Tether, the company behind the $87 billion USDT stablecoin, has announced its entry into Bitcoin mining.

With a planned investment of approximately $500 million over the next six months, Tether is set to become a key player in this energy-intensive and competitive field.

Tether Pivots Into Bitcoin Mining

Tether’s strategy involves constructing its own mining facilities and acquiring stakes in existing Bitcoin mining companies. This move includes a significant part of a $610 million credit facility extended to Northern Data AG. Subsequently indicating Tether’s commitment to the sector.

“We are committed to being part of the Bitcoin mining ecosystem. When it comes to the expansions, building new substations and new sites, we are taking them extremely seriously. Mining for us is something that we have to learn and grow over time We are not in a rush to become the biggest miner in the world,” Tether CEO, Paolo Ardoino, said.

Tether, primarily known for managing the USDT stablecoin, is diversifying its business model. This expansion into mining could impact the already saturated market for Bitcoin’s limited supply. Hence, marking a new direction for Tether’s revenue sources.

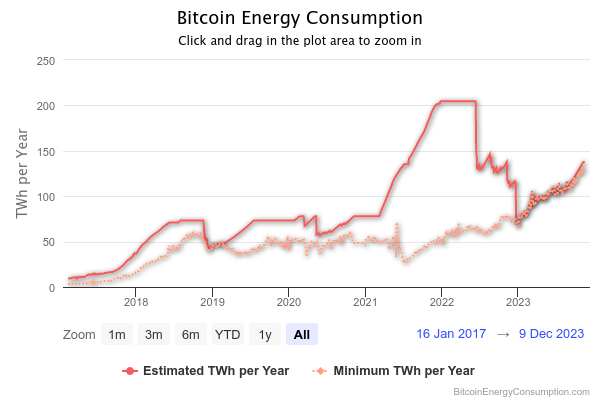

Bitcoin mining, the process of validating transactions on the blockchain, uses specialized equipment to secure the network and earn new BTC tokens in return. It requires substantial energy and resources. Indeed, Bitcoin’s energy consumption is reportedly around 127 terawatt-hours (TWh) annually, surpassing the energy usage of entire nations such as Norway.

In the United States, it is estimated that crypto operations contribute a carbon footprint ranging from 25 to 50 million tons of CO2 each year. This level of emissions is comparable to the amount produced yearly by diesel fuel consumption in the US railroad sector.

Tether has chosen Uruguay, Paraguay, and El Salvador as locations for its mining operations. Each site’s capacity ranges from 40 to 70 megawatts, with the goal of achieving a 1% share of the total network’s computing power. However, the competitive nature of the crypto mining industry and the upcoming Bitcoin halving present challenges to Tether’s new venture.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Tether’s move into this sector comes when many miners are struggling, highlighting the potential for market dynamics to shift. The company plans to reach 120 megawatts by the end of 2023 and up to 450 megawatts by 2025.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.