Uniswap v4 is here. The ecosystem has come a long way since 2018, having matured from operating as a simple automated market maker. With v4, Uniswap has simplified processes, is cheaper, and more flexible for decentralized finance (DeFi) degens and users. So what exactly does v4 bring to the table, and how does it compare to previous versions? This guide covers everything you need to know about the latest version of the decentralized exchange in 2025.

KEY TAKEAWAYS

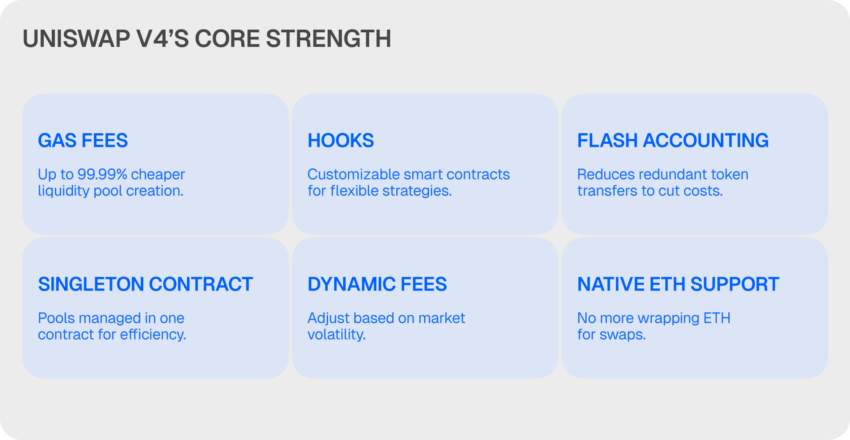

➤Uniswap v4 is the most gas-efficient, customizable, and advanced version yet, featuring hooks, dynamic fees, and flash accounting.

➤Pools are now managed under a single contract (PoolManager), reducing gas fees by up to 99.99%, while ERC-6909 replaces ERC-1155 for better liquidity management.

➤V4 is the future, but v2 and v3 still have utility — liquidity depth, fixed fee structures, and established ecosystems mean traders and LPs can choose what works best for them.

What is Uniswap v4: How is it different?

Uniswap v4 is the latest upgrade to the world’s largest decentralized exchange, designed to cut trading costs, improve efficiency, and give users more control over liquidity and fees.

Uniswap v4 is the talk of the DeFi town in 2025. Here is a quick overview of all the new features it packs:

- Much lower gas fees – Up to 99.99% cheaper to create liquidity pools.

- Hooks – Developers can customize trading logic (like dynamic fees & limit orders).

- Flash accounting – Cuts down on unnecessary token transfers, saving gas fees.

- Dynamic fees – Pools can adjust fees automatically based on market conditions.

- Native ETH support – No more wrapping ETH into WETH before trading.

- Singleton contract – Uniswap v4 manages all pools under one contract, which lowers complexity by several notches.

Uniswap v4 vs. other versions

Here’s a quick rundown of the features each previous version introduced.

Uniswap v1 (2018)

- First-ever decentralized automated market maker (AMM).

- ETH was required as the bridge for every trade (no direct token-to-token swaps).

- No price oracles, no advanced trading strategies — just a basic swap system.

Uniswap v2 (2020)

- Direct ERC-20 to ERC-20 trading (ETH no longer needed as a bridge).

- Flash swaps — users can borrow assets without upfront collateral.

- Introduced price oracles, making swaps more secure.

Uniswap v3 (2021)

- Concentrated liquidity — liquidity providers (LPs) could choose price ranges for their funds.

- Multiple fee tiers (0.05%, 0.3%, 1%) for better market efficiency.

- More capital-efficient but expensive due to separate pool contracts.

Fact check: The expensive elements of Uniswap v3 are the gas costs, as each liquidity pool is a separate smart contract. Every new pool deployment and multi-hop swap require multiple contract interactions, making transactions costlier compared to v4.

Uniswap versions compared

| Feature | Uniswap v1 | Uniswap v2 | Uniswap v3 | Uniswap v4 |

| Launch Year | 2018 | 2020 | 2021 | 2025 |

| Smart contract Structure | Single smart contract for all pairs | Separate contract per liquidity pool | Separate contract per liquidity pool | Singleton contract (all pools in one) |

| Liquidity provision | Equal liquidity across all price ranges | More flexible LP structure | Concentrated liquidity (LPs set price ranges) | More efficient LP structure with ERC-6909 |

| Fee model | Fixed 0.30% fee | Fixed fee (0.30%) but allowed customization | Multiple fee tiers (0.05%, 0.3%, 1%) | Dynamic fees + customizable hooks |

| Gas efficiency | High (gas-intensive operations) | Improved but still gas-heavy | More efficient but costly due to multiple contracts | Most gas-efficient version (99.99% cheaper pool creation) |

| Swapping mechanism | ETH as a bridge for all swaps | Direct ERC-20 to ERC-20 swaps | More efficient swapping with flexible LP positions | More flexible swapping with improved LP control |

| Price oracles | No oracles, simple price mechanism | Introduced TWAP price oracles | More advanced price oracles | Advanced oracles + external integrations |

| Token standard | ERC-20 only | ERC-20 only | ERC-721 for LP positions | ERC-6909 for gas-efficient liquidity claims |

| ETH support | ETH must be wrapped (WETH) | ETH must be wrapped (WETH) | ETH must be wrapped (WETH) | Native ETH support (no wrapping required) |

| Customization (hooks) | No hooks | No hooks | No hooks | Yes (hooks allow pool-level customization) |

| Flash accounting | No flash accounting | No flash accounting | No flash accounting | Yes (reduces unnecessary token transfers) |

| Multi-hop swap costs | High (each hop required token transfer) | Moderate (some gas optimizations) | High (each pool interaction required token movement) | Low (flash accounting optimizes swaps) |

| Security enhancements | Basic security model | Improved security with better oracle mechanisms | Highly audited, no major hacks | Most audited version with $15.5M bug bounty |

Uniswap v4 features: A deep dive

In the following sections, we will look more closely into each new trait.

The biggest change: The Singleton contract

Before (v3): Every new liquidity pool required a separate smart contract, making transactions more expensive.

Now (v4): One big contract (Singleton Design) handles all pools under one roof, significantly reducing gas fees.

Here is an easier explanation: Imagine every new trading pair needed a brand-new store (v3). Now, all trading pairs exist inside one massive shopping mall (v4), making transactions cheaper & faster.

The key concepts have of course already been memed:

Hooks

Before (v3): Uniswap’s logic was fixed — trades followed a set pattern, and liquidity providers had limited control.

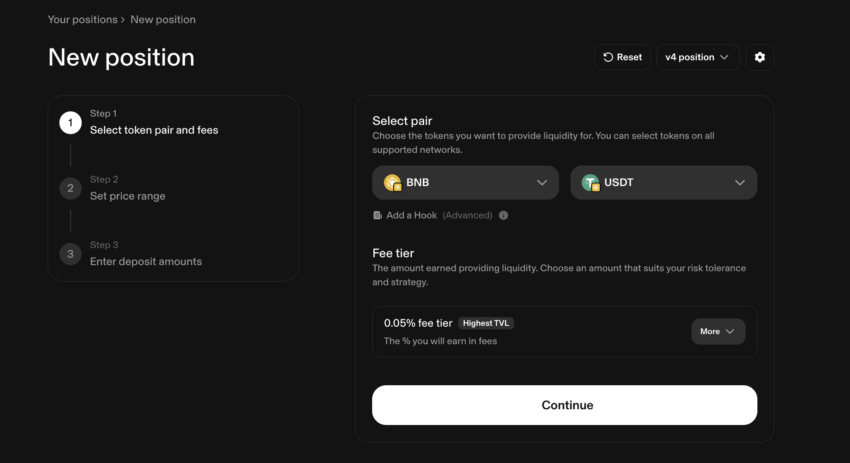

Now (v4): Developers can add custom trading rules using Hooks.

In simple terms, Hooks are like smart plugins — they let pools automatically change fees, manage liquidity, or execute limit orders.

Hooks allow you to:

- Set dynamic fees that adjust automatically during high volatility.

- Create limit orders so a swap only happens when the price is right.

- Auto-reinvest LP rewards without manual intervention.

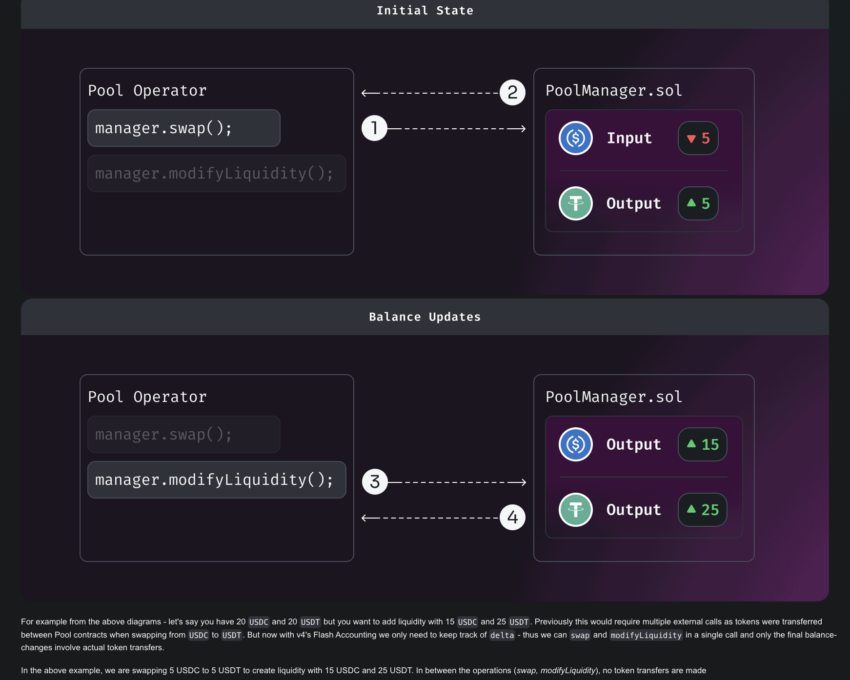

What’s up with Flash Accounting?

Before (v3): Every time you swap tokens, Uniswap transfers tokens back and forth multiple times per trade.

Now (v4): Uniswap keeps track of all balance changes internally and only transfers the final amount, cutting down gas fees.

Imagine you’re at a restaurant ordering five dishes. v3 would bring each dish separately from the kitchen, increasing service time. v4 prepares everything at once and brings it in one go, saving time and effort.

Dynamic fees

This feature brings smarter pricing for swaps. Here are the differences:

Before (v3): Pools had fixed fees (0.05%, 0.3%, 1%), meaning LPs couldn’t adjust based on market trends.

Now (v4): Fees can increase during high volatility and decrease during calm periods, optimizing LP earnings.

Why it matters: Traders get cheaper fees when markets are stable, and LPs earn higher rewards when demand is high. A win-win for everyone.

Native ETH support

Before (v3): You had to wrap ETH into WETH before trading.

Now (v4): You can trade with native ETH, saving extra gas fees & simplifying transactions.

In v3, before buying something with cash, you first had to convert it into a gift card (WETH). In v4, you can pay directly with cash (ETH) — no unnecessary steps.

Better liquidity management with Subscribers

Before (v3): If you wanted extra rewards for providing liquidity, you had to stake your position, meaning you temporarily gave up control.

Now (v4): Subscribers let you earn rewards without giving up control of your funds.

In v3, to earn extra rewards, you had to hand over your car keys to a valet (staking). In v4, you keep your keys but still earn parking rewards (subscribers).

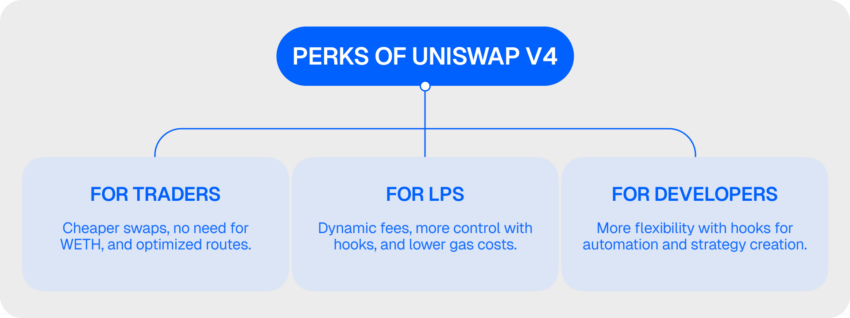

Who should switch to Uniswap v4?

You can consider using v4:

- If you’re a trader: You get lower gas fees, native ETH support, and more efficient swaps.

- If you’re a liquidity provider: You can optimize your liquidity with hooks and earn better rewards with dynamic fees.

- If you’re a developer: You gain full control over trading strategies with custom hooks.

Or, if you’re looking for an alternative to Uniswap entirely, the below X posts sets out a few options.

How do pools work in Uniswap?

If you’ve used Uniswap before, you’ve interacted with liquidity pools — but you might not know how they work behind the scenes.

Fact check: A pool is just a big pot of two tokens (like ETH and USDC) that traders swap between. Liquidity providers (LPs) pool their tokens to earn a cut of the trading fees.

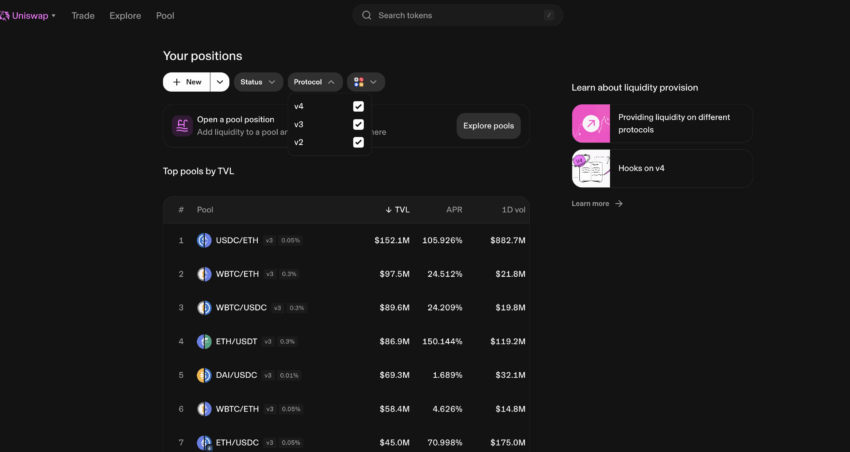

How pools worked in Uniswap v3 vs. v4

Before (v3): Every single trading pair had its own separate smart contract, meaning if you wanted to trade across multiple pools, Uniswap had to interact with multiple contracts, increasing gas fees and slowing things down.

Now (v4): Pools don’t live in separate contracts anymore. Instead, they all exist inside one big contract called the PoolManager.

This means:

- Creating a new pool is up to 99.99% cheaper compared to previous versions — because you’re not deploying an entire new contract.

- Multi-hop swaps (swapping through multiple pools) are far cheaper — because tokens don’t have to move around so much.

- All pools are managed in one place, making everything faster and more efficient.

Also, v3 left another issue to solve — how tokens move within pools. Every trade or liquidity adjustment in previous versions required multiple ERC-20 transfers, which increased gas costs unnecessarily.

ERC-6909: A more gas-efficient token system for pools

In Uniswap v4, the protocol has upgraded from ERC-1155 to ERC-6909 to optimize token claims, redemptions, and liquidity positions.

Did you know? Before ERC-6909, Uniswap v4 was considering ERC-1155, a multi-token standard that could handle multiple token types in one contract. However, it had mandatory callbacks and batching constraints, making some operations unnecessarily expensive.

Now, Uniswap v4 introduces ERC-6909, a lighter and more gas-efficient token standard that helps liquidity providers and traders save on fees by reducing unnecessary external calls.

What this means for liquidity providers and traders:

- Lower gas fees when providing or removing liquidity.

- More efficient liquidity management — LPs don’t need to move ERC-20 tokens every time they interact with the pool.

- High-frequency traders and liquidity managers benefit the most since they avoid costly ERC-20 approvals and transfers.

Here’s a simplified explanation: In v3, every time you interacted with a pool, it was like withdrawing and redepositing cash at the bank — costly and inefficient. In v4, ERC-6909 lets you hold a claim token, like a prepaid balance, that adjusts automatically — saving time and gas fees.

The current state of Uniswap v4

Yes, Uniswap v4 is live. But there is more happening in the background:

- v4 is deployed on 10+ blockchains, including Ethereum, Polygon, Arbitrum, OP Mainnet, Base, BNB Chain, Blast, World Chain, Avalanche, and Zora Network.

- Liquidity is still migrating — many traders are still using v3 pools, but new liquidity is being added to v4 every day. Pools might be available in time.

- Swaps are being routed across v2, v3, and v4 through UniswapX, which automatically finds the best price for you.

Note: If you’re swapping, you don’t have to do anything — Uniswap automatically routes your trade to the best pool (whether it’s v2, v3, or v4). Also, if you’re providing liquidity, you now have a choice. You can stick to v3 if you like, or migrate to v4 for lower gas costs and increased customization options.

Did you know? v4 is not a forced upgrade — it’s just an improved option for those who want lower fees and more control.

Uniswap v4 versus older versions

Uniswap v4 brings cheaper transactions, more flexibility, and advanced features, making it the best choice for most users moving forward. However, v3 still holds an edge in deep liquidity, and some traders and LPs may prefer its fixed fee structures and established ecosystem. For now, v4 is the future, but v3 and v2 still serve specific needs, so your decision should be based on your trading style and liquidity strategy.

Frequently asked questions

Is Uniswap v4 fully replacing v3, or will both exist side by side?

Does Uniswap v4 really make gas fees much cheaper?

Can Uniswap v4 stop MEV (Maximal Extractable Value) attacks?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.