The TON ecosystem is arguably the biggest breakthrough of the crypto industry in 2024, becoming one of the best-known blockchains. Within the year, it has seen massive growth in several metrics, such as trading volume and the total value locked (TVL). Moreover, TON has established a formidable user base, tapping from Telegram’s massive 900 million users.

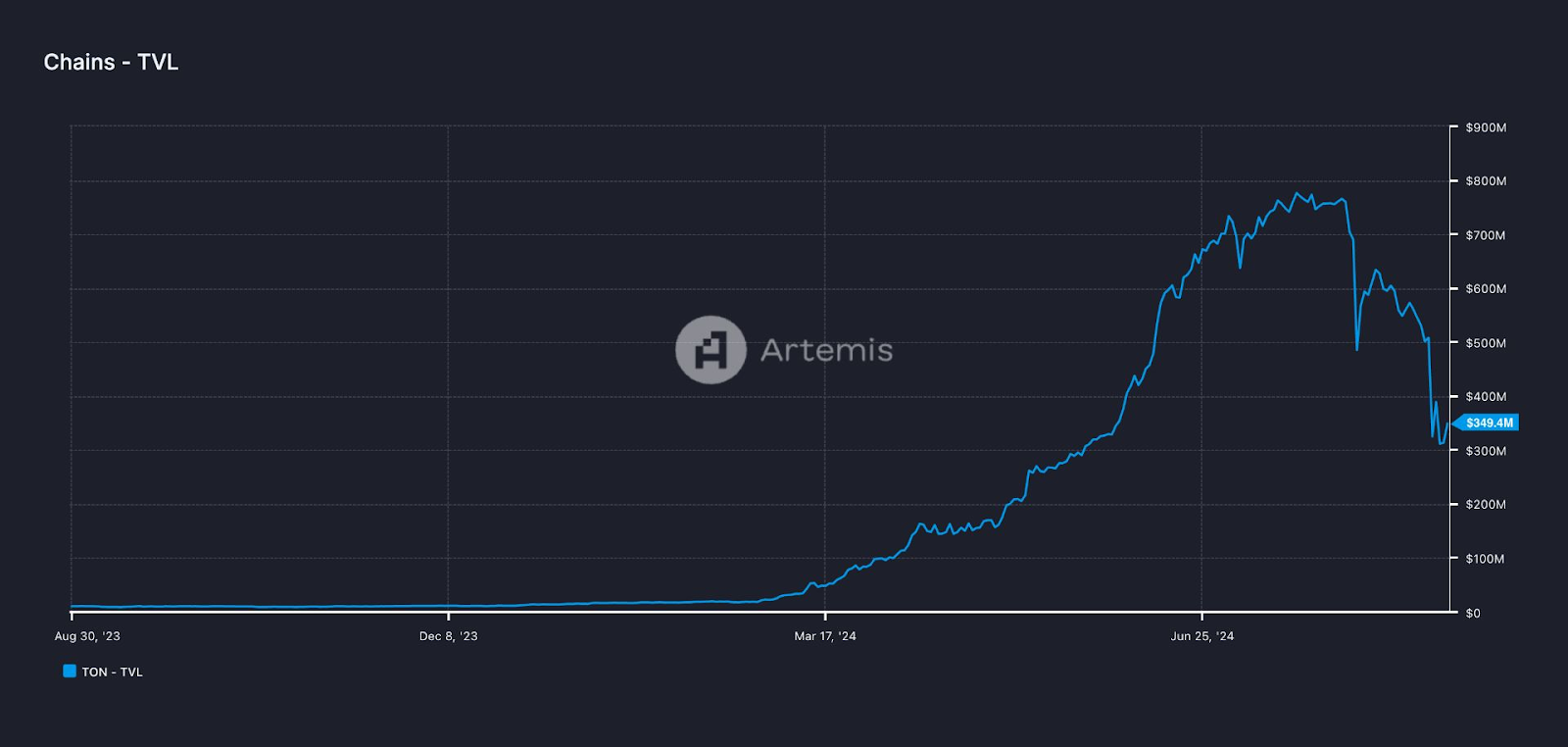

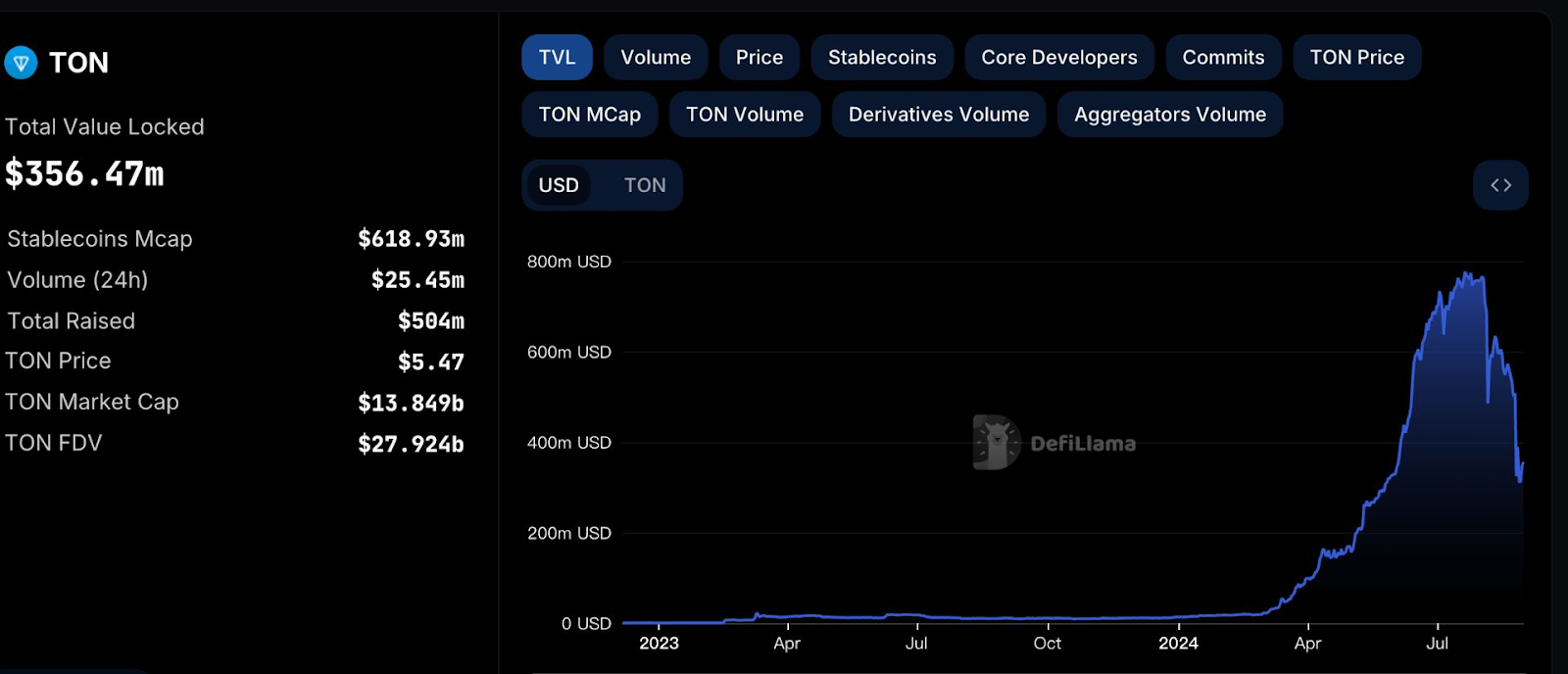

Going back in time, the TON Network has faced major extinction struggles, especially with its legal troubles in 2020. After a revival in 2022, 2024 has been a fantastic year for the TON Network, reaching $773 million TVL in July. This article provides a detailed review of the TON ecosystem performance in 2024, its challenges, and the future outlook.

On 16th September 2024, Bitget published a new report analyzing how much the TON blockchain has grown in the past few years. Their report confirms over 10x growth in transaction numbers, TVL, decentralized exchange (DEX) trading volume, and other metrics within the TON Network.

Bitget’s Review on TON’s Performance

According to Bitget findings, TON taps Telegram’s 900 million users, with a diverse user base in CIS (Commonwealth of Independent States), South Asia, Southeast Asia, Brazil, and Nigeria. Furthermore, the report highlighted increasing transactions, reaching approximately 1.2 million daily from a previous 100,000. In August, the network had 1,159 decentralized applications (dApps) and over 900,000 daily active addresses (DAA).

The DeFi development on TON has also been massive. Bitget confirmed a TVL growth of $20 million at the beginning of the year to nearly $350 million at the time of their report. DEX trading volume also increased to $40 million daily, an impressive increase from $2 million at the start of 2024. Other metrics, like transaction fee revenue, surged to $75,000 daily.

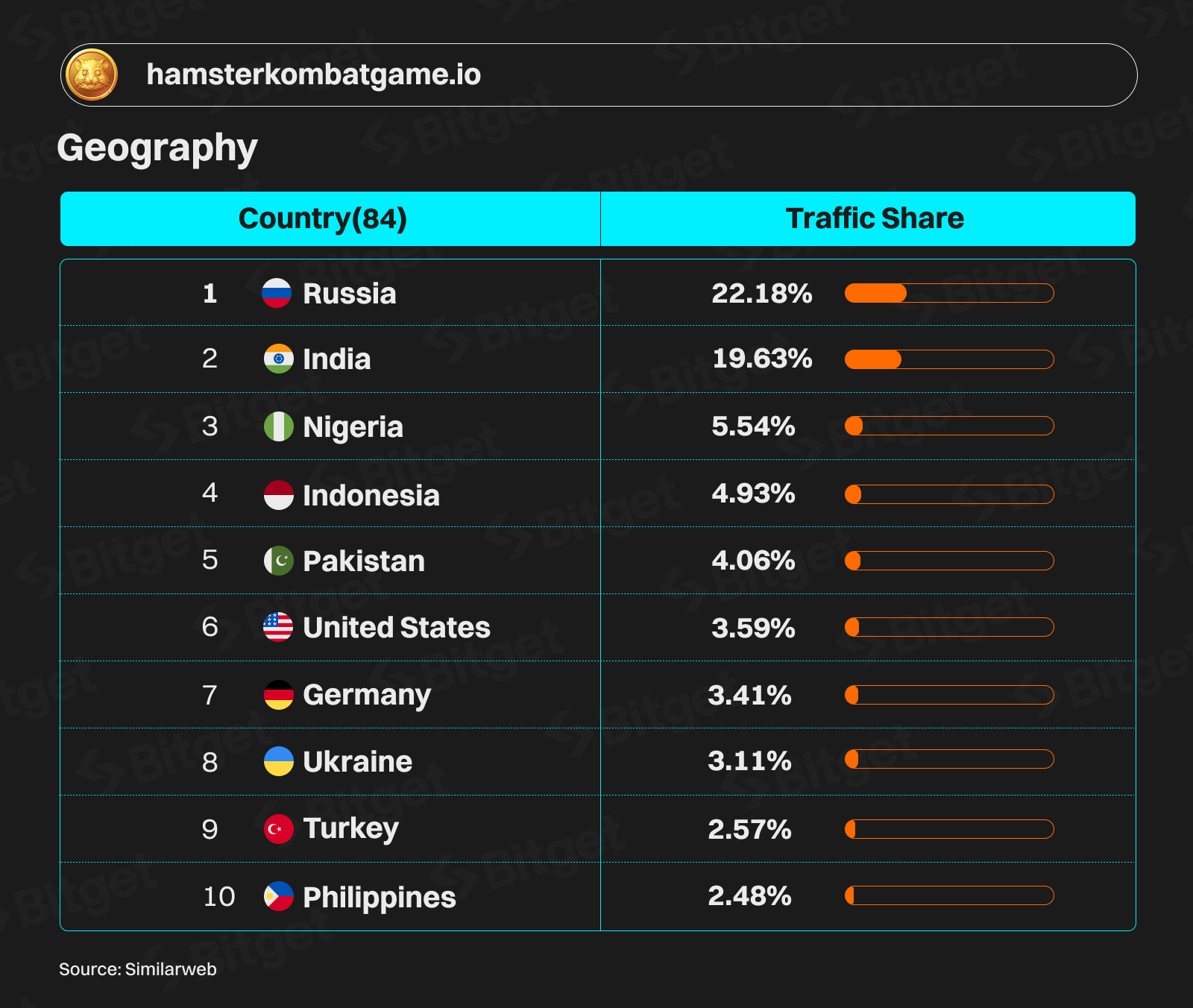

Bitget also identified key regions for TON growth. First comes the Telegram user base. Besides this, traffic from popular TON projects like Notcoin, Dogs, and Hamster were analyzed.

CIS countries, including Russia, Belarus, Uzbekistan, and Kazakhstan, comprised 66% of Notcoin’s traffic. The remaining countries that followed were Indonesia, Vietnam, China, and India. In the case of Hamster, Russia, India, and Nigeria were the top three countries.

Policy initiatives like the Open League trial run, innovative operational approach, and collaboration with industry veterans contribute to TON development. In the technological aspect, multi-chain architecture, asynchronous smart contracts, and TON Proxy are unique features.

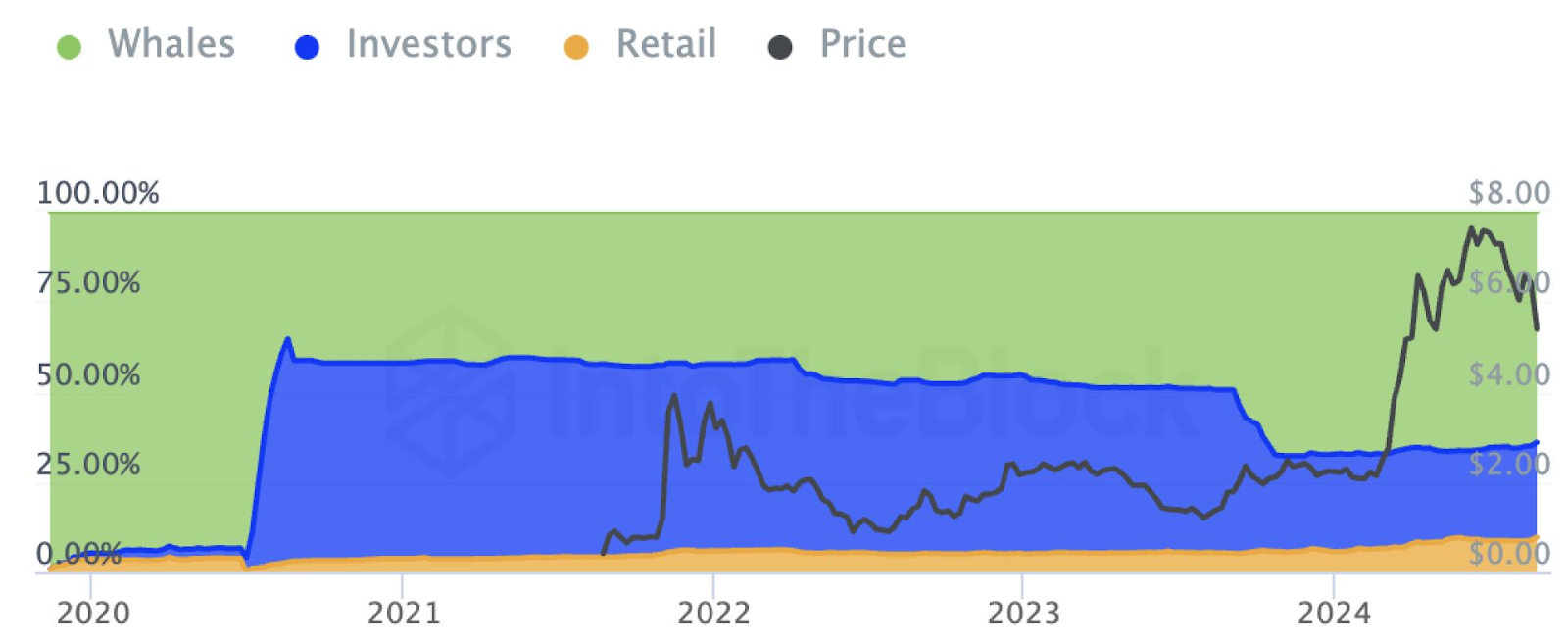

Toncoin (TON) performance is another critical aspect of Bitget review. The trading volume went from less than $200,000 to an average of around $300 million per day in less than 3 years. The centralization risk of the TON cryptocurrency has also reduced in the past year. Whale holdings decreased from 70% at the beginning of the year to 29% at the time of the Bitget report. Conversely, retail user holdings shot up, increasing from 14% at the start of the year to 42%.

TON Ecosystem – Summary of DeFi, Memecoin, Utility Tools, and GameFi Activities

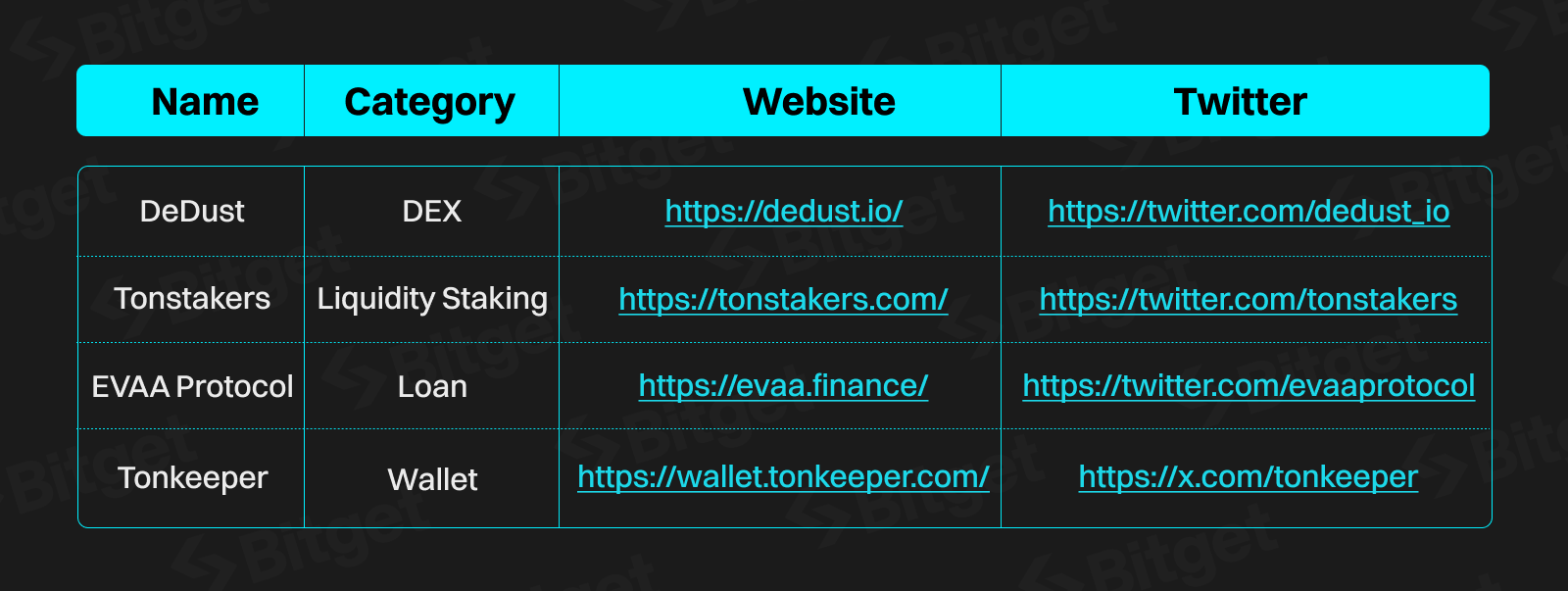

Sectors within the TON ecosystem have performed differently. Starting with DeFi, many projects represent the sub-sectors within the TON DeFi ecosystem. For instance, DeDust is the leading DEX on TON, with a TVL of $130 million. Tonstakers provides liquid staking, amassing over $170 million TVL. EVAA Protocol offers lending services, while Tonkeeper is the leading self-custody crypto wallet.

GameFi on TON is still in its early stages. The introduction of mini-gaming apps on Telegram indicates huge potential. Games like Catizen and Hamster are major successes in this sector. Memecoins are also in their early stages within the TON blockchain. This is mainly because of the low trading volume on the network’s DEX market. Nevertheless, memes like REDO and Fish stand out.

Bitget commends the TON ecosystem for having quality utility tools. Web-based tools and Telegram bots are the two major categories of utility tools on TON. However, Tonviewer is the most popular, serving as the primary blockchain explorer.

What Has Set TON Apart From Other Networks?

Many unique features set the Open Network up for the success it has enjoyed in 2024. They range from introducing the tap-to-earn model to combining CeFi and DeFi functionalities within the ecosystem.

TON Network’s Tap-To-Earn Model

The tap-to-earn model within the TON ecosystem boosted its popularity, with projects like Notcoin pioneering this model. By clicking on their mobile device screen, users were eligible to earn NOT tokens. This model appears to be an excellent onboarding strategy for newbies within the crypto industry, as they only need to tap their screens to earn rewards. Other projects, such as Hamster, have also adopted this model.

Viral Mass Airdrops

Viral mass airdrops have become a trend within the TON Network, where users can earn big rewards by participating via Telegram. There’s no barrier, as users mostly have to open the airdrop bots and participate in tasks like joining channels and groups to earn points. This has been quite effective in onboarding Web2 users into Web3.

Accessibility of Native Crypto Wallet

The partnership with Telegram to create a native crypto wallet within the platform has been a success. Indeed, integrating a native crypto wallet on Telegram aids Web2 users coming into Web3. They can easily send crypto to their contacts, making it resemble some traditional payment systems.

Besides Telegram, the TON Foundation has also collaborated numerous times to improve payments on their networks. They partnered with Tether and Oobit network back in May 2024 to develop a crypto payment solution.

Viral Mini-Gaming Projects

Besides the tap-to-earn model, mini-gaming projects within the TON ecosystem on Telegram have heavily contributed to its recent success in 2024. The pet-raising mini-app Catizen stands out in this category, where users earn rewards for caring for virtual pets. The Catizen’s success led to the introduction of other mini-apps like Gatto.

CeDeFi Projects Tapping Into Telegram User Base

With over 900 million users, CeDeFi projects can acquire more customers by tapping into this user base. An excellent case study is Blum, a CeDeFi project that combines CeFi and DeFi exchange functionalities. Their proposed services will provide a seamless onboarding process and a secure crypto platform with an intuitive user interface.

The popularity of task distribution platforms on Telegram, like PEPE Miner Bot, is also among the unique features contributing to the growth of the TON Network.

Analyzing the Weaknesses – Challenges TON Network Faces

Despite the general success in 2024, critical challenges remain within the TON ecosystem. Bitget’s latest TON research report aggregates different data sources to highlight the network’s weaknesses.

According to data from DefiLlama on 1st October 2024, TON had only 35 protocols listed on the network. Other networks like Sui, Base, Arbitrum, Optimism, and Avalanche have more. This indicates how weak the DeFi sector within the TON Network is, taking a bad position as one of the blockchains with the fewest DeFi projects.

Low Trading Volume

Bitget highlighted the low trading volume within the TON ecosystem in their report. When making their report, Bitget noted that leading DEXs on TON, such as DeDust and STON.fi, had their trading volume hovering around $15 million within a 24-hour timeframe.

In comparison, decentralized exchanges like Raydium and Uniswap have consistently recorded trading volumes above $1 billion. Another important highlight from the report is the dominance of the TON/USDT trading pair. Traders majorly abandon other trading pairs, as TON/USDT makes up 70% of trading volumes.

Weak Lending Demand on TON

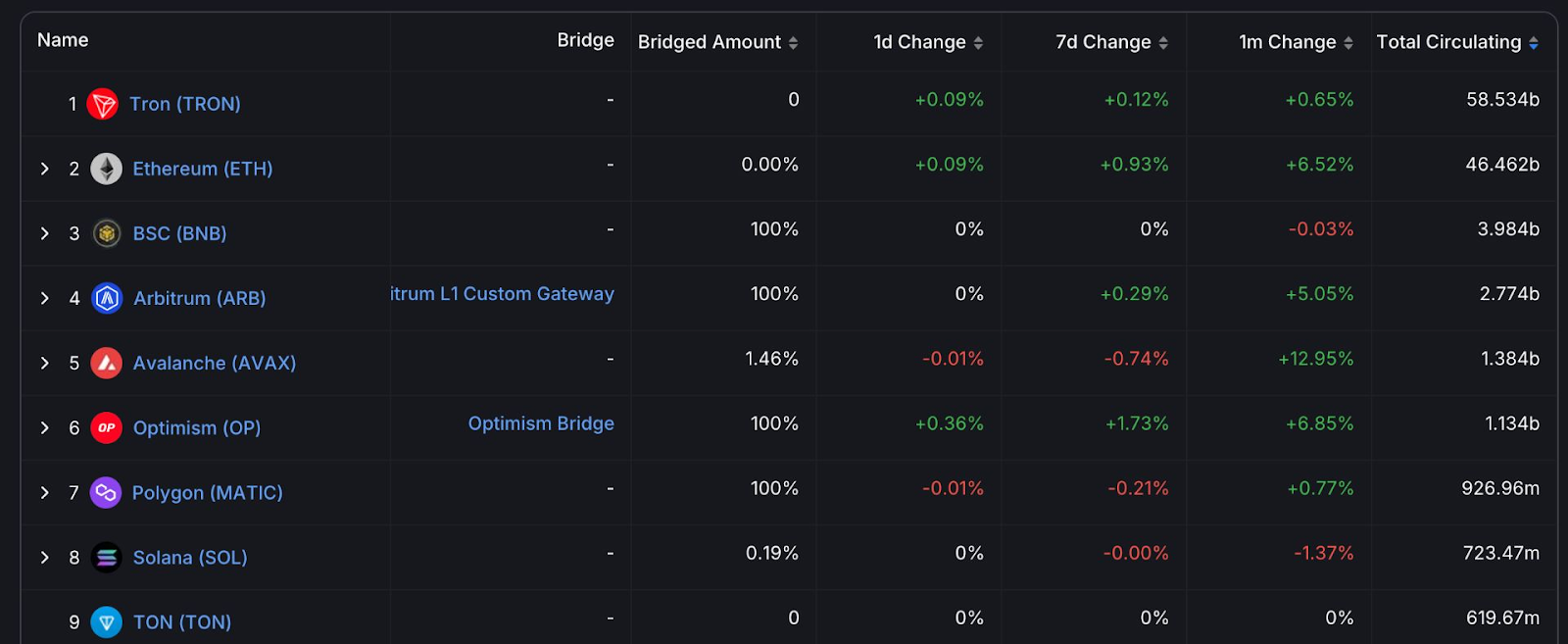

At the time of the Bitget report, the EVAA Protocol emerged as the largest lending protocol on TON. Still, it has a low TVL of less than $33 million, which is poor compared to many other lending protocols. Although lending services are lacking on TON, the blockchain isn’t low on stablecoins, as it was the ninth-largest blockchain by USDT issuance.

Bitget reported that the TON Foundation is making efforts to ensure they address these shortcomings. Launching its own Layer 2 network based on Polygon technology is one of the TON Network’s first steps to address this. This layer 2 will be named the TON Applications Chain (TAC), aiding more development on TON.

What Does the Future Hold for the TON Ecosystem? Potentials and Opportunities Ahead

Undoubtedly, the TON ecosystem holds a lot of potential and opportunities for retail investors and investment institutions.

The free airdrop and tap-to-earn sectors have a high potential for TON. Airdrops like DOGS, which give free rewards to users based on the value and age of their Telegram accounts, are highly appealing to users. Furthermore, tap-to-earn projects like Hamster Kombat have been reported to be a huge success, achieving over 239 million registrations in just three months.

The potential of the free airdrop and tap-to-earn sectors on TON is highlighted by their record of overtaking previously popular airdrops. For instance, Notcoin’s airdrop was larger than the ZKsync and LayerZero combined, with $2.5 billion distributed to the community.

Bitget’s report noted the potential of the DeFi sector on TON. Starting with $14 million in the early days of 2024, the TVL of the TON ecosystem grew to over $773 million within the year. Although the number of DeFi protocols and lending activities is low, there’s still room for growth.

The TON Network has a unique design, making it difficult for mature projects from EVM chains to move to the network. Hence, native DEX projects on TON have a huge potential to grow without competing with mature EVM chains in the same blockchain. Liquid staking and lending protocols are subsectors to watch out for in DeFi.

Are There Opportunities?

Besides potentials, Bitget highlighted the opportunities the TON Network offers to both retail and institutional investors.

For retail investors, TON, through projects like Notcoin, Dogs, and Hamster, now provides opportunities to earn in crypto with little effort. Users can spend a few minutes of their day performing tasks and playing entertaining games to earn rewards. Nevertheless, there’s still the risk of phishing scams and fund theft with some dishonest projects.

For institutional investors, there’s an opportunity to invest in the growing infrastructure of the TON ecosystem. They can also get TON at a discount via OTC transactions. Crypto exchanges can also benefit from the growing TON, as they can partner with these projects to grow their user base. For instance, Bitget confirmed they received nearly 1 million new users due to activities from the DOGS airdrop project.

A highlight on the risks for institutional investors and exchanges shows the barriers ahead. First, regulatory compliance is still an issue for Telegram, which could affect TON’s price. This played out when Pavel Durov was arrested on 24th August 2024. Secondly, crypto exchanges might find it hard to identify stable and quality projects within the TON ecosystem. This is because most of them are grassroots initiatives and lack VC investments.

Future Developments That Will Benefit TON

In the concluding part of their review, Bitget noted that TON can still improve the network, especially in the technical aspects. Expanding their blockchain by developing the platform’s cross-chain compatibility, sharding, and node function separation are examples of future TON expansion processes.

Other technical aspects to watch out for are the TON proxy and payment systems. There’s also the prospect of TON storage, where storage nodes will be registered and ranked. The expected criteria for ranking will include size, reputation, and geographical location in the storage marketplace.

Of course, Bitget’s expert opinion is that roadblocks to these developments should be expected. Although multi-chain and sharding mechanisms enhance scalability, they will create complexity in the TON architecture. There’s also the challenge of computational and network resources needed to run the network. Moreover, TON is still relatively new compared to mature platforms like Ethereum, leading to a lack of developer community support.

There are a few other issues to highlight. First, the viral airdrops and tap-to-earn model have been a success. But for TON to maintain its success, it would have to move beyond this. It will be essential to find a way to keep users’ funds within their ecosystem by developing their DeFi architecture.

Secondly, breaking into the European and American user base will be crucial to maintaining regional balance. Regulatory stability is another critical factor for growth. Telegram, which backs the TON Network, constantly faces regulatory issues due to its privacy and encryption policies. This situation has to be permanently fixed in the future to ensure it doesn’t create constant volatility in the TON ecosystem performance.

Conclusion

TON emerged as one of the most popular and fastest-growing blockchains in 2024, reaching a massive TVL of over $773 million at one point. A new report from Bitget critiques the TON Network, providing updates on its current status, unique features, potentials, opportunities, challenges, and developmental plans. The popularity of airdrops, Tap-to-Earn models, and task platforms on the TON ecosystem are some potential associated with the network.

Both retail and institutional investors, and even exchanges, can benefit from TON’s growth. However, there are risks to keep in mind, such as phishing attacks for retailers and regulatory hurdles for institutional investors and exchanges. In the future, Bitget suggests that TON can improve its platform by sorting out regulatory issues with Telegram, making technical enhancements, and improving the developer community.

While concluding their review, Bitget had some predictions for TON. They predict the “de-Telegramization” of the TON Network. Bitget also expects increased support from Web3 funds and the TON Foundation, a breakout of meme coins, and the increased valuation of Telegram bots.

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.