Ripple’s XRP has experienced a dip in trading activity over the past 24 hours. This has led to a 2% drop in its price and a 12% decrease in trading volume.

If the altcoin breaks below the ascending trend line it has held above since September 6, it could face a further 18% decline.

Ripple‘s Derivatives Traders Exit Market

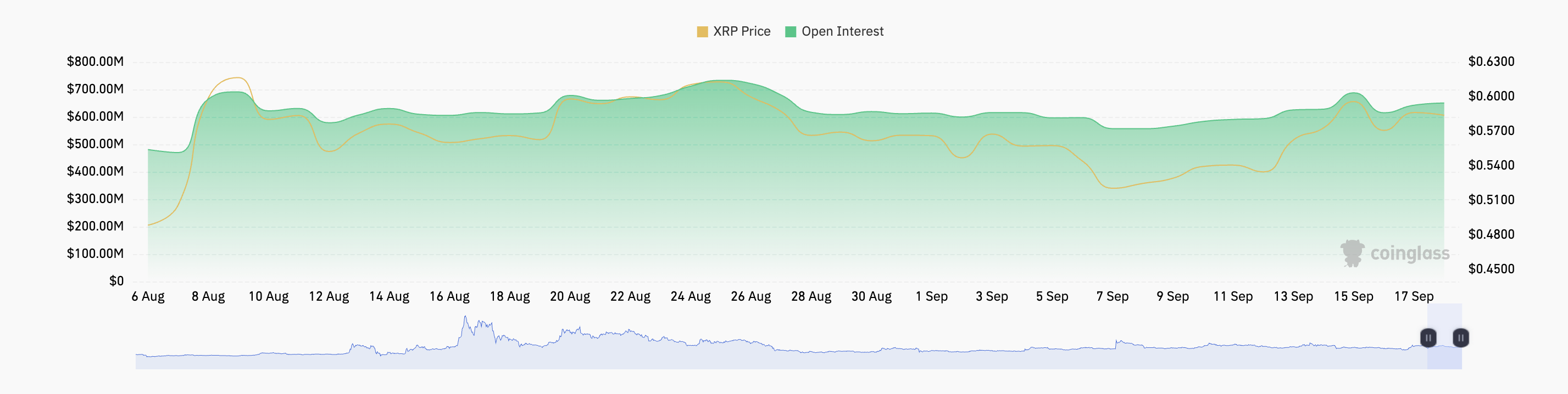

Ripple’s price decline over the past 24 hours has also impacted its derivatives market. According to Coinglass data, trading volume in XRP derivatives dropped by 22% during this period.

The reduced trading volume suggests fewer traders are entering or exiting positions, which decreases liquidity. Lower liquidity can make it harder for market participants to execute trades at their desired prices.

Additionally, XRP’s open interest — representing the total number of open futures and options contracts — has declined by 2%, totaling $634 million. Generally, this shows a waning interest in the asset or a lack of conviction in the current trend.

Read more: XRP ETF Explained: What It Is and How It Works

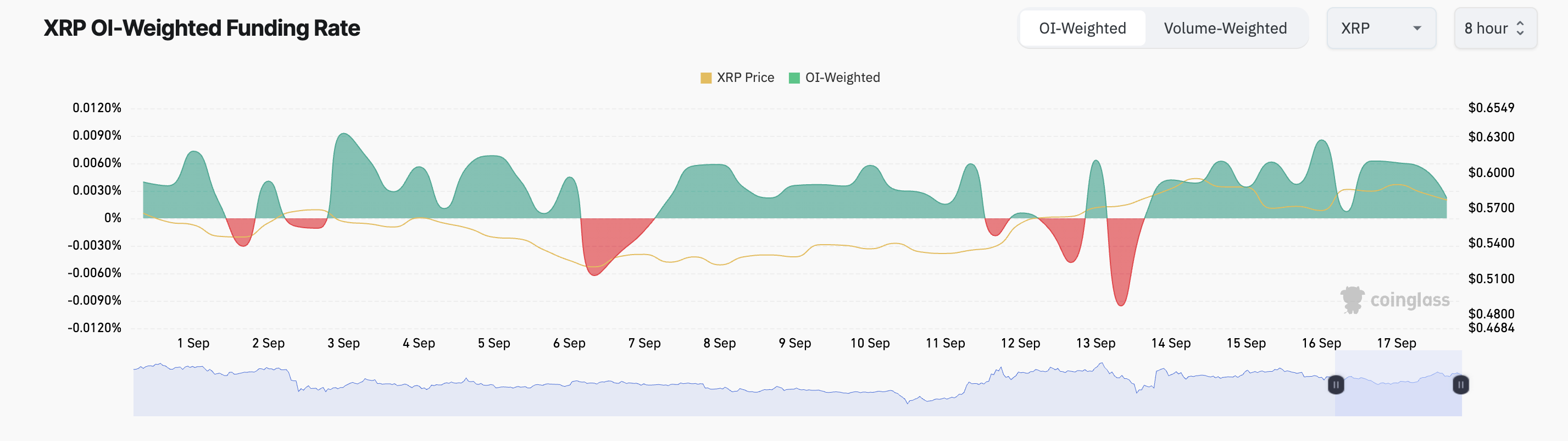

Interestingly, while some traders have closed their contracts, the ones in the market continue to demand long positions, as evidenced by XRP’s positive funding rate. At press time, the token’s funding rate, which is a periodic payment to ensure its contract price stays close to its spot price, is 0.0022%.

When an asset’s funding rate is positive, there is a higher demand for long positions than short ones.

XRP Price Prediction: Why the Bulls Must Defend the Ascending Line

XRP trades at $0.57, attempting to fall below its ascending trend line. If the selling pressure in the market strengthens further, the bulls will be unable to defend this level, causing the altcoin to seek support at $0.45.

This would mean an 18% drop from its current value.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, if XRP reverses the current trend and rallies, it will retest support at $0.60. If the move is successful, the uptrend is confirmed, and the token’s price will climb toward $0.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.