While bitcoin (BTC) is the most popular crypto, it has limited transaction capacity. As such, a number of altchains, including bitcoin cash (BCH), have emerged over the years, offering faster and cheaper transactions. In this article, we’ll dive into the workings of BCH and its unique features, giving a comprehensive overview of both the native crypto and the network powering the coin.

Do you want to buy BCH? Use and test these exchanges

Best for beginners and advanced crypto traders

Secure exchange with high deposit & withdrawal limits

Best for demo and spot trading

Our methodology for selecting the exchanges and wallets to hold and purchase BCH

This guide selects a number of exchanges to buy and hold Bitcoin Cash (BCH). Each platform was tested over a period of six months.

Some of the considerations that were taken into account for the top exchanges are security, user-experience, features and products. Security includes compliance, account controls, proof of reserves, and many other factors.

User-experience can be summed up as smooth operation, balanced design, and appearance. Features and products include luxuries such as trading features, financial instruments, etc.

For wallets, security was most important. This includes account controls, strong encryption, operational security, and enhanced security options. Additional points were given for wallets that provided additional features like in-app browsers, Bluetooth, near-field communication, etc.

Exchanges

• YouHodler: YouHodler allows customers to borrow, use crypto as collateral, and earn interest on their idle cryptocurrency.

• Kraken: Kraken offers derivatives trading via an advanced trading interface, multiple order types, and account protections.

• OKX: OKX offers derivatives trading, staking, and ensures platform security by offering two funds and a proof of reserves.

Wallets

• Ledger: Ledger is the industry standard for cold storage. The wallet has a mobile app, Bluetooth, and supports multiple assets.

• Trezor: Trezor utilizes Shamir encryption, 50 digit pins, and supports multiple assets, especially EVM native cryptocurrencies.

• Trust Wallet: Trust Wallet is an all in one wallet that supports in-app staking, browser, and unsafe app alerts.

• Exodus: Exodus wallet is platform agnostic., which means that it supports iOS, Android, Mac, Linux, Windows, and Chrome and Brave browser extensions.

This process utilizes primary and secondary research to guarantee the relevancy of information. It is also peer reviewed and fact-checked to ensure the accuracy of the information. To learn more about BeInCrypto’s Verification Process, click here.

What is bitcoin cash?

Bitcoin Cash (BCH) was created to solve Bitcoin’s scalability problems. Bitcoin’s transaction processing, constrained by a 1 MB block size, often results in network congestion and high fees. As such, developers forked the network, and Bitcoin Cash, along with the native coin BCH, emerged.

History of Bitcoin Cash

To truly understand Bitcoin Cash, it is imperative to understand the concept of “forks” within the crypto domain. Forks can be broadly categorized into two distinct classes: “soft forks” and “hard forks.”

Soft forks encompass backward-compatible changes that do not necessitate an upgrade for all participants. Note that these alterations maintain compatibility with the original blockchain, allowing users the discretion to opt for their preferred version. Conversely, hard forks create a new, autonomous blockchain, thereby causing a schism within the network. Bitcoin Cash represents a hard fork of the original Bitcoin network.

Big blocks vs. small blocks debate

The scalability problem sparked a fierce debate in the bitcoin community, leading to two core camps of belief: “Big blocks” and “small blocks.” Those on the big blocks side looked to increase the block size. Meanwhile, those in the “small blocks” camp advocated for keeping the size at 1 MB while focusing on transaction optimization and the Lightning Network.

The “big blocks” camp believed larger blocks would solve scalability issues, while the “small blocks” camp emphasized the risk of compromising decentralization and network functionality with larger blocks.

At first, the official Bitcoin Twitter account (now X) supported the hard fork. However, that support was publicly withdrawn, with a number of Twitter arguments and tongue-in-cheek speculation by key crypto figures.

The birth of Bitcoin Cash

At deadlock in August 2017, both camps took action. The “small block” community activated SegWit, while “big block” supporters created Bitcoin Cash, featuring an 8 MB block size. Initially, there was uncertainty about which version would come out on top. Ultimately, greater computational power and network security determine the “winning” blockchain.

Initially, Bitcoin Cash received significant backing from Bitmain, a leading mining entity. Additionally, Roger Ver — rumored to possess about 100,000 bitcoins — secured his reputation as one of the first bitcoin billionaires and supported the currency. Roger Ver even procured the domain name Bitcoin.com to endorse the Bitcoin Cash network (a direct competition with Bitcoin.org, which officially promoted the original BTC). In 2018, the Bitcoin Cash network forked again, creating Bitcoin SV and Bitcoin ABC.

How does Bitcoin Cash work?

Much like Bitcoin, Bitcoin Cash employs a proof-of-work (PoW) consensus mechanism to safeguard its network. Miners, the key actors, engage in the competitive processing of transactions and block additions to the Bitcoin Cash blockchain using sophisticated computing equipment. Both cryptocurrencies share the SHA-256 hashing algorithm, a common thread in their cryptographic underpinnings.

When comparing Bitcoin and Bitcoin Cash, the latter shares many parallels with the original Bitcoin, yet it presents several noteworthy distinctions:

- Enlarged block size: Initially restricted to 8 MB, Bitcoin Cash subsequently raised its block size threshold to 32 MB, although, in practice, Bitcoin Cash blocks rarely exceed 1 MB in size.

- Absence of SegWit or Lightning Network: Bitcoin Cash doesn’t support Segregated Witness (SegWit) or the Lightning Network, which the Small Blocks faction proposed to improve transaction efficiency

- Swifter difficulty adjustments: Compared to the original Bitcoin, Bitcoin Cash adjusts its mining difficulty more quickly, potentially giving miners an opportunity to gain advantages.

What makes bitcoin cash unique?

“We can reverse the damage done by fiat by trusting the immutable chain of #BitcoinCash.”

@thecyphercat: Twitter

Like Bitcoin, Bitcoin Cash operates as a decentralized P2P electronic cash system entirely independent of central authorities.

- Immutable: Each bitcoin transaction permanently records in a block and intricately links to the previous block, ensuring a transaction history that cannot change.

- A hard cap: The unalterable limit of 21 million bitcoin is an inherent feature of the core Bitcoin code. This fundamental constraint establishes bitcoin as a secure store of value in the digital domain, safeguarding its scarcity over extended periods.

- Accessible to all: Bitcoin Cash remains fully decentralized, without a central authority or CEO. It welcomes users without requiring any permissions, ensuring inclusivity.

- Pseudonymous: Transactions on the Bitcoin Cash network don’t directly connect to personal identities, allowing users to transact without censorship.

- Transparent: All transactions are openly documented on a global public ledger, the blockchain. Periodically updated in blocks linked together, this transparency enables anyone to trace the complete ownership history, bolstering security against potential fraud.

- Distributed: The blockchain, serving as the public ledger, is voluntarily maintained by a network of participants known as “nodes,” enhancing the longevity and resilience of the recorded information.

Bitcoin cash (BCH) tokenomics

Do you want to buy BCH? Use and test these exchanges

Best for beginners and advanced crypto traders

Secure exchange with high deposit & withdrawal limits

Best for demo and spot trading

Bitcoin cash, like bitcoin (BTC), has a fixed supply. The maximum supply of BCH is capped at 21 million coins, just like BTC.

As of mid-October 2023, there are approximately 17.12 million BCH-holding addresses, and the top 10 addresses collectively hold close to 2.3 million BCH, as per CoinMarketCap data. When Bitcoin Cash separated from Bitcoin through a hard fork, nearly 16.5 million BCH coins were distributed among existing BTC holders at a 1:1 ratio.

Important facts about BCH

- Issuance schedule: BCH, like BTC, follows a predetermined algorithmic issuance schedule. This means that the rate at which new BCH is created and added to the circulating supply is pre-defined and relatively predictable. It provides some degree of certainty to token holders regarding future supply.

- Use cases: BCH functions primarily as a digital currency geared towards seamless P2P transactions. Its key strength lies in its capacity for swift and cost-effective exchanges, positioning it as a viable substitute for conventional fiat currencies in everyday transactions.

- Ownership: BCH is owned by individuals and entities who have acquired them through various means, including mining, trading, or purchase.

- Future supply: The rate at which new BCH coins are created diminishes over time due to the halving events that occur approximately every four years, similar to bitcoin. This feature can contribute to a perception of scarcity and influence token value.

- Development and governance: BCH has a community of developers and stakeholders who participate in decision-making processes. Changes to the network and protocol are subject to consensus within this community.

BCH wallet

To engage with the Bitcoin Cash network, you must have a BCH wallet. This allows you to manage and store your BCH. Different BCH wallet types have pros and cons; your selection should match your personal requirements. If you’re new to BCH and dealing with a small amount, mobile or web wallets provide a good balance of security and user-friendliness. Conversely, some more experienced users may prefer hardware wallets for added security.

Popular BCH wallet options include hardware wallets like Trezor and Ledger, mobile wallets like Trust Wallet, and desktop wallets like Exodus.

Does Bitcoin Cash have a future?

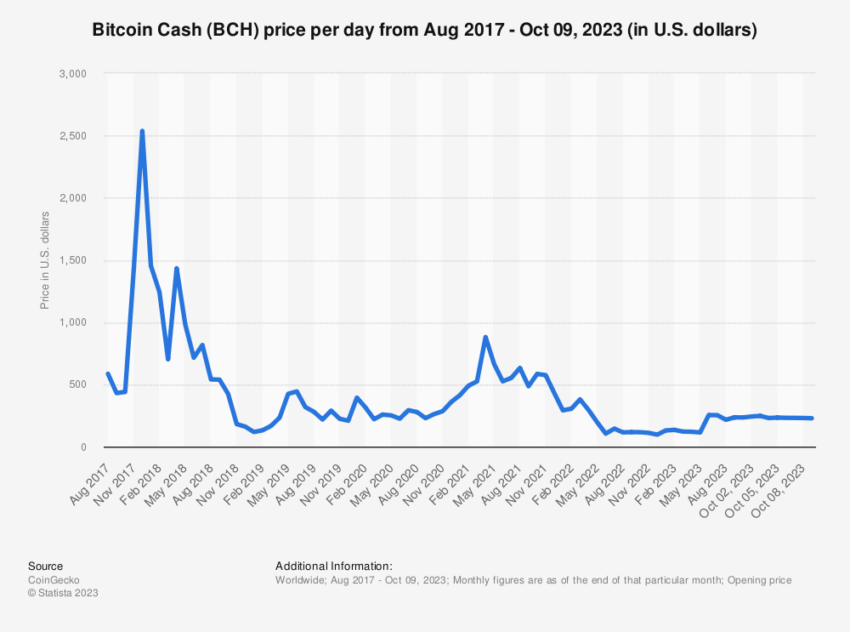

While Bitcoin Cash offers larger blocks and faster adjustments, it has not come close to the reputation or adoption of the original Bitcoin network. However, Bitcoin Cash remains a significant player. As a top 20 crypto, BCH likely isn’t going anywhere. But whether the BCH coin will recover from the bear market to beat previous all-time highs depends on wider adoption as well as market forces.

Frequently asked questions

How does Bitcoin Cash work?

Is Bitcoin Cash better than bitcoin?

Is bitcoin cash a good investment?

Is Bitcoin Cash safe?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.