The continued correlation between Bitcoin (BTC) and U.S. stocks in 2020 is calling into question crypto’s place as a hedge against market uncertainties.

The largest crypto by market capitalization recently suffered a $1,500 decline which coincided with a massive gutting of tech stocks.

Bitcoin Moving in Tandem With the Equity Market

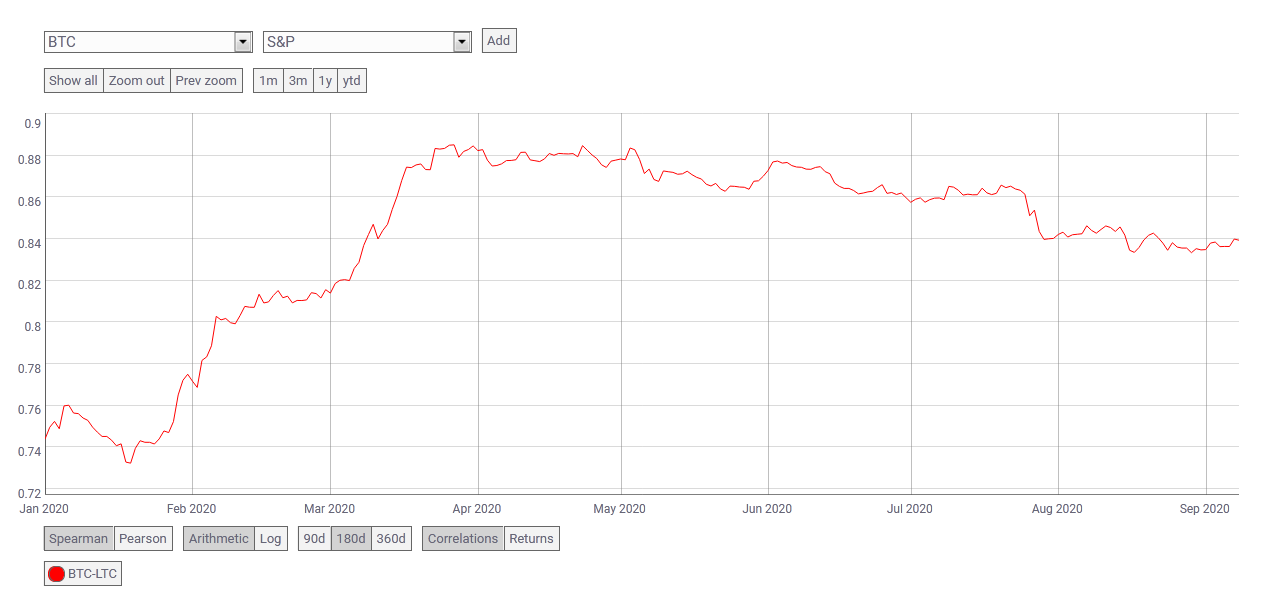

Bitcoin and the stock market have seen a great deal of co-movement in 2020, with their respective peaks and troughs coinciding regularly. For Bloomberg analyst Joe Weisenthal, this apparent correlation is proving to be the biggest problem for BTC in 2020.

2020 Is a Unique Year

While the data does suggest a correlation between Bitcoin and the stock market, an argument could be made for characterizing 2020 as a unique year. Indeed, Weisenthal raises the same point, calling 2020 “an exceptional year,” but also adding that such periods are when uncorrelated assets prove their mettle. Tweeting on Wednesday, stock-to-flow (S2F) model creator PlanB maintained that Bitcoin was still a hedge asset. According to him, the still-maturing BTC will become a more robust risk-off commodity compared to gold as it becomes scarcer. However, for now, the data points to a continuation of this correlation trend, at least in the short term. Quantitative easing by the Federal Reserve means that more cash is available for investments. At the time of writing, Bitcoin is attempting to consolidate above the $10,000 level after staving off multiple dips below $9,800. The Nasdaq 100 futures market is also seeing a similar recovery, pointing to the return of some optimism among investors.US Dollar Recovery?

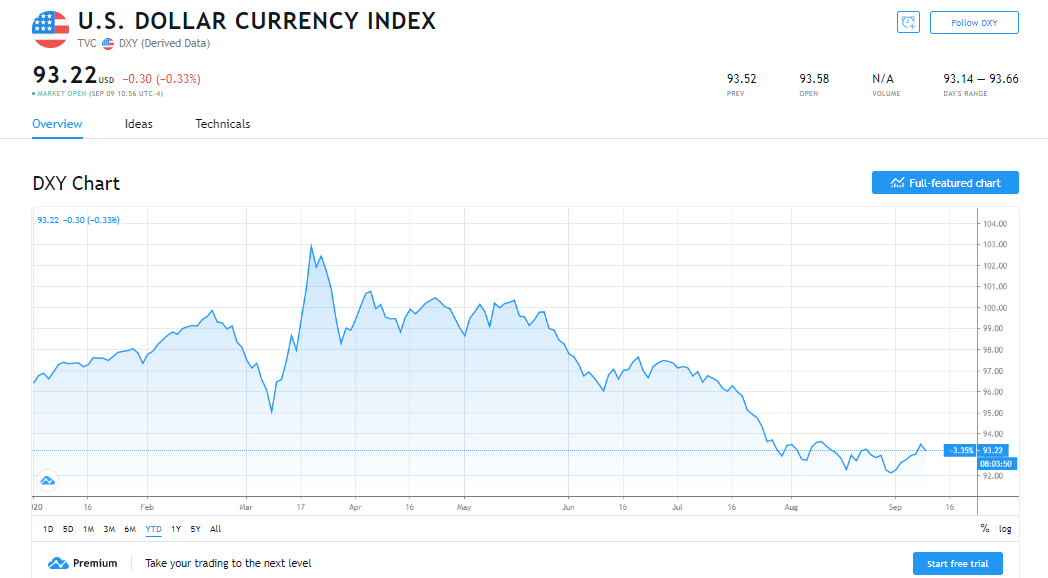

The recent U.S. dollar recovery might play a pivotal role in determining the destiny of the price action for both Bitcoin and the stock market. For Robert Balan of the stock market analytics platform Seeking Alpha, the U.S. dollar recovery may extend until the middle of 2021.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored