The US Bureau of Labor Statistics will release its December nonfarm payrolls report on Jan. 5, 2024. The US Federal Reserve was optimistic about the economy at its last meeting of 2024, but it will face a conundrum if the jobs market didn’t cool in December, making the future of Bitcoin slightly uncertain.

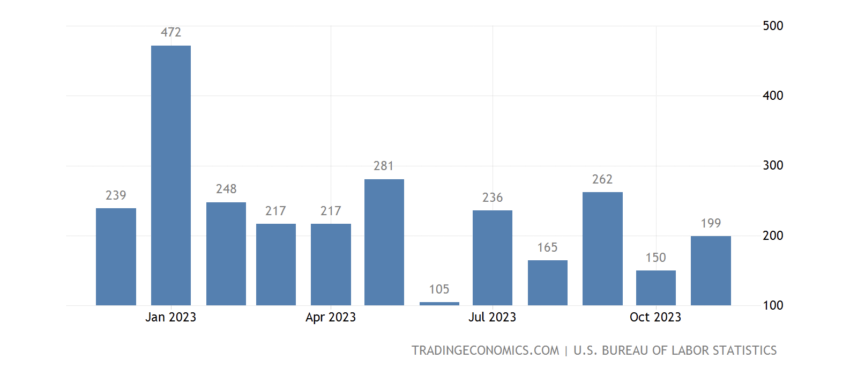

In November, the nonfarm payrolls report reported that US jobs grew from 150,000 in October to 199,000 in November, stoking hopes that the US economy had finally reached the Goldilocks moment. Inflation has been getting closer to 2% recently, while wage growth has moderated.

US Nonfarm Payrolls Could Delay Soft Landing

But some economists warn that it’s not all a bed of roses. Former New York Fed president Bill Dudley believes that markets may have overreacted to the Fed’s implied pivot away from tightening.

“[One] thing that could go wrong is that the Fed could ease policy prematurely, or the market itself could ease financial conditions prematurely, which will stimulate the economy and make it so that the Fed can’t cut rates as quickly as the market expects. I think the market is getting a little bit ahead of itself here by taking the Fed’s optimism and translating [it] into very large reductions in short-term rates in 2024,” Dudley told Bloomberg last week.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Former World Bank Treasury Secretary Lawrence Summer said a soft landing could occur in 6-8 months. Higher neutral rates have meant that interest rates have less impact, he argues. The neutral, or R-star rate, is the rate at which the economy is not growing or shrinking.

Christopher Ailman, the California State Teachers Retirement System’s Chief Investment Officer, said, “it’s tough seeing the market having legs.” He predicts low, single-digit returns on the S&P 500 as the best-case market scenario in a president’s election cycle year.

US Economy Could Drive Bitcoin in 2024

But what of crypto? At the end of 2023, markets were excited about the US Securities and Exchange Commission (SEC) approving a spot Bitcoin exchange-traded fund (ETF) in January 2024. Bitcoin ended 2023 156% higher compared to January last year, according to data from CoinGecko.

Optimism is still in the air. Cathie Wood, the CIO and CEO of ARK Invest, said ARK and its ETF partner 21Shares had “crossed all” their “t’s” and “dotted all” their “i’s.” If ETFs are approved, they will give institutional investors what Michael Saylor calls a “high bandwidth” channel to invest in the asset.

However, investment adviser Daniel P. Weiner thinks the asset class will lose popularity after an initial wave of interest. Supply and demand shocks caused by institutional investment and the upcoming halving may be short-lived, calling into question Bitcoin’s role in investment portfolios.

Bitcoin’s correlation with the S&P 500 has increased to 0.7% from -0.77% since, making it increasingly prone to US macro conditions in 2024. Factors like election pressure and how the US economy responds to the Fed’s balancing act will likely play a part in crypto price movements in 2024.

Read more: How to Buy Bitcoin (BTC) in Four Easy Steps – A Beginner’s Guide

Do you have something to say about US nonfarm payrolls or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.