Tether, the issuer of the world’s largest stablecoin, USDT, is further diversifying its operations by expanding into agriculture.

This move reflects Tether’s ongoing strategy to grow its business beyond its USDT offerings.

Tether Expands Beyond Finance Into Agriculture

According to a recent filing with the US Securities and Exchange Commission (SEC), Tether has invested $100 million to acquire a 9.8% stake in Adecoagro, a prominent agricultural company in Argentina.

This transaction, completed between July 29 and August 16, 2024, secured over 10 million shares for Tether. The filing also confirmed that the investment was funded with Tether’s working capital.

Adecoagro, valued at over $1 billion, operates in Argentina, Brazil, and Uruguay. It processes around 550,000 liters of milk daily and also generates renewable energy using biodigesters.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

Tether’s CEO, Paolo Ardoino, acknowledged the investment with a globe emoji on the platform X. However, Tether has not provided further comments on this acquisition.

While the move might seem unexpected for a company best known for its dominance in the stablecoin market, Tether has a track record of expanding into various sectors. This includes notable investments in Bitcoin mining, artificial intelligence, and education.

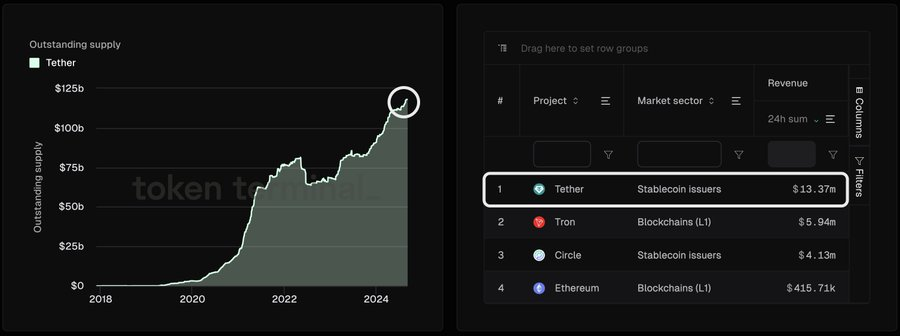

Meanwhile, Tether’s main business, its USDT stablecoin, remains the largest in the industry, with a market cap exceeding $118 billion. It operates across multiple blockchain networks and has focused on improving access to stablecoin solutions in emerging markets.

Ardoino noted that USDT had become the digital dollar for millions in regions underserved by traditional monetary systems.

“USDT has become the trusted digital dollar for hundreds of millions of people. It simply gives everyone access to stability, when they need it the most, regardless of their social status,” he stated.

Read more: A Guide to the Best Stablecoins in 2024

Tether’s efforts have paid off financially, generating over $13 million in daily revenue, according to Token Terminal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.