Roni Cohen-Pavon, the former chief revenue officer of the now-bankrupt crypto lender Celsius Network, has reportedly pleaded guilty to four fraud charges.

During the court hearing, he reportedly committed to cooperating with US authorities in their ongoing investigations.

Not All Celsius Executives Pleaded Guilty

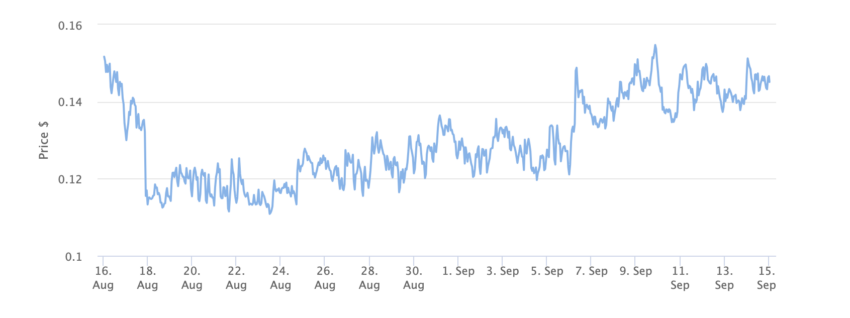

According to a September 14 report, former Celsius executive Roni Cohen-Pavon entered his guilty plea in the United States District Court of Manhattan. He faced charges of conspiracy, securities fraud, market manipulation, and wire fraud for manipulating the price of Celsius’ native token, CEL.

He reportedly agreed to assist the US Attorney’s office and the Federal Bureau of Investigation (FBI) with investigations and testify in court if necessary.

Read more: How To Identify a Scam Crypto Project

On July 14, reports disclosed that former Celsius CEO Alex Mashinsky entered a plea of not guilty to fraud charges. Prosecutors leveled seven criminal counts against him, which included wire fraud, securities fraud, and commodities fraud.

They also asserted that Mashinsky orchestrated a calculated, multi-year scheme profiting $42 million from exploiting customers.

The not-guilty plea came only days after Cohen-Pavon and Mashinsky were handed the charges. The United States Securities and Exchange Commission (SEC) accused both of artificially boosting the price of CEL.

At the time of publication, CEL’s price is $0.14.

Bear Market Marked a Turning Point for Celsius

The SEC further alleged that both sold their holdings just before Celsius collapsed in July 2022.

Furthermore, the Department of Justice (DOJ), Commodities Futures Trading Commission (CFTC), Federal Trade Commission (FTC), and the US Government lodged comparable charges against Celsius and Mashinsky.

The FTC prohibited the Celsius network from engaging in trading activities and levied a fine of $4.7 billion. Mashinsky, on the other hand, declined to accept the FTC settlement.

Celsius experienced a decline following the peak of the bull market in 2021. At the time, numerous crypto companies provided high yields on digital assets.

However, with the arrival of last year’s bear market, several crypto-lending firms declared bankruptcy. Millions of dollars belonging to users are currently stuck on these platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.