Crypto payroll, once a niche idea, is now a disruptive innovation, with major players like PayPal, Sequoia Capital, and Fidelity exploring cryptocurrency in business payments. But what does this mean for employee compensation models? Can decentralized, blockchain-based payroll unlock new value by enabling instant, egalitarian, and transparent pay for remote workers and global talent? Or will regulatory headaches and crypto’s volatility spoil the payroll party even before it gets started?

This guide delves into these issues, aiming to facilitate meaningful dialogue on how crypto could significantly transform work in the web3 era.

In this guide:

What is crypto payroll?

The concept of crypto payroll refers to the idea of companies compensating employees all or in part with cryptocurrencies rather than traditional fiat money like Dollars or Euros.

At its core, this new approach is all about moving compensation onto decentralized platforms that utilize blockchain-based digital assets as a medium of exchange. So, instead of direct deposit paychecks in government-backed currencies, workers receive payment in Bitcoin, Ether, stablecoins, or other crypto assets. As novel as it may seem, this concept actually aligns well with larger shifts underway in how finance and technology interact.

Factors driving the rising popularity of crypto payroll

Several factors are behind the rising popularity of crypto payrolls. First, trustless and distributed technologies like blockchain promise greater transparency, security, speed, and cost savings for peer-to-peer transactions. Second, exposure to crypto appeals to technologically adept workers wanting assets with growth potential. Many prefer it over fiat savings, which inevitably lose value to inflation over time.

Finally, the growing ubiquity of crypto wallets, debit cards, payment apps, and exchange integration now makes owning and spending crypto much more practical.

For employers specifically, offering crypto payroll shows a commitment to innovation that helps attract top young talent from generational cohorts where cryptocurrency awareness continues rising exponentially. Younger workers grew up in a digital-first world, where decentralized finance aligns with peer-to-peer values and dismantles institutional hierarchies.

At the same time, existing employees see appeal in bonus opportunities from crypto that may gain value beyond salaries, losing purchasing power over time. This stands true across both white and blue-collar occupations. Tax implications around capital gains versus income do warrant consideration as well.

A work in progress

Indeed, it’s important not to overlook the potential pitfalls. For instance, crypto volatility almost certainly brings questions about income uncertainty from factors unrelated to job performance. On top of that, administrative handling around crypto transactions also requires appropriate upgrades to payroll systems and accounting. And yes, you must always be on your toes to ensure regulatory compliance.

On that note, let’s now quickly analyze the benefits and drawbacks of crypto payrolls.

Find your perfect match

Get the Web3 pro tips for HR team of BE[IN]CRYPTO

Benefits of crypto payrolls

Some of the key benefits of crypto payroll include:

Faster transactions

First off, the speed and efficiency of cryptocurrency transactions are generally unmatched — even more so for cross-border transactions. It lets you send and receive payments almost instantly, no matter where you are in the world. In fact, the transaction time for most popular digital assets is usually just a few minutes. This game-changer is for international employees who often grapple with slow bank processes and hefty transaction fees. Cryptocurrencies like BTC or USDT, for example, expedite global payments with a level of convenience that traditional banking can’t match. You could even argue that such convenience is particularly befitting for someone pursuing a web3 career.

Security

Then there’s the aspect of security and independence. The decentralized nature of cryptocurrencies means you’re not at the mercy of traditional financial institutions. Transactions are permanent, transparent, and secure on the blockchain. And it can go a long way in providing the kind of peace of mind that’s hard to find in traditional banking systems. This autonomy is especially appealing when savvy individuals seek more control over their finances.

Privacy

Privacy is another significant advantage. Cryptocurrencies allow for anonymity in transactions, which is crucial in industries where confidentiality is important. Plus, for freelancers, this translates into receiving payments while maintaining personal privacy.

Investment potential

Moreover, crypto payroll isn’t just about getting paid; it’s about potential financial growth. Receiving payments in crypto, such as Bitcoin is akin to an investment. This aspect can offer a significant financial upside, as the value of these digital assets might increase, giving employees the chance to earn beyond their standard pay. It’s an exciting prospect for those willing to go the extra mile to grow their wealth.

Growing adoption of digital assets

Finally, the increasing global awareness and acceptance of cryptocurrencies make them an attractive option for various sectors. Countries facing high inflation, like Argentina, find cryptocurrency particularly beneficial, as it provides a stable alternative to volatile local currencies.

Challenges in implementing crypto payrolls

Implementing crypto payroll in your organization comes with its fair share of challenges. Some of these include:

Reputation issues

One significant concern is the trust and reputation issue. Due to their pseudonymous nature, cryptocurrencies have often been linked — rightly or wrongly — to illicit activities like money laundering. This association can be a red flag for companies keen on maintaining a clean and trustworthy image.

Global acceptance is not quite there yet

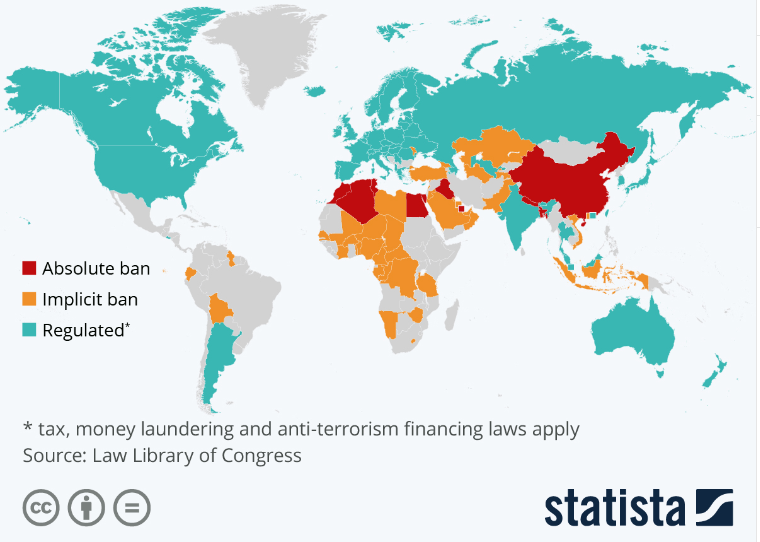

Then, there’s the hurdle of global acceptance. While adoption is on the rise globally, cryptocurrencies remain an outright no-go, or at the very least, a gray area in many jurisdictions. Regulations are a patchwork of varying rules and tax treatments worldwide. These factors combine to create a labyrinth for businesses setting up crypto payroll services internationally. This inconsistency complicates transactions and limits the broader adoption of crypto in payroll systems.

Integration

Another major challenge is integration. With its reliance on conventional banking and credit systems, the current financial ecosystem isn’t fully compatible with cryptocurrencies. Many banks are hostile toward decentralized digital assets and wouldn’t touch crypto transactions with a 10-foot pole. That makes it remarkably difficult to weave these digital currencies into the fabric of legal money flows. This integration gap presents usability issues and complicates compliance with financial regulations.

Crypto volatility

Holding cryptocurrencies like Bitcoin and Ether, known for their price volatility, exposes organizations to financial risks. Additionally, the technical aspects of managing these assets, like safeguarding against cyber attacks and ensuring secure transactions, can take a toll on organizations with limited resources. For example, the loss of transaction keys can lead to significant issues.

Tax implications and liabilities

Tax implications and reporting also pose significant challenges. In many jurisdictions, like the U.S., cryptocurrencies are treated as property, not currency. This classification issue can bring a host of complexities for employees receiving crypto as part of their salary and for employers managing these digital assets on their balance sheets.

High crypto tax rates can also be a cause of concern. For instance, in India, any money you make from buying, selling, or swapping crypto gets hit with a flat 30% tax (plus 4% surcharges) — for both capital gain and business income. Worse still, you cannot offset losses from digital asset sales against other income sources. Such rigid tax policies can also dissuade many employers from implementing crypto payrolls. On top of that, the need for management and secure retention of cryptocurrencies adds another layer of complexity.

Crypto payroll integration 101 for businesses

For organizations considering embracing crypto payroll, kicking the tires first with small-scale pilot programs may prove more practical than going all-in immediately. It could highlight practical and regulatory unknowns and pave the way for a smoother, more informed full-scale rollout. Key considerations fall into a few primary buckets:

Understand local regulations

First and foremost, be well-versed in terms of legality. Crypto payroll must align with local employment laws and tax regulations. A thorough check on these factors ensures compliance and helps avoid potential legal hurdles.

Stablecoins as an option

Second, while exciting in concept, crypto income introduces volatility risks that could undermine budget predictability for workers relying on clear salary expectations. For more risk-averse employees, options like pricing compensation in USD-pegged stablecoins may help temper market fluctuations in either direction.

Utilize specialized software

Specialized software and services are emerging to help automate crypto paycheck calculations, tax withholding, compliance auditing, and more. It’s a heavy lift doing all these fully manual. Therefore, it’s crucial to thoroughly research and select a solution that aligns with our organization’s needs and security protocols. Aim to identify comprehensive solutions that simplify the process as much as possible.

Clear policy documentation

Commit time on the policy side before going live. Workers need clarity around timetables for pay dispersal, currency valuation determination, volatility risk management, fee handling, etc. You should also spell out contingency plans even for improbable scenarios now. As they say, being overprepared beats reactionary scrambling!

Employee choice and education

Take a neutral approach in presenting opinions to employees. Crypto payroll fundamentally changes compensation dynamics in ways many will find unfamiliar or maybe intimidating. Make enrollment voluntary based upon fully informed individual selection. For instance, here at BeInCrypto, employees get to choose how they get paid: in traditional fiat currency or crypto. Your salary, your rules — that’s the ideal approach.

Expert consultation

Don’t hesitate to consult with legal, financial, and crypto experts if needed. This stuff is the Wild West, so leverage seasoned pioneers who can guide you through the complex web of regulatory, tax, and technical issues.

Security measures

Implement stringent security protocols to protect both the company’s and employees’ digital assets. This includes secure storage solutions and access controls.

Flexible conversion options

Make sure to provide flexibility in how employees can handle crypto payments. Some may wish to instantly convert to fiat currency for everyday spending stability rather than holding the assets. Others might want to move funds into long-term investment accounts or crypto wallets. Accommodating those choices is ideal rather than forcing a one-size-fits-all approach.

Regular reviews and adjustments

Lastly, commit to reevaluating the crypto payroll program at least quarterly, if not monthly. This space evolves incredibly fast. New coins, updated regulations, security threats, and more could unravel past assumptions overnight. Maintain an agile, adaptable posture to modify systems and policies on the fly if/when needed. If you fall behind industry trends, that exciting initiative could quickly become a compliance, retention, or stability liability.

Crypto payroll: Sustainable shift or a fleeting fascination?

Crypto payroll sits at a crossroads of innovation, blending cutting-edge finance, technology, and the fast-changing nature of work. On one hand, the concept aligns with the growing digitalization of finance and work. It resonates with the increasing desire for financial autonomy and freedom from traditional systems, usually prevalent more among younger generations.

Yet, it’s still a largely uncharted territory with its fair share of challenges and unknowns — so many blanks still need filling in. Ultimately, the future of crypto payroll may hinge on balancing these new opportunities with the practical realities and risks of digital finance.

Frequently asked questions

Can you pay employees in crypto?

Which is the best cryptocurrency for payroll?

What is a crypto payroll?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.