The Aave protocol is a decentralized application (DApp) on Ethereum that has become synonymous with flash loans. So, how do you use the Aave protocol? This guide looks at how the platform functions and demonstrates how you can make its system work for your daily crypto needs in 2025.

KEY TAKEAWAYS

➤ Aave is a decentralized application on Ethereum that allows users to lend and borrow without intermediaries.

➤ Users can supply crypto to earn interest, borrow funds, and participate in governance.

➤ Flash loans on Aave allow developers to borrow funds without collateral, provided the loan is repaid in the same block.

➤ It has become popular for arbitrage traders executing MEV strategies to earn profits.

How to supply (deposit funds) on Aave

Aave is an crypto lending and borrowing protocol based on the Ethereum blockchain. It allows users to borrow or lend a variety of cryptocurrencies.

Users can take DeFi loans and earn interest on their deposits. Essentially, Aave is a bridge between the classic financial sector and decentralized ecosystems.

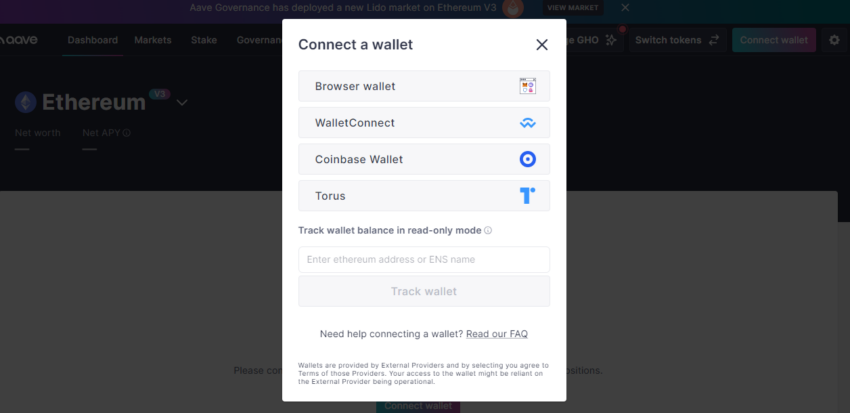

The first step is to deposit funds on the platform. To do that, you will need to connect your crypto wallet.

1. Click on “Launch App.”

2. Next, you will have to connect a wallet. The platform offers several options, including hardware wallets such as Ledger. For this example, we have used MetaMask.

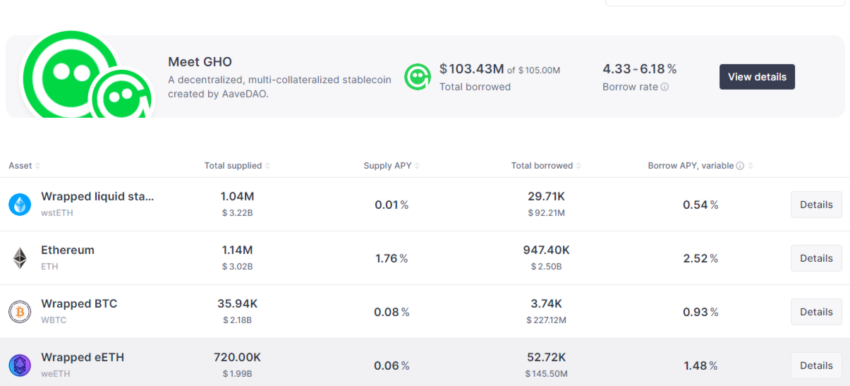

3. Next, you will want to deposit funds into Aave. This allows you to borrow, stake, or vote in the platform’s governance system. Select an asset from the list of available assets.

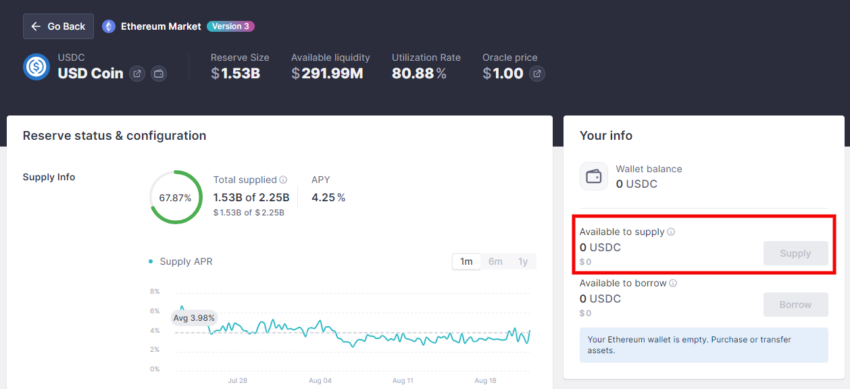

4. Simply go to the “Supply” section. Click on the option, then choose the asset and the amount that you wish to deposit. As soon as the transaction is confirmed, you can use the amount inside the platform.

You can deposit any amount that you want. There is no minimum or maximum value. Of course, the total value of your interest will be based on how much you choose to deposit.

Note that you can deselect your asset once you deposit. This will prevent the asset from being used as collateral. You can also choose to withdraw your funds, as long as they are not being used for any of the functions mentioned previously.

Staking on Aave

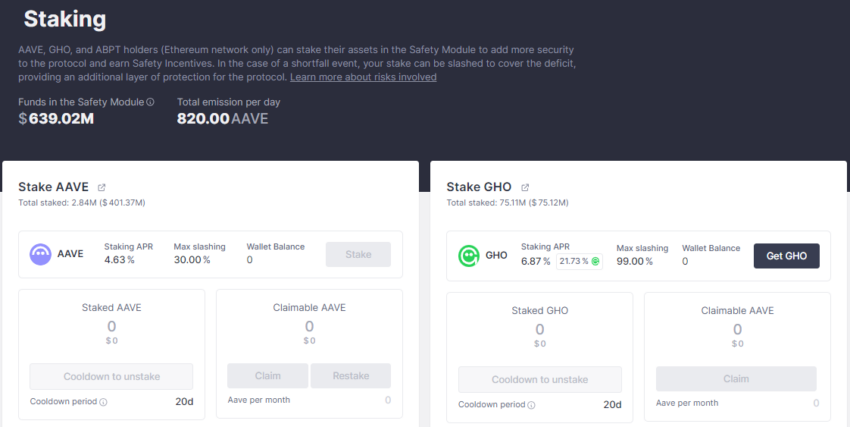

On the Aave platform, staking is extremely simple and requires only a single click of a button. To stake, you will need the platform’s native tokens. One way to acquire the token is through any of the crypto exchanges. After this step, you can navigate to the staking section of the Aave website.

You will need to choose the “Stake” option, which appears on the new or classic version of the platform. Once you have made your decision, you need to confirm the amount that you plan to stake. This will lock it into the system.

The platform will also show you the rewards that you are set to receive. You will be shown the APR (annual percentage rate). This is the value that you receive per year when you make your funds accessible for loans. This value considers the rates and fees paid by borrowers.

You will also be shown a value known as “slashing.” This refers to the fee that could be lost in the unlikely event of the network being compromised. If this should happen, this amount would be used to maintain the network in functional order.

When you want to stop staking, simply choose the “Unstake” option and input the amount that you wish to remove. There will be a “Cooldown” period. This is the time required for the amount to become available for the unstaking process. Once the cooldown has elapsed, users have two days in which they can remove their funds.

You will also need to claim your rewards. To do so, visit the staking section and click “Claim.” The rewards will end up in the wallet from which you initially deposited the funds.

How to borrow on Aave

The AAVE protocol also allows users to borrow funds. In order to do that once more, you will first need to deposit some of the native tokens to the platform. The deposited sums are used as collateral when taking out a crypto loan. You will then click on the “Borrow” option that is shown in your dashboard.

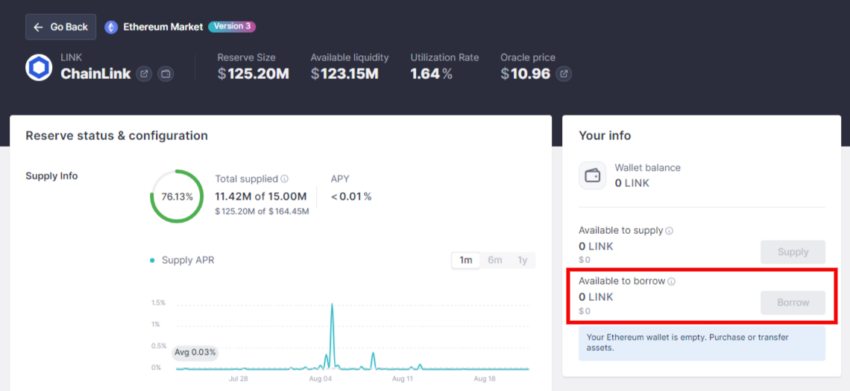

Once on the borrowing page, you will be provided with a list of tokens. From this, choose the token that you wish to borrow. You will be shown how much you are able to borrow and the APY.

When you click on a coin, you will be provided additional financial information. For example, you have displayed the Utilization rate. This indicates how much of the asset is borrowed funds and how much is available. This shows you the popularity of the particular asset. This rate will also determine the interest rate that you will need to pay. A higher rate determines a larger interest rate that you will pay.

You also see the available liquidity, which tells you how much you can borrow. The current market price for the asset in question is also displayed.

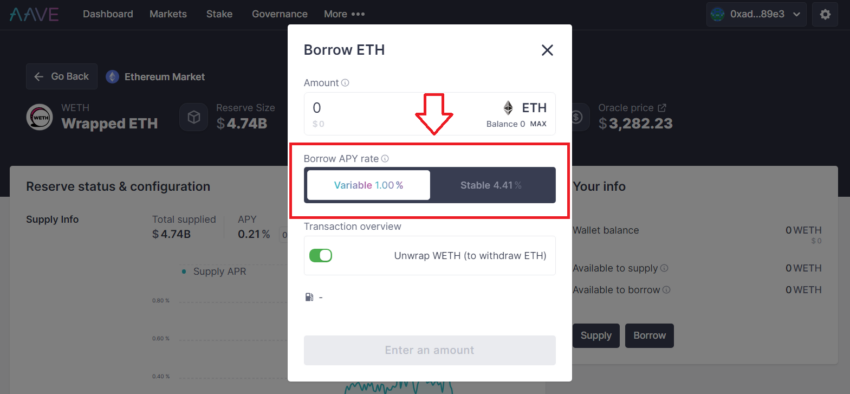

Stable and variable rates

Aave also provides two options for rates. The platform offers a stable and variable rate. Essentially, by paying a higher interest rate, you can make the APY more stable. By doing this, you have a clearer, more predictable understanding of what reward you will receive per year.

The variable rate is similar to other platforms that provide these types of loans. The variable APY, however, depends on factors related to the fluctuation of the market. Visit your dashboard section to see the evolution of assets, including your APY. You are able to change your interest rate type from the dashboard menu, by choosing “APR type.”

Remember that you will repay the loan in the same asset that you borrowed. You will repay the borrowed value, as well as the interest rate. Note that the interest rate is calculated using an algorithm that considers the supply and demand for an asset. You can also use the collateral as a means to pay back the loan.

The platform also includes an indicator known as the “Health Factor.” The health factor indicates the safety of your deposited assets compared to the borrowed assets and their value. A higher value indicates a greater degree of security for your assets. Paying your loan or depositing additional funds will positively influence the health factor.

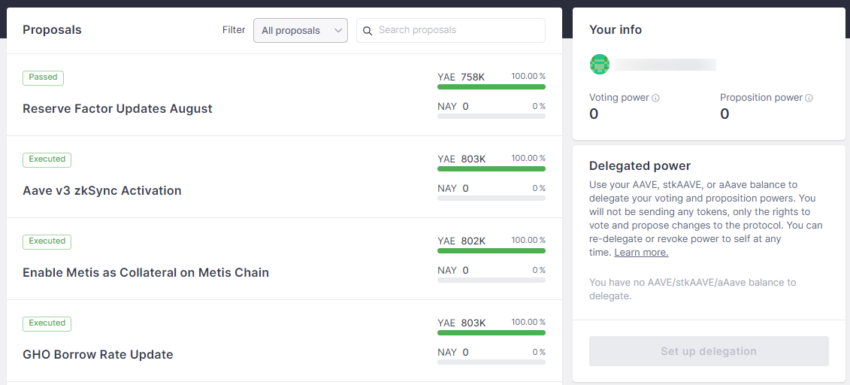

Governance on Aave

The governance feature is part of Aave’s attempt to create a DeFi system. It’s security is maintained by the participation of Aave stakeholders and the use of the protocol’s native token. Users can vote provided that they have AAVE tokens or stkAAVE — the staked AAVE token.

To vote, you will need to visit the “Governance” section. You will select the relevant proposal. Finally, confirm your vote from the right-hand side.

You will be able to vote again upon depositing a new amount of AAVE tokens. The governance setup is part of what the platform calls “Aavenomics.” It is a method to implement new ideas on behalf of the community in a bid to improve the protocol.

Aave’s flash loans

Flash loans allow users to borrow money quickly without paying collateral. They are designed particularly for developers. Users can borrow any amount of digital assets. In exchange, the funds must be returned in full within one block transaction.

Flash loans require building a specific type of contract. This contract instructs the system to pay the amount, as well as take back the amount plus the interest required. Platforms such as Furucombo can be utilized for taking out flash loans.

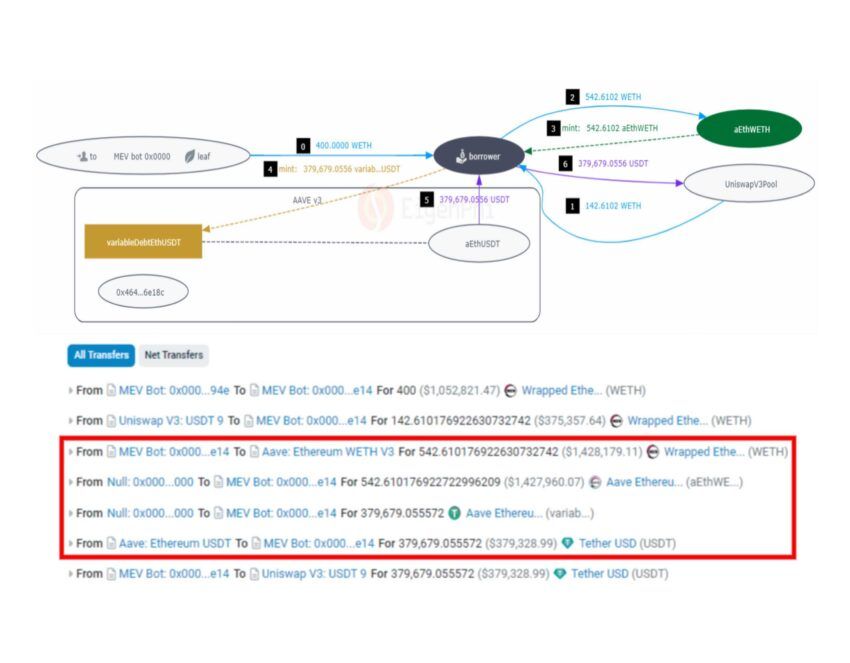

Flash loans are particularly useful for arbitrage trading, a type of trade in which you buy a cryptocurrency at a low price and sell it at a higher price. This is a type of MEV or maximal extractable value. Below is an example of an arbitrage trade utilizing Aave flash loans.

When you onsider an economic system and its economic activity on top of this system, it’s basically the value that the system can extract from the activity.

Justin Drake, Ethereum developer, on the defintion of MEV

MEV strategies often utilize flash loans because they are low-cost and allow users to command large amounts of liquidity to make profits in seconds. Alongside arbitrage, other MEV uses for flash loans include sandwich attacks (i.e., frontrunning and backrunning transactions).

Should you use Aave?

Platforms such as Aave appeal to a specific type of DeFi user; those who aren’t content with keeping their funds locked up in a wallet. Projects like Aave take advantage of the difficulties that the classic banking system provides. Smart contracts allow users to get away from many of the hassles of regular banking and access loans without barriers such as credit checks.

While there are risks to borrowing or lending money in crypto, the same can be said about the banking system. Meanwhile, DeFi offers better rewards than TradFi. However, DeFi lending should not be considered lightly. Your capital is at risk, and decentralized assets are highly volatile. Ensure to do your own research (DYOR) and proceed with caution.

Frequently asked questions

Does Aave pay you to borrow?

How much can you earn on Aave?

What is the point of Aave?

How do you make money on Aave?

What is Aave, and how does it work?

What can you do with the AAVE token?

What is the point of Aave?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.