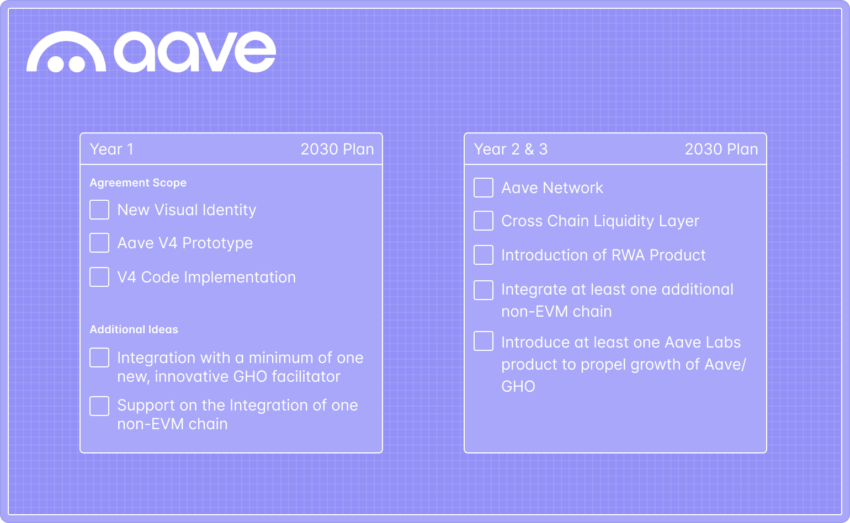

Aave Protocol is preparing for a significant upgrade with its upcoming V4 release, scheduled for mid-2025.

This new version builds on the foundation laid by V3, aiming to transform the decentralized finance (DeFi) sector with new features and improved user experience.

How Aave V4 Enhances Lending Protocol

Aave V4 introduces a new architectural blueprint to minimize governance overhead and enhance modularity. This change promises to optimize capital efficiency and integrate the Aave-native stablecoin, GHO, more seamlessly than ever before.

Moreover, V4 will incorporate risk management tools and a more efficient liquidation engine to bolster security and user confidence.

“Given the competitive DeFi landscape, we believe the key to staying ahead is continued innovation, building, and shipping excellent solutions that address the ongoing requirements of the Aave community. The suggested ideas aim to position Aave at the forefront of DeFi in 2030 and beyond,” Aave Labs wrote.

The highlight of V4 is the introduction of a Unified Liquidity Layer. This feature evolves from the Portals concept in V3, offering a more abstract and independent framework for liquidity management. It will allow Aave to adjust supply and draw caps, interest rates, and incentives without the cumbersome need to migrate liquidity for new borrow modules.

Another significant advancement is the implementation of fuzzy-controlled interest rates. This approach automates interest adjustments based on real-time market conditions. The integration with Chainlink ensures the most accurate and efficient on-chain interest rate models.

Read more: Aave (AAVE) Price Prediction 2024/2025/2030

Aave V4 also plans to introduce Liquidity Premiums. This feature will enable differentiated borrowing costs based on the risk profile of the collateral, fine-tuning the economic incentives for using riskier assets.

For user convenience, V4 will debut Smart Accounts. These accounts address the operational complexity of managing multiple wallets by allowing users to handle various borrowing positions from a single wallet interface.

Regarding risk management, V4 will adopt a dynamic risk configuration system. This system allows for asset-specific configurations that can evolve without impacting existing borrowers, significantly reducing governance friction.

Read more: How To Use Aave?

The development timeline for Aave V4 spans from initial research in Q2 2024 to a complete rollout by mid-2025. This phased approach includes extensive community engagement, rigorous testing, and multiple audits to meet security and reliability standards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.