CEO of embattled crypto lender Celsius Alex Mashinsky has resigned as the company’s CEO as it faces Chapter 11 bankruptcy in New York.

In a letter to the Special Committee of the Board of Directors of the Celsius Network, the former Celsius boss said,

“Effective immediately, please accept my resignation as CEO of Celsius Network Ltd, as well as my directorships and other positions at each of its direct and indirect subsidiaries, with the exception of my director position at Celsius Network Ltd. I regret that my continued role as CEO has become an increasing distraction, and I am very sorry about the difficult financial circumstances members of our community are facing. Since the pause, I have worked tirelessly to help the Company and its advisors put forward a viable plan for the Company to return coins to creditors in the fairest and most efficient way. I am committed to helping the Company continue to flesh out and promote that plan, in order to help account holders become whole.”

Company revival seems short-lived

The announcement comes after the company filed for Chapter 11 bankruptcy as leveraged bets made at the height of the crypto bull market started to unwind earlier this year, leaving customers bereft of $4.7 billion. It paused customer withdrawals in June 2022, citing volatile market conditions.

No successor to Mashinsky has been named as of yet.

Just two weeks ago, Mashinsky floated a daring plan to revitalize the failing company by introducing a new crypto wallet and charging special fees for transactions. The plan was met with skepticism from employees.

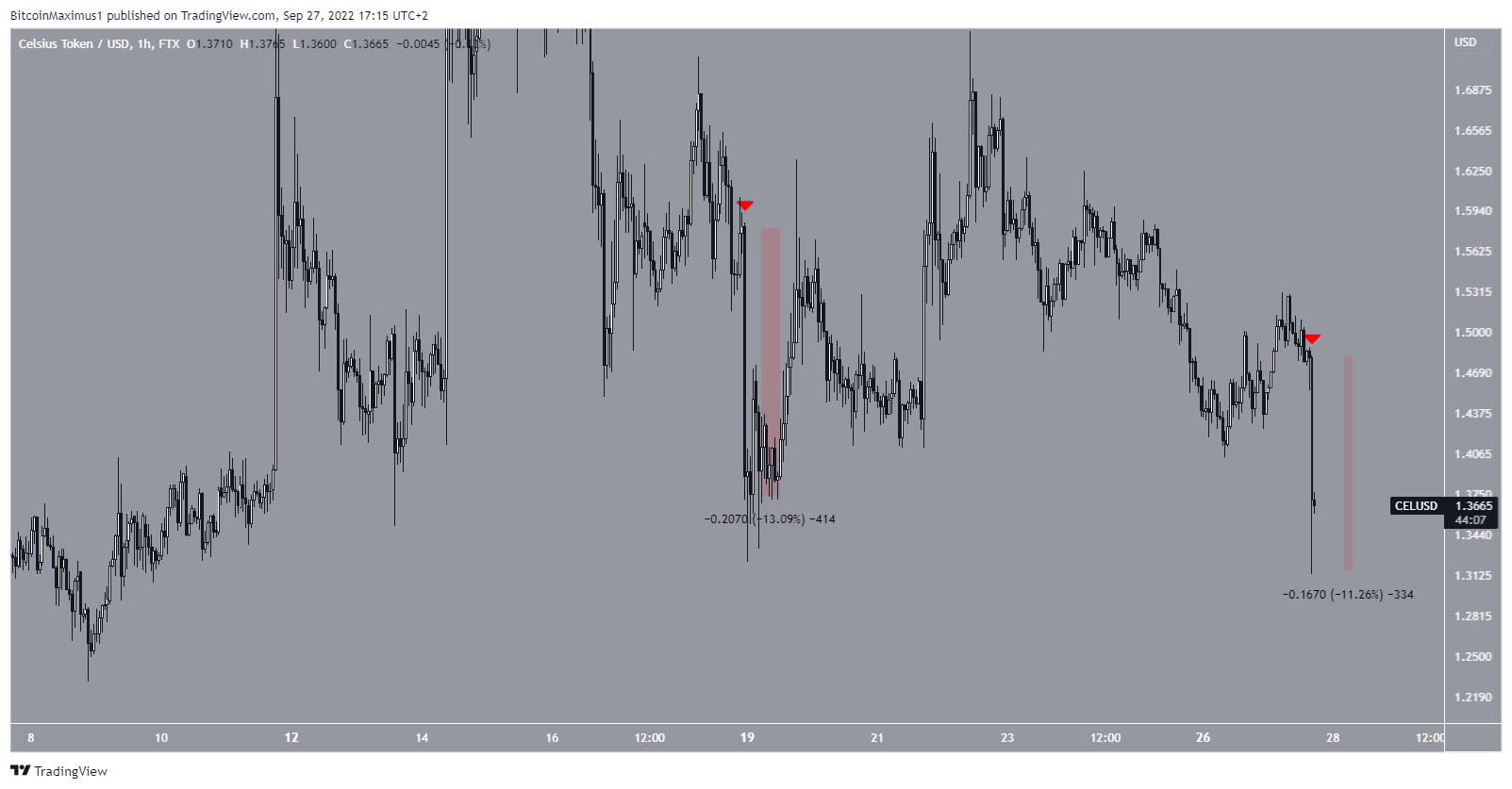

Following the announcement, the company’s native CEL token fell 10%

Shortly after the announcement, the price decreased by 11%, leading to a low of 1.31. This was the lowest price since Sept. 9 and the sharpest hourly decrease since Sept. 18 (red icons)

Future movement

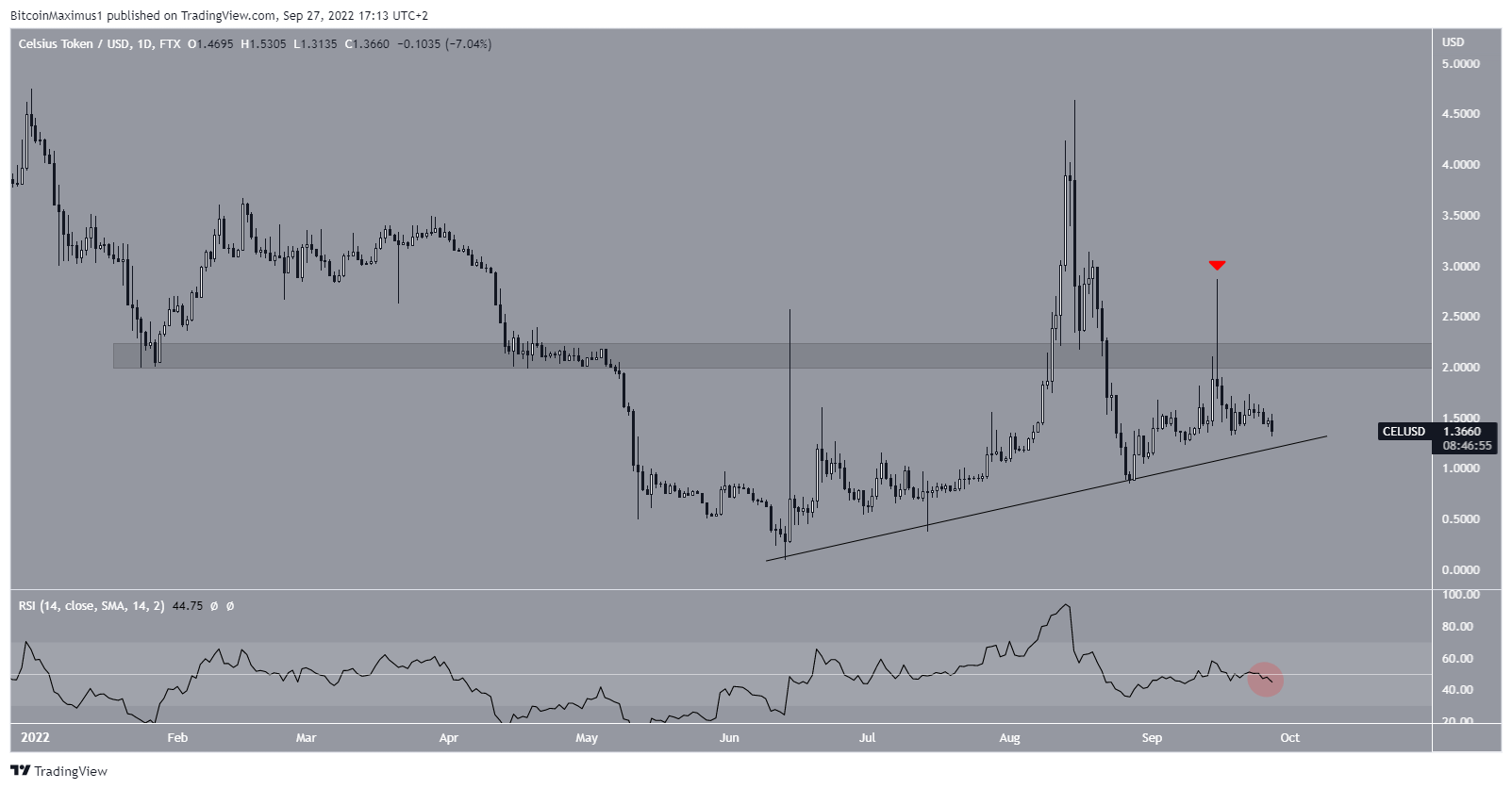

CEL has been increasing alongside an ascending support line since June 13. The rate of increase accelerated on Aug. 7, and the price reached a high of $4.63 on Aug. 13. This seemingly caused a breakout above the $2.10 resistance area.

However, the breakout turned out to be only a deviation, since the price fell below the area shortly afterward. Additionally, it validated it as resistance one more on Sept. 15, creating a very long upper wick (red icon), which is considered a sign of selling pressure.

Now, CEL has returned back to the ascending support line. A breakdown below it would likely lead to new yearly lows.

Due to the rejection from the aforementioned resistance and the RSI decrease below 50 (red circle), a breakdown from the ascending support line would be the most likely scenario.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.