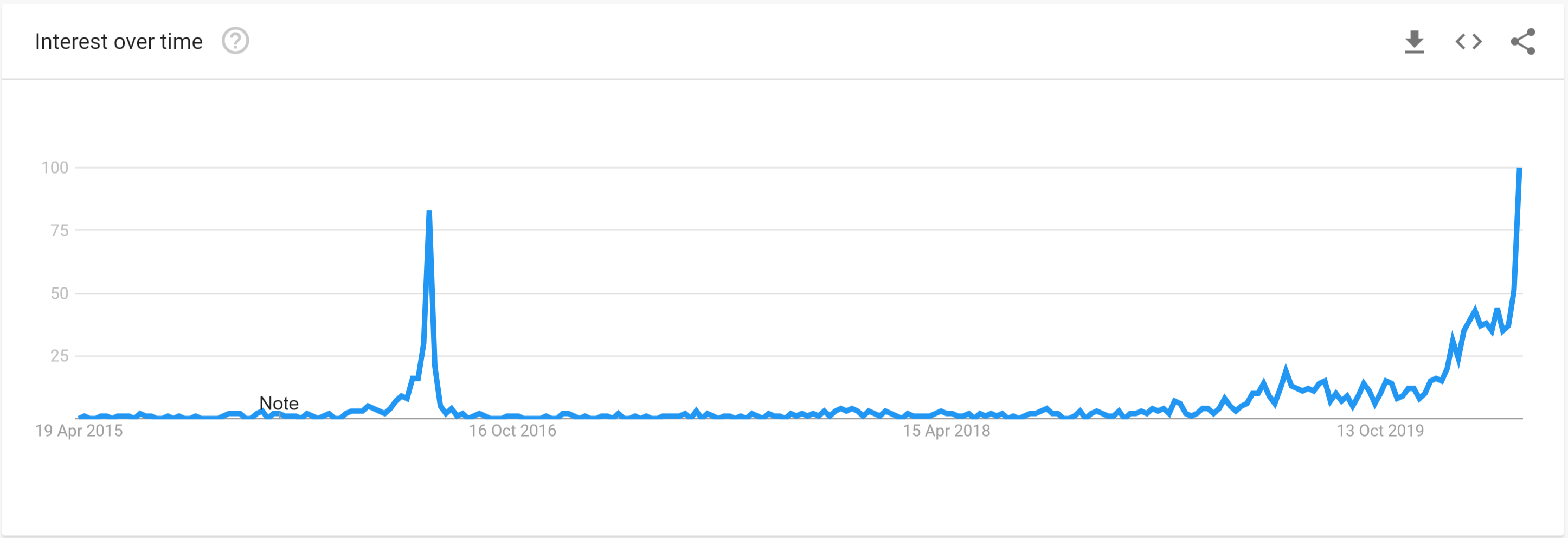

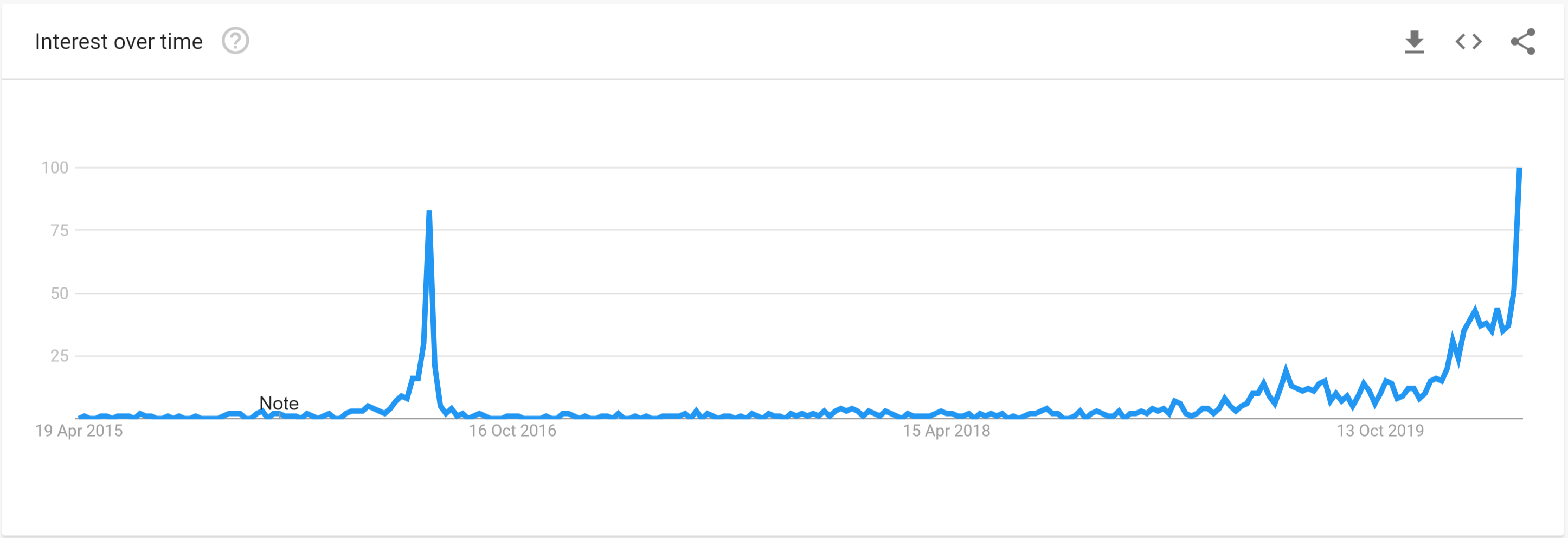

Google searches for “Bitcoin Halving” have exploded past any levels seen during the last halving in 2016. Metrics show that more and more people are searching for information surrounding the first and foremost cryptocurrency’s block-reward halving before it takes place in mid-May.

Google searches are often among the best ways to measure retail interest in cryptocurrencies. Bitcoin’s halving, set to take place in mid-May, has been highly anticipated — and there’s been a rapid increase in Google search interest as a result.

Google Trends is showing that the public is researching Bitcoin’s halving event like never before. In fact, there are more Google searches for “Bitcoin Halving” today than there were before the last halving in 2016. It’s a bullish sign as we come closer and closer to the supply of new bitcoins being cut in half.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored