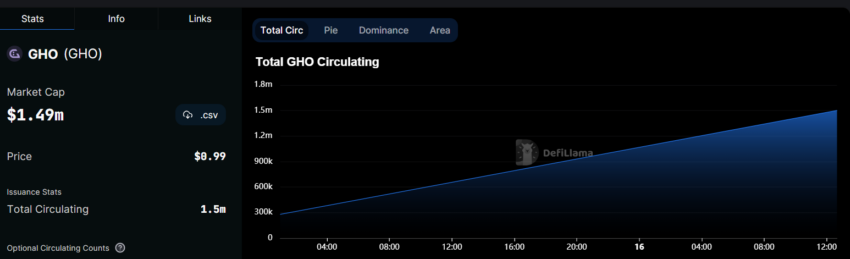

After the recent launch of Aave’s decentralized stablecoin, GHO, on the Ethereum mainnet, its circulating supply soared to $1.5 million within the first 24 hours.

Issued by AAVE, the second-largest DeFi protocol with a total value of $6.1 billion, GHO is a decentralized, overcollateralized stablecoin. The stablecoin pegged to the US dollar, is backed by digital assets such as Ethereum. The assets are entirely verifiable and transparent, as confirmed by on-chain data.

GHO Architecture and Mechanism

Aave shared that the launch of GHO supports its vision of fostering an inclusive financial ecosystem. It indicated that GHO’s revenues would enhance its DAO treasury, with governance responsibility entrusted to AAVE and stkAAVE token holders.

Thus, any policy amendments would involve community proposals and necessitate community votes for ratification.

“All transactions are performed through self-executing smart contracts, and all data regarding GHO transactions is available and auditable directly from the blockchain or via numerous user interfaces,” Aave stated.

GHO has introduced innovative roles and mechanisms, including Facilitators endorsed by the DAO to mint GHO. There are two facilitators for the stablecoin: the Aave V3 market on Ethereum and the Flashminting Facilitator.

The Aave V3 market boasts a minting capacity of $100, a limit that the Aave DAO may opt to increase. On the other hand, the Flashminting Facilitator allows users to mint GHO without collateral, provided they repay within the same block.

The early response from the community implies that the stablecoin has experienced initial adoption. According to data on the Aave website, users have borrowed $1.81 million from the available $100 million.

DeFi-Native Stablecoins Growing

The launch of GHO adds Aave to a growing roster of DeFi-native stablecoin issuers, a list currently led by MakerDAO’s DAI. Other DeFi projects, including Curve Finance, have recently introduced their USD-pegged stablecoins, such as crvUSD.

Ignas, a DeFi researcher, posited that issuing these stablecoins could lure new users to these platforms while boosting their revenues.

“These will increase capital efficiency, reduce dependence on native token emissions for liquidity attraction, and enhance the value proposition for their native governance tokens,” Ignas said.

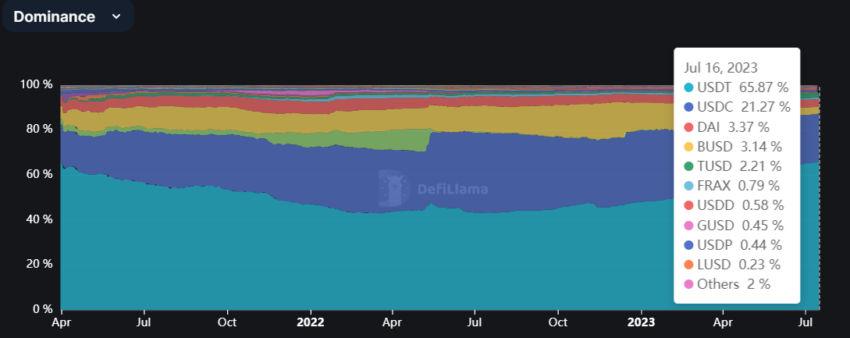

However, the circulating supply of stablecoins issued by these DeFi projects significantly lags behind those from centralized crypto companies like Tether and Circle.

These two issuers dominate 87% of the market and have drawn substantial criticism from the crypto community over their capability to freeze funds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.