The decentralized finance space has continued to expand despite reports indicating that revenue has actually fallen over the past quarter. A new all-time high for DeFi is indicative that it is still the most bullish aspect of the cryptocurrency industry.

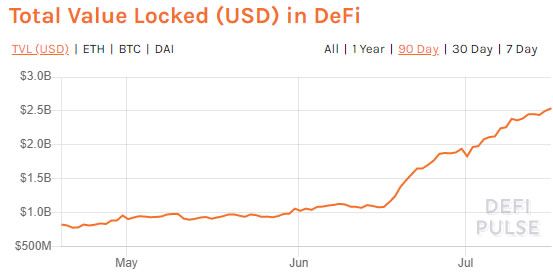

Yet again, DeFi markets have hit a new all-time high in terms of total value locked (TVL). That level is now at $2.55 billion and it is showing no signs of slowing down. Since the beginning of 2020, DeFi TVL has increased 270%, the majority of that coming in the past month or so.

DeFi Newcomers Flood The Field

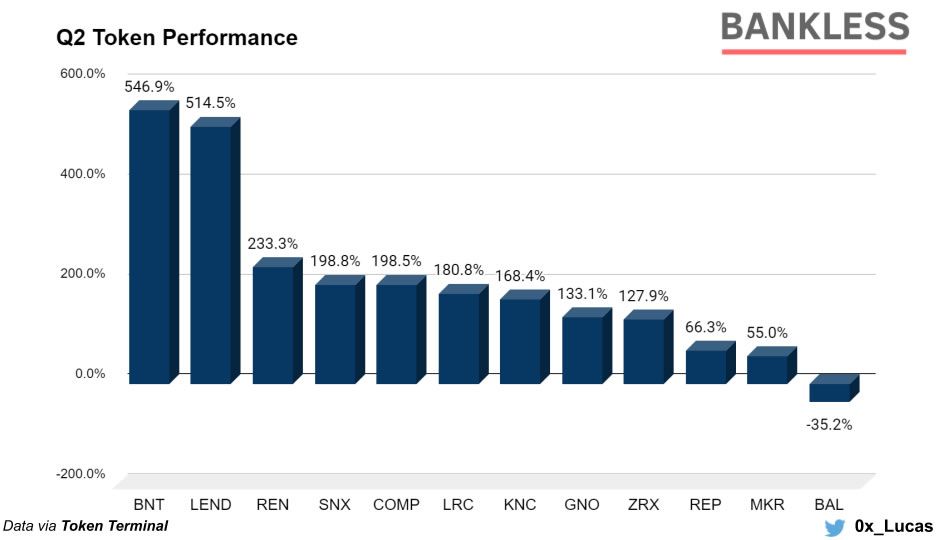

The research has delved into everything DeFi, from reported earnings to token valuations and DEX usage. Under a new Simple Agreement for Future Governance (SAFG) model, protocols can compliantly distribute tokens in virtually any jurisdiction to users for providing value-added services to the platform. According to DeFi Rate, the SAGF framework contract is embedded directly into the protocol and requires no lawyers or third-party overseers.It’s a simple, permissionless token distribution mechanism where participation in X and earns Y tokens that grant the ability to vote on future changes.This model has paved the way for a raft of new token launches over the past quarter which has shifted the balance in the DeFi ecosystem dramatically. DeFi in Q2 has been largely defined by the recovery from the mid-March pandemic induced crypto crash which wiped 50% off digital currencies in a matter of days. Not only has DeFi recovered, but it has boomed, far outpacing cryptocurrency markets that still haven’t managed to regain their February highs. DeFi analyst, Lucas Campbell, stated that token valuation was now easier since protocols can track earnings in real-time so traditional models such as PE ratios can be used. PE is defined as a price to earnings ratio which is now being deployed to ascertain value for DeFi tokens. Taking the top DeFi tokens, the analyst plotted the PE ratios for each, noting that the liquidity farming frenzy has resulted in impressive performances for most of them.

On average, DeFi assets in Q2 increased by 199%, substantially outperforming both ETH and BTC which increased by 70% and 43%, respectively.Bancor’s BNT has been the best performer for the quarter as it surged 546% following the announcement of the V2 upgrade for the liquidity protocol. Aave’s LEND was a close second with a gain of 514% over the same three month period. In terms of PE ratio alone, which was calculated by Q2 annualized earnings divided by market cap as of July 7, Augur was off the chart with a ratio of 26,673. Gnosis came in second with less than half of that at 12,480, while DEX protocol 0x decreased to a much more sustainable 251. Bancor continues to hold onto the lowest PE ratio of just 92. A high PE ratio could mean that an asset is overvalued, or that investors are expecting high growth rates in the future. This combination of a surge in token prices coupled with a decrease in earnings has generally led to an increase in PE ratios for DeFi tokens across the board.

Are DeFi Earnings Really Down?

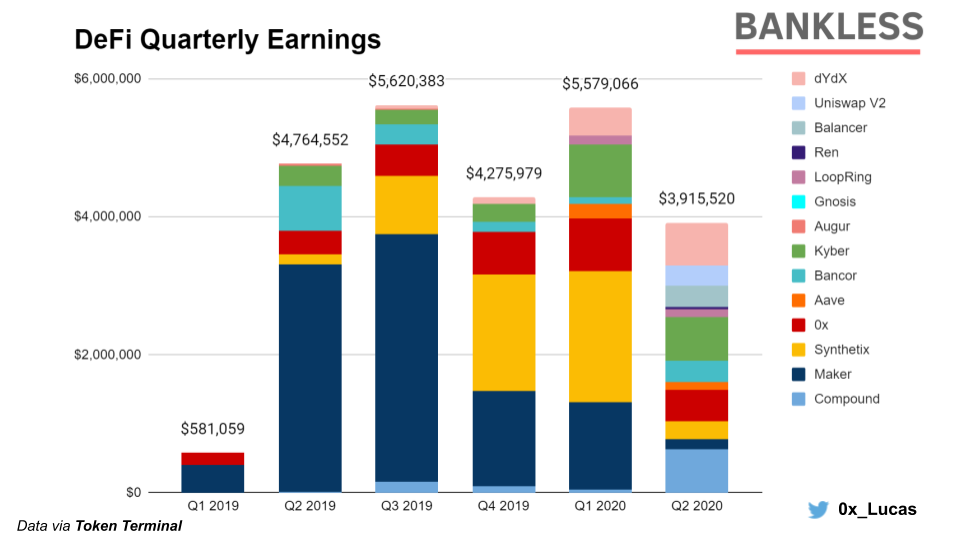

The Bankless report also revealed that DeFi earnings were down for the second quarter, which it largely attributed to two protocols; MakerDAO and Synthetix. From reported earnings of $5.57 million in the first quarter, the figure fell by 42% to $3.91 million for the Q2 period. MakerDAO dropped its Dai Savings Rate (DSR) and stability fee in March in an effort to bring Dai back to its peg of one dollar. The stablecoin traded as high as $1.08 during the crypto crash so all efforts were made to bring this back in line with what it should be. This resulted in a quarterly earnings decline of 87% from $1.2 million in Q1 to $152k in Q2. Synthetix was the second cause of the overall decline in DeFi earnings for the quarter as the protocol appeared to have misreported its earnings for the previous quarter. From around $2 million, reported earnings were adjusted down to a more realistic $267k in Q2, the report added. Not all was doom and gloom though. Growth for new players on the DeFi field painted a far more balanced picture in Q2 than one dominated by just Maker and Synthetix, which had over 50% of the earnings reported for Q1.

As such, we’re beginning to see an increasingly diverse ecosystem for DeFi protocols as they begin to compete for a slice of the market share.

Aave Lands $3 Million Investment

In a related development, flash loan protocol Aave has just been granted a $3 million investment from Framework Ventures and Three Arrows Capital. The two funds purchased Aave’s native LEND tokens directly from the company according to the official announcement. LEND has been one of the best performing tokens of the year for the entire cryptocurrency industry, surging over 1,500% since Jan 1. The investment was made when LEND was just $0.10 and now the two holders have over $7 million worth at current prices of around $0.26. Framework Ventures’ Michael Anderson stated;We believe there will be a significant market shift of private borrow/lend activity moving to decentralized money market protocols. Aave stands to significantly benefit from this underlying shift,In terms of total value locked, Aave has surged into fourth place on the charts according to DeFi Pulse. TVL on the platform has surged 240% in just six weeks to reach an all-time high of $218 million. Aave is one of the numerous winners in this year’s DeFi boom while stalwarts and former frontrunners such as MakerDAO, which has recently improved governance, are playing catch up to the new kids on the digital block.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored