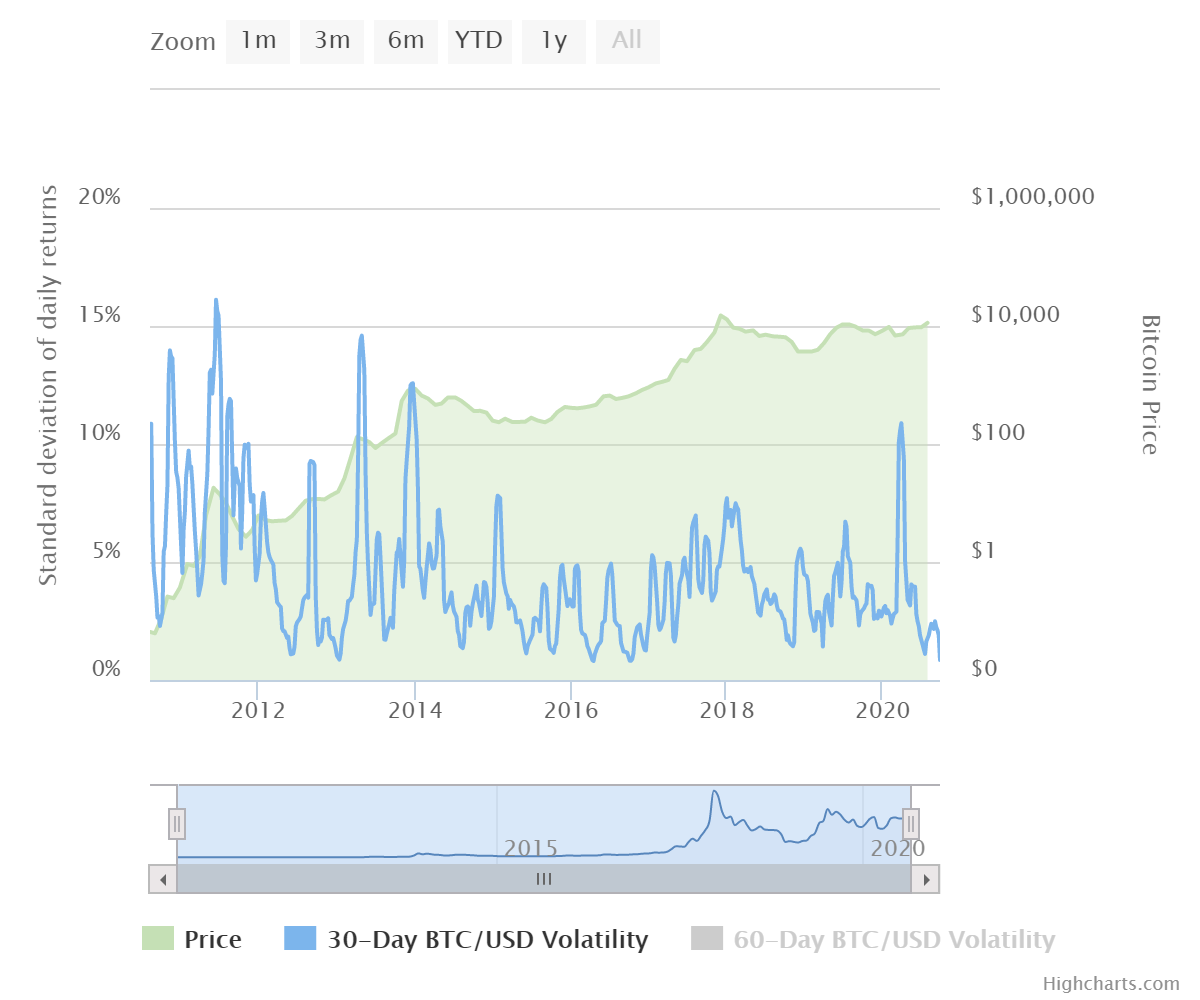

According to one metric, bitcoin’s 30-day volatility has hit a near-record low, recording a standard deviation of only 0.85%.

The last time the alpha crypto was this stable was in Jan 2013 and April 2016, before it went on unprecedented runs to achieve several 1000% gains, all in the space of a year (or two).

In simplest terms, volatility measures the change in the price of an asset over a specific period. Most pundits will, by now, know that bitcoin has high volatility compared with most traditional assets.

However, ‘Buy Bitcoin Worldwide’ notes that even that century-old safe-haven hedge, gold, averages around 1.2%, though, it’s unclear whether that’s also a 30-day reading.

Queue the Bitcoin Bulls

That didn’t stop prominent crypto market analyst, Willy Woo, from predicting an incoming bull market. Woo, who “builds models, not price targets,” theorizes that the current hodling pressure will inevitably lead to a capitulation of the bears:BeInCrypto reported this low volatility phenomenon earlier on in the year, noting the price carnage that followed. Nevertheless, Woo is adamant that buyers are propping up the price:When volatility is at a minimum, it means trade volumes are at a low, which means exchange fees revenue are at lows, which means exchanges sell less BTC profits to fiat, which mean investor buy pressure dominates the next move.

— Willy Woo (@woonomic) October 5, 2020

ELI5: Bullish https://t.co/pAjtbSPtyh

Note that volatility reaching lows also means buyers have laid down a floor on spot markets as they accumulate, this stops downward moves and lowers volatility. (accumulation bottoms).Bitcoin has, after all, remained above $10,000 for a record number of days, a sign that crypto bulls often use to indicate heavy accumulation and a calm before the storm. Woo also speculates that this is the perfect environment for whales to get in on the action:

@michael_saylor saw this effect as they mopped up $425m of coins.Saylor, who is the head of Microstrategy, made an unprecedented investment in the leading crypto in August. He believes that gold’s paltry volatility will be no match for bitcoin when that storm finally returns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Ryan Smith

Ryan was BiC's U.S. Time Zone Editor until the end of Feb 2021. He is fascinated with the history and evolution of money and the role that crypto plays in fixing a broken financial system. When not meticulously looking over the charts, he can be found jamming some board games or running the trails in his local nature reserve.

Ryan was BiC's U.S. Time Zone Editor until the end of Feb 2021. He is fascinated with the history and evolution of money and the role that crypto plays in fixing a broken financial system. When not meticulously looking over the charts, he can be found jamming some board games or running the trails in his local nature reserve.

READ FULL BIO

Sponsored

Sponsored