Sui (SUI) trading volume has dropped by 30% in the past 24 hours, following the token’s failure to reclaim the $2 level despite recently reaching a new all-time high.

Following this development, traders who had anticipated a swift move toward $3 have now tempered their expectations. This on-chain analysis explores the reasons behind this shift and what may lie ahead for SUI.

Interest in Sui Continues to Fade

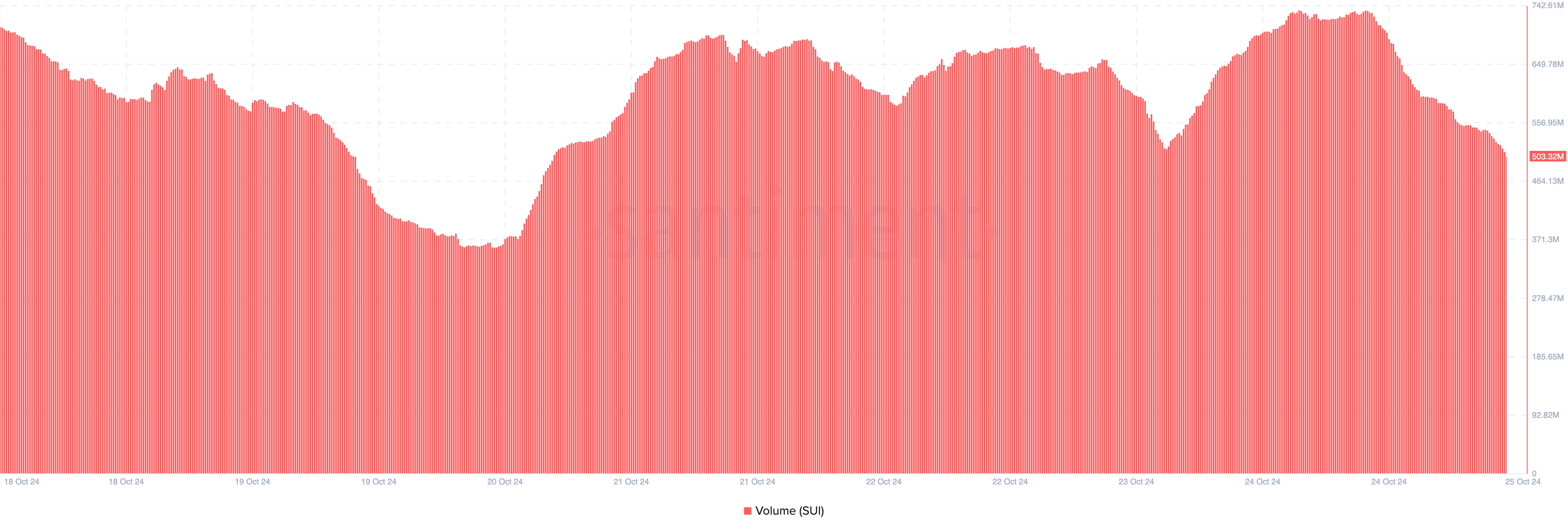

On October 24, Sui’s trading volume was over $700 million. However, as of this writing, the metric has dropped to $503.32 million, representing a 30% decline within the mentioned timeframe.

Crypto trading volume measures how frequently a particular coin is traded within a specific time frame. Investors use this metric to gauge the asset’s buying and selling popularity at any given moment.

Thus, the drop in SUI’s trading volume indicates fading market interest. Typically, declining volume during a price recovery signals bearish momentum. If this trend persists, SUI’s price may fall below the $1.91 level.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

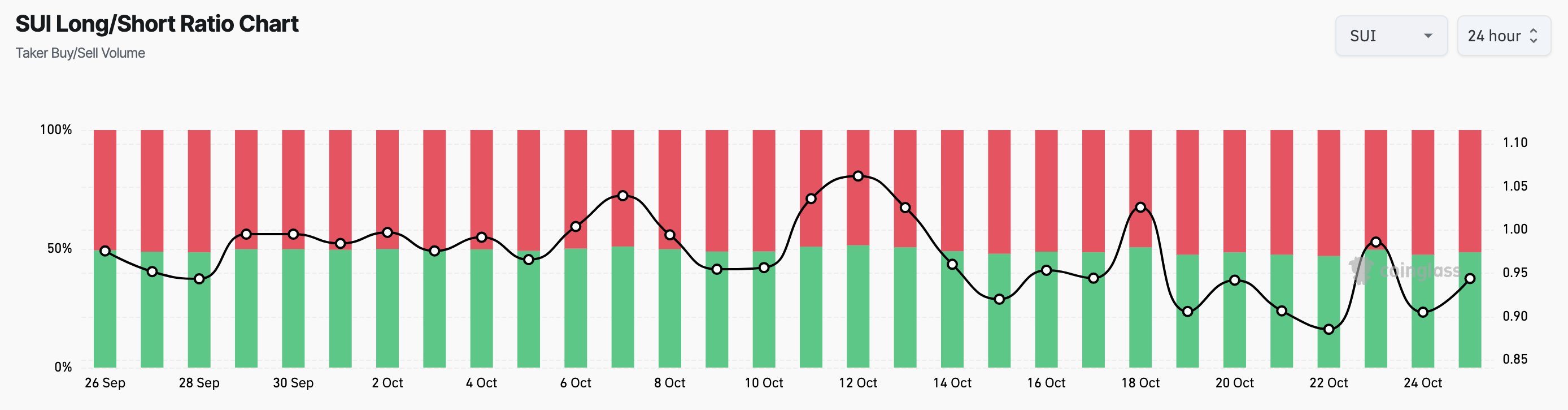

In line with this perspective, Coinglass data reveals that the 24-hour Long/Short Ratio is currently below 1. This ratio serves as a gauge of investor sentiment; when it exceeds 1, it indicates more longs—those betting on a price increase—than shorts.

Conversely, a reading below this threshold suggests a different sentiment. While the Long/Short Ratio is under 1, the data also shows that it is close to this level. This indicates that the average trader is not necessarily bearish but is likely to remain on the sidelines, awaiting clarity on how high or low SUI’s price may go.

SUI Price Prediction: No Recovery Yet

Based on the daily chart, SUI’s price has fallen below the 20-day Exponential Moving Average (EMA) for the first time since April. The last time this happened, SUI’s price plunged by 62% within four months.

However, this is not to say such a situation will repeat itself. Still, it is unlikely that the altcoin will recover in the short term. As it stands, the token might drop by double digits. If that happens, then SUI’s price could decline to $1.64.

Read more: Everything You Need to Know About the Sui Blockchain

On the other hand, if Sui’s trading volume increases, this outlook could shift. In that scenario, bulls would need to assert buying pressure and prevent bears from dominating the market. If they succeed, the altcoin’s value could rally to $2.37.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.