A proposal to restructure SushiSwap’s decentralized autonomous organization (DAO) and treasury has stirred widespread controversy, dividing the community. On April 3, 2024, the team behind the decentralized exchange (DEX) SushiSwap proposed a plan to increase agility and drive innovation. Voting on the proposal will continue until April 10.

As of April 9, the latest data shows that 66.2% of voters have voted in favor of the proposal, while 33.8% have voted against it.

Will SushiSwap’s Latest Proposal Get Greenlight Despite Heavy Criticisms?

SushiSwap introduced a proposal titled “Evolving Sushi – Burū no Shinka.” Under the plan, the Sushi DAO would transition to primarily on-chain governance, overseeing the treasury and token supply.

Furthermore, the proposal suggests creating “Sushi Labs,” a new entity with autonomy in project development and operations.

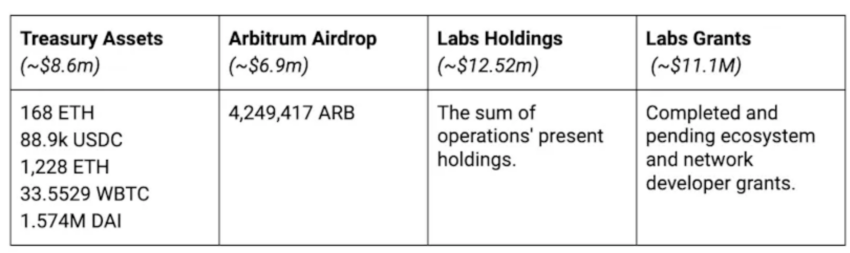

It requests that Sushi DAO grant Sushi Labs 25 million SUSHI tokens and include assets from various sources such as the Arbitrum airdrop, business development, partner grants, Kanpai 2.0, Sushi 2.0, rewards, stablecoins, and “Sushi House” funds.

“This grant will bolster Sushi Labs’ competitive edge against rivals like Uniswap and 1inch by enabling Sushi Labs to attract and support top talent and development standards. It aims to sustain Sushi’s product ecosystem with new DEX services and develop a multi-token ecosystem,” the proposal claimed.

Read more: How To Use SushiSwap: A Step-by-Step Guide

Additionally, Sushi Labs would become the exclusive recipient of any future airdrops destined for Sushi from protocols and partners.

Despite the proposal’s forward-looking objectives, it has not been without its critics. Vocal opposition appears on social media platforms and within SushiSwap’s own discussion forums. This opposition highlights concerns regarding governance transparency, equitable distribution of resources, and the long-term implications for the SushiSwap community.

Naïm Boubziz, a former contributor now aligned with Reunit Wallet, argues that the proposed changes might centralize power within Sushi Labs, diminishing the decentralized ethos underpinning the SushiSwap project.

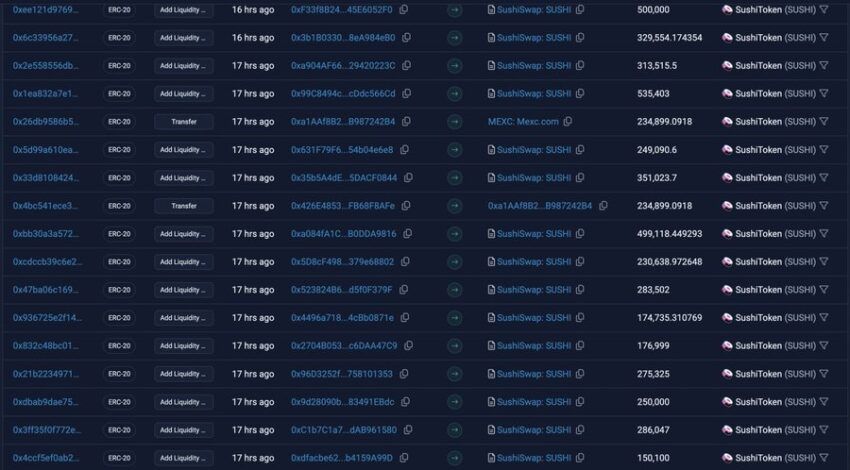

Boubziz pointed out some movements that occurred a few hours before the creation of the snapshot. According to him, new wallets added liquidity before the snapshot was created. However, the same wallets withdrew liquidity after the snapshot was created.

Therefore, he suggests that everyone should pay attention to these movements.

“If that’s not manipulation, what is it?” Boubziz challenged.

Moreover, a community member who goes by the pseudonym “savesushiswap.eth” has expressed concern regarding the team’s wallet. The wallet recently received 4,000,000 SUSHI from the multisig treasury and has voted for itself. This is the first time such an event has occurred.

The member believes some team members’ votes were already morally questionable for such a proposal, but the team’s wallet voting for itself raises further concerns.

“I suppose you will have a good explanation for this,” savesushiswap.eth wrote.

Yet, Jared Grey, Head Chef at SushiSwap, defends the proposal. He cites previous leadership precedents and a need to protect SushiSwap from hostile influences.

“Presently, the vote is ongoing, so any outcome is possible. However, we plan to continue to drive this proposal towards a beneficial outcome for the Sushi protocol,” Grey highlighted.

Read more: SushiSwap (SUSHI) Price Prediction 2024/2025/2030

SushiSwap, originally a fork from Uniswap V2, has seen its fair share of highs and lows. During its prime time in November 2021, SushiSwap recorded a total value locked (TVL) of $8.07 billion and a volume of $849.14 billion.

However, SushiSwap’s fortunes later declined significantly. As of writing, its TVL is only $356.12 million and has a volume of $3.79 million.

The price of SUSHI, SushiSwap’s native token, has also reflected this downturn, plunging from $1.70 on April 9, 2024, at 00.12 UTC to $1.65 at 07.07 UTC.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.