Ethereum gas fees have plummeted to their lowest level in several years, driven by increasing transactions on the network’s layer-2 networks.

This significant drop has made on-chain transactions much cheaper for users and prompted discussions about their long-term effect on the network.

Ethereum’s Gas Fee Reduction Leads to Supply Increase

According to Etherscan data, the average gas fee on the Ethereum mainnet fell below 1 Gwei yesterday but has since rebounded to around 2 Gwei, or approximately $0.06. Meanwhile, some transactions may still attract fees of up to 5 Gwei, roughly $0.22.

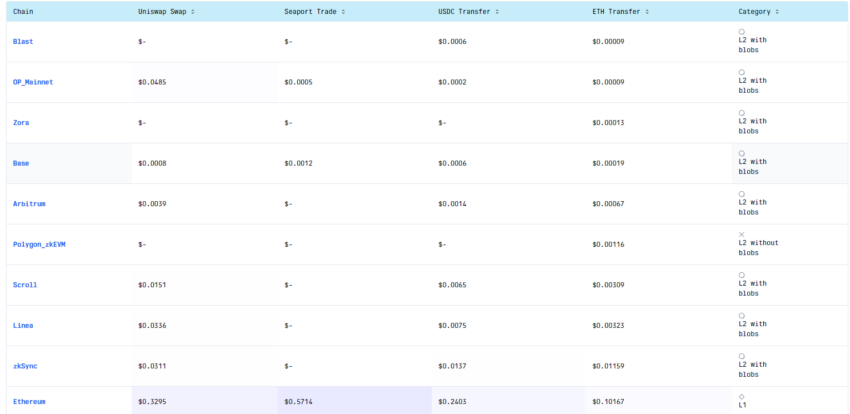

This fee reduction is also noticeable across Ethereum’s Layer 2 scaling solutions. Data from Gasfees.io indicates that average fees on Optimism, Base, Arbitrum, and Linea are currently below $0.01.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Market observers said the decline in gas fees may be linked to the introduction of blob-based transactions with the Dencun upgrade in March. This upgrade has significantly increased Layer 2 transaction volumes due to the lower fees.

For context, L2beats data shows that prominent layer-2 networks like Base and Arbitrum now process more transactions per second than Ethereum itself. Over the past day, Base handled 39.80 transactions per second (TPS), and Arbitrum managed 17.28 TPS. In contrast, Ethereum processed around 12.17 TPS.

These trends have led some stakeholders, such as Martin Koppelman, Co-Founder of Gnosis, to advocate for increased Layer 1 activity. Koppelman suggests that raising the gas limit, even with low fees, could be a strategic move to boost base layer usage.

“IMO Ethereum needs to get more L1 activity again and even if it sounds counterintuitive at such low rates, raising the gas limit can be part of a strategy,” he stated.

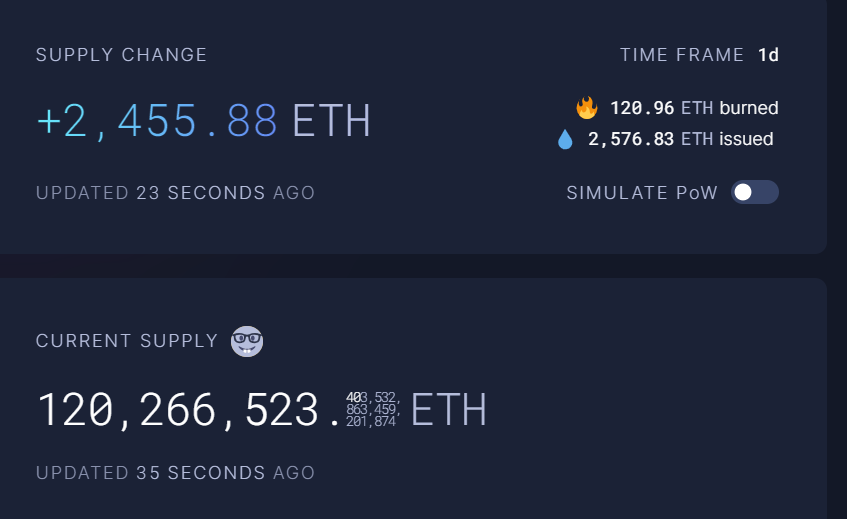

On the other hand, the reduction in fees has sparked concerns about network inflation. With fewer ETH being burned, the network’s supply has been rising.

According to Ultrasound.money, only 120 ETH were burned in the past day, while the supply increased by more than 2,500 ETH. This imbalance suggests a growing ETH supply, counteracting the deflationary trend previously observed.

Read more: How to Invest in Ethereum ETFs?

If this trend continues, Ethereum’s supply could expand by over 943,000 ETH, equivalent to $2.5 billion, within the next year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.