ParaFi Capital, an alternative asset management firm, has taken a key step in integrating blockchain into its operations by tokenizing part of its venture fund.

This move was conducted on the Avalanche blockchain in partnership with Securitize. It will permit a broader range of investors to participate in ParaFi’s venture strategy.

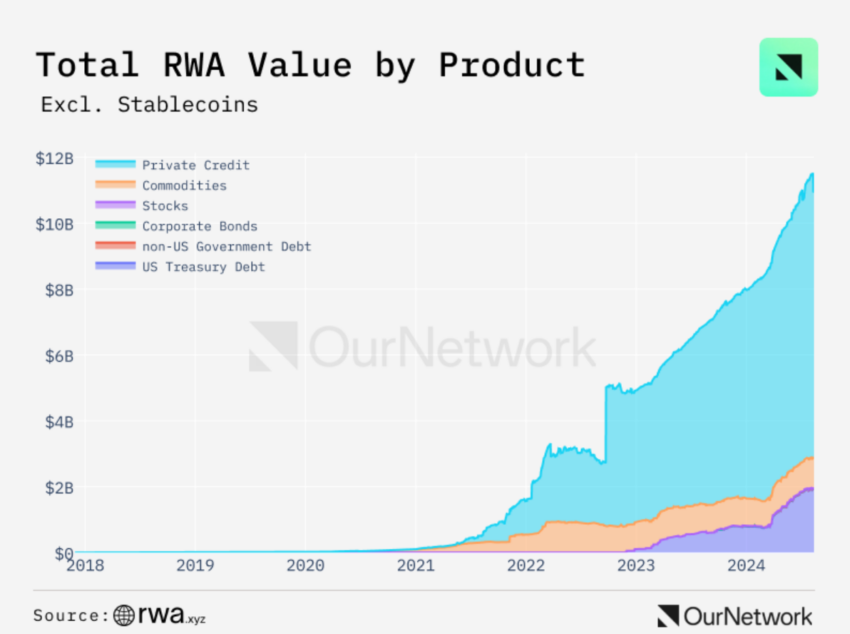

Real-World Asset Tokenization Surges as Demand for US Treasuries Grows

The firm sees tokenization as enhancing efficiency by reducing legal and administrative costs. Moreover, this initiative reflects ParaFi’s strategic shift from simply investing in tokenization technology to applying it within its own operations.

“Tokenization of private market strategies can unlock streamlined settlement processes, reduce legal and administrative costs, and longer term can unlock a broad range of benefits including liquidity, programmability, and cross-margining,” Ben Forman, ParaFi’s Founder and Managing Partner, told BeInCrypto in an email.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

This transition follows ParaFi’s August 2024 fundraising, where it secured $120 million from institutional investors like Theta Capital Management and Accolade Partners. The firm aims to use this funding to enlarge its footprint in the crypto domain by acquiring stakes in the general partners of crypto-focused funds.

This initiative also serves as a crucial component of ParaFi’s comprehensive strategy. Over the next three to five years, it aims to build a portfolio with 30 to 50 stakes, reinforcing its dedication to tokenization technology.

Furthermore, by tokenizing its fund, ParaFi opens access to a broader pool of investors beyond its existing institutional clients. These include endowments, foundations, and family offices.

These tokenized interests will eventually be tradable on Securitize Markets, enabling secondary market trading. Additionally, Securitize Credit’s lending and borrowing services will be available to investors, adding further financial options.

Carlos Domingo, CEO of Securitize, highlighted the increasing benefits of asset managers transitioning to blockchain-based models. Securitize, known for tokenizing traditional assets for major firms—including BlackRock, has leveraged its platform to facilitate ParaFi’s entry into the tokenized finance space.

Additionally, Domingo emphasized the importance of regulatory compliance and institutional adoption in the tokenization space. He elaborated on Securitize’s efforts to navigate regulatory challenges, noting that the company has secured a registered transfer agent license and a broker-dealer to handle the tokenization process comprehensively.

Domingo also commented on the evolution of the regulatory scene in this segment. He expressed hope that regulators would recognize the benefits of blockchain technology for capital markets while ensuring compliance with securities laws.

“To date, legislative efforts related to digital assets have primarily focused on crypto digital assets and stablecoins, with less of a focus on legislation that enables traditional financial services and regulated financial products to benefit from blockchain technology and tokenization. We need clarity on the definition of tokenized securities – as it is important to distinguish between tokenized securities that are lawfully issued as securities and crypto assets,” he told BeInCrypto.

This initiative selected Avalanche because of its EVM compatibility, low transaction fees, and sub-second finality. These features make Avalanche highly suitable for institutional use. As more institutions look into blockchain-based solutions, the Avalanche ecosystem continues to grow, encompassing tokenized assets in various sectors.

“Financial markets demand innovation, and recently, we’ve seen significant leaps forward in the evolution of financial assets leveraging blockchain and tokenization as enablers for greater access and utility,” John Wu, President of Ava Labs, said.

ParaFi’s tokenization comes as the broader market for tokenized real-world assets expands. BeInCrypto reported that the market has surpassed $10.9 billion, according to data from OurNetwork. This surge is driven by an increased demand for private loans and US Treasury debt.

Read more: RWA Tokenization: A Look at Security and Trust

Indeed, the tokenized US Treasury market has experienced exponential growth in 2024. RWA.xyz data shows this segment’s total value expanded from $726.23 million to $2.2 billion year-to-date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.