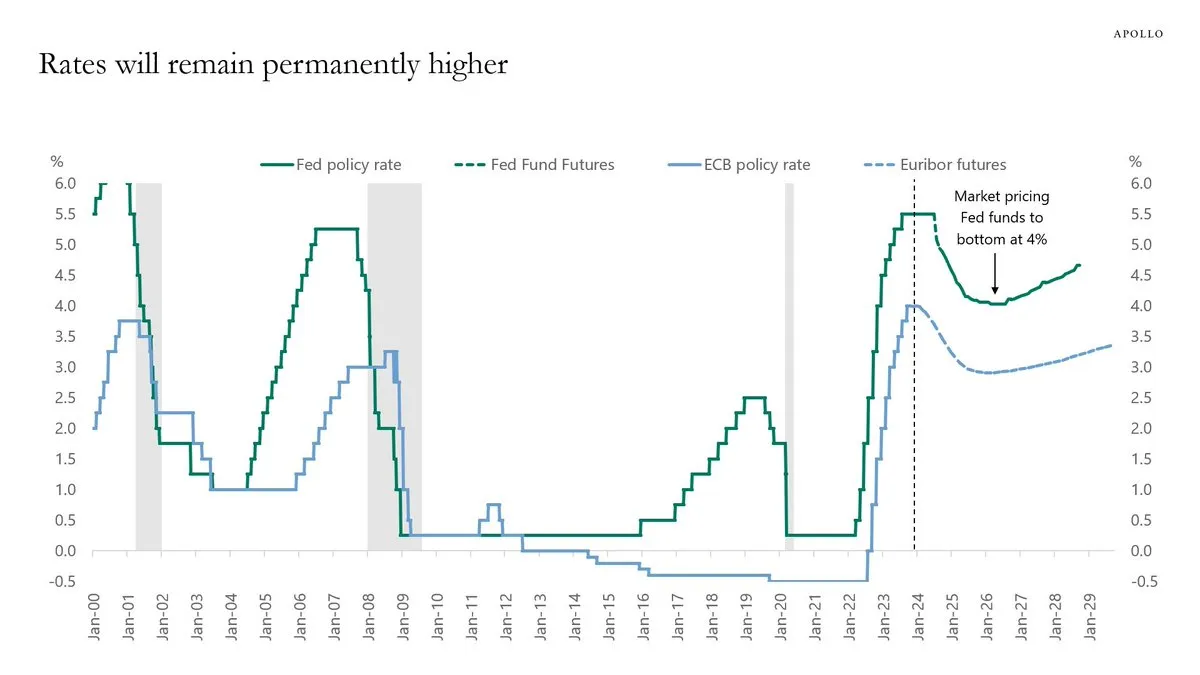

Permanently high interest rates in the United States could be here to stay, according to economists. The markets are already beginning to factor in high rates and the premise that they may not return to the US central bank’s target.

On October 16, macroeconomics outlet The Kobeissi Letter said there seems to be a view that once inflation hits 2%, interest rates are going back down to historic lows.

High-Interest Rates Here to Stay?

However, it appears that the markets are already factoring in higher interest rates going forward.

“Markets are pricing that the Fed funds rate will bottom at 4% in 2025 and then start rising again.”

“Higher interest rates are the new normal,” it noted before adding, “The era of ‘free money’ is over.”

The Federal Reserve suspended its rate hiking in July. However, that does not necessarily mean they will automatically fall. US rates are currently a crippling 5.5%, having been hiked 11 times since early 2020.

Nevertheless, skyrocketing national debts may push the Fed into lowering rates quicker as interest payments surge. US national debt is currently at a record high of $33.56 trillion, with billions being added to the pile every day.

Last week, analysts at Goldman Sachs commented:

“The main implication of the tightening in financial conditions led by rising rates is that the drag on GDP growth will last longer.”

They added other risks of high rates include “elevated valuations of risky assets in financial markets, the surprising survival of unprofitable firms in the corporate sector, and wide federal deficits.” BlackRock has also predicted that rates will remain high.

Moody’s Investors Service said that US companies face growing refinancing and default risks, with interest rates expected to stay high and financial conditions for borrowers tightening.

Moreover, consumer sentiment soured in October, with households expecting higher inflation over the next year.

This week’s economic calendar reveals monthly retail sales data, which is also expected to decline.

Impact on Crypto?

High interest rates hurt the average debt-laden consumer. They result in higher payments and rates on mortgage, auto, credit card, and bank loans.

This means less available capital for higher-risk investments such as crypto or stocks.

Moreover, high rates mean better returns on savings accounts. This means that there are incentives to leave cash in interest-bearing accounts rather than dabble in digital assets.

Long-term high rates will impact economic growth by slowing it down. Persistently high rates also make the economy more prone to falling into recession if combined with other negative shocks, such as geopolitical tensions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.