August was a bearish month for the cryptocurrency market. This was noticeable in the case of both Bitcoin (BTC) and various altcoins, which have experienced significant decreases since their yearly highs in July.

Despite a bearish cryptocurrency market, some altcoins have bullish-looking formations. With that said, BeInCrypto looks at the top cryptos for September that could hit new all-time highs.

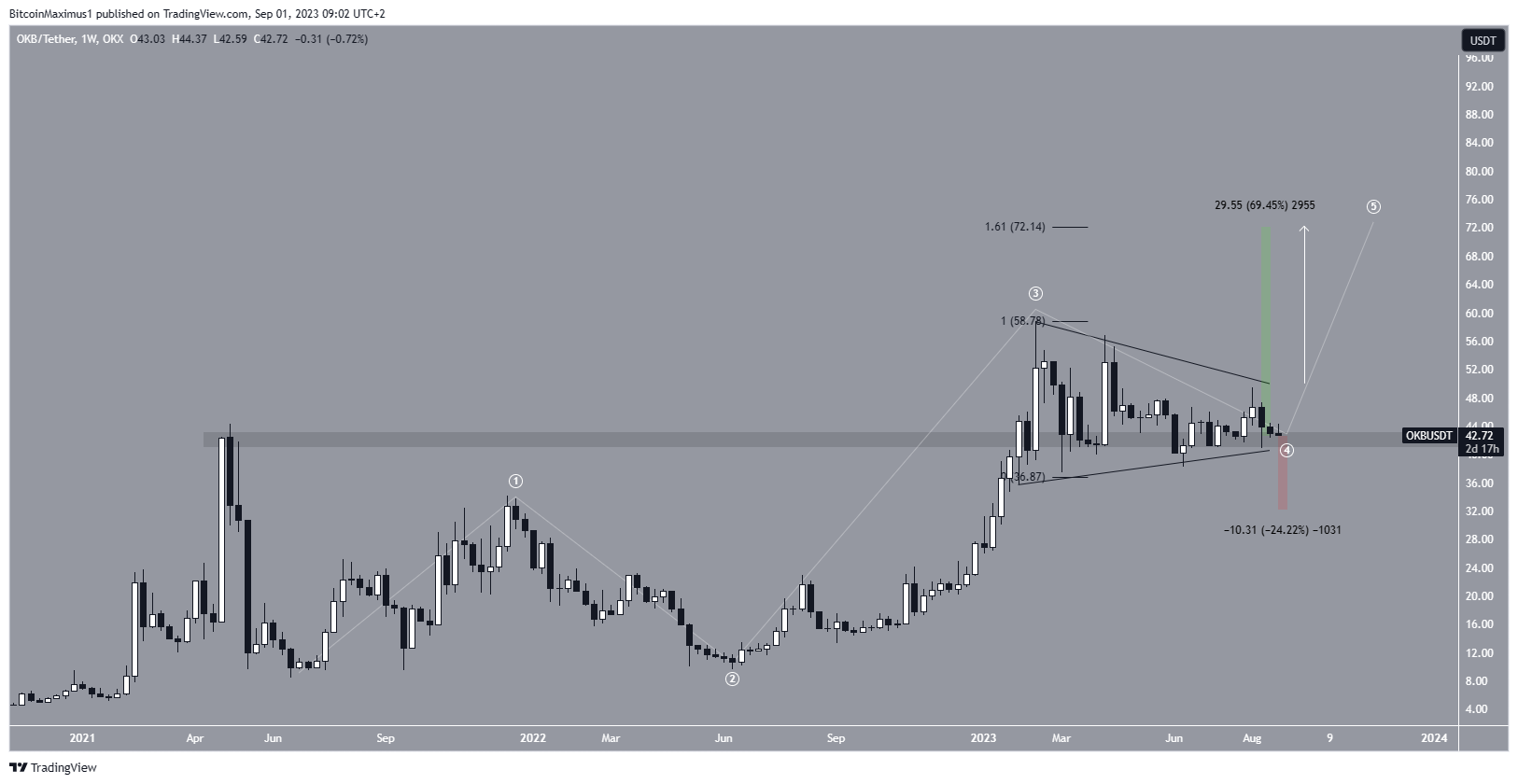

OKB Price Wave Count Supports New All-Time High

The OKB price has increased significantly since June 2021. The increase resembles a five-wave upward movement (white). If so, it is currently in wave four of this Elliott Wave count.

Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology.

Read More: 6 Best Copy Trading Platforms in 2023

Wave four has taken the shape of a symmetrical triangle, which is the most common shape in a wave four. This supports the most likely wave count and price action, suggesting that an eventual breakout from the triangle is expected.

If OKB breaks out, the next resistance will be at $72.10, amounting to a new all-time high price. The target is found by the 1.61 Fib extension of wave four. It also aligns with the projection of the triangle’s length to its breakout point (white). It is 70% above the current price.

Despite this bullish OKB price prediction, a breakdown from the triangle and the $42 support area will mean that the trend is still bearish. In that case, the price could decrease by 25% to the next support near $30.

Read More: Best Crypto Sign-Up Bonuses in 2023

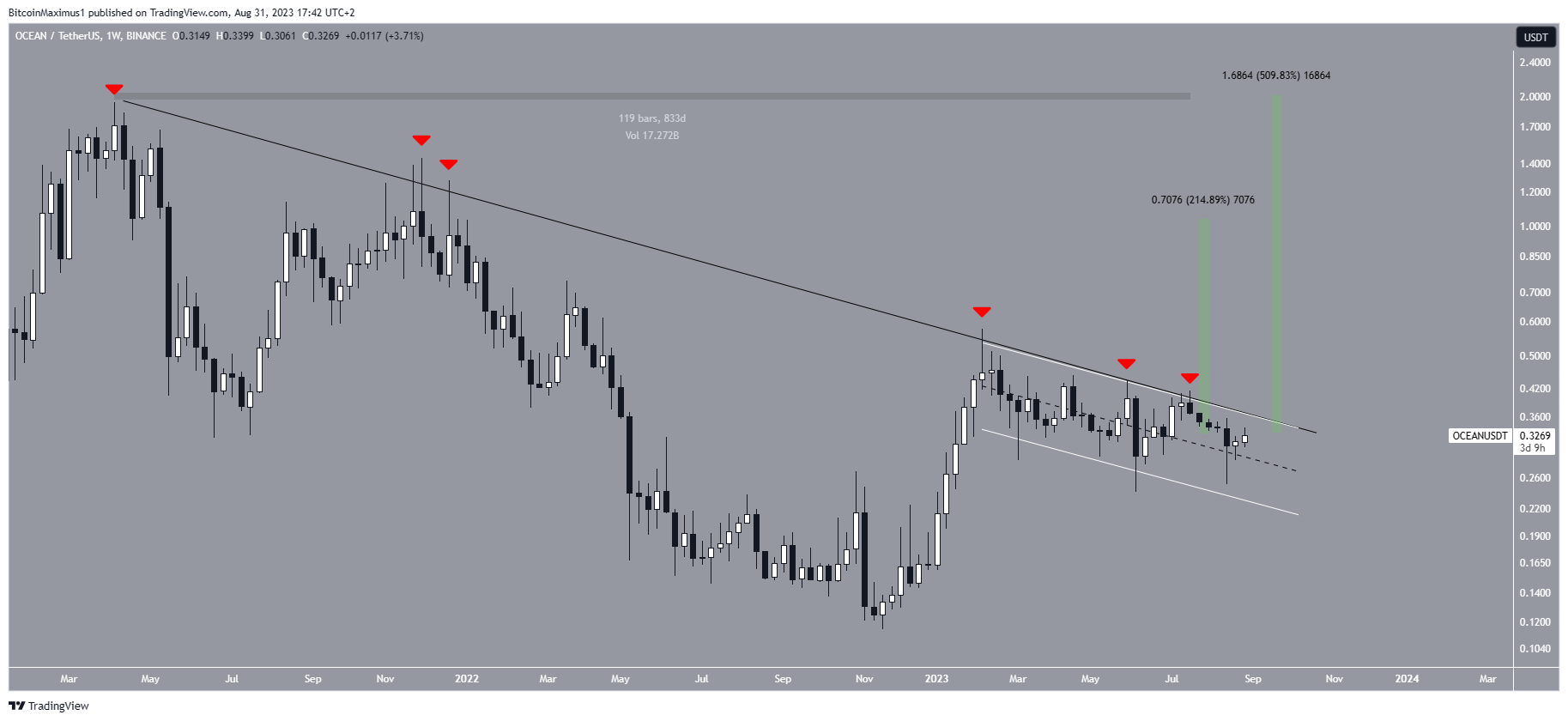

Ocean Protocol (OCEAN) Shows Signs of a Breakout

The OCEAN price has experienced a decline below a descending resistance line after reaching its all-time high of $1.94 in April 2021. This downward trend has persisted for a span of 829 days. During this time, the price has made six unsuccessful efforts to break out from this trend line (red icons).

Because trend lines tend to lose strength with each touch, there is a higher likelihood of eventually breaking out from this trend line.

Furthermore, starting from early February, the price has been trading within a descending parallel channel (white). This pattern is typically associated with corrective movements. As a result, the most probable future price scenario is a breakout from this channel. This expectation aligns with the repeated breakout attempts weakening the resistance established over the long term.

Nevertheless, achieving that previous peak would be challenging considering the considerable difference of over 500% between the all-time high and the current price.

A more realistic target following a successful long-term breakout would be the $1 resistance zone. The area is 215% higher than the current price.

Bitcoin Cash (BCH) Clears Corrective Pattern

The BCH Price began an upward movement in November 2022. After creating a higher low in June 2023, the price accelerated its rate of increase. This led to a new yearly high of $329.

The entire upward movement looks like a five-wave increase. If so, the BCH price completed wave four by bouncing at the 0.618 Fib retracement support level on August 17 (green icon). Besides validating the Fib support, the bounce also validated the support line of a descending parallel channel.

If wave five materializes, the BCH price will break out from the descending channel and reach a high of nearly $400. While this is not a new all-time high, it is a 90% increase measuring from the current price.

However, despite this bullish BCH price prediction, a close below the channel’s resistance line will mean that the breakout was invalid. In that case, the price can fall by 35% to the closest support at $140.

Toncoin (TON) Could Cruise in September

The TON price has fallen under a descending resistance line since December 2022. The rejection on April 2023 (red icon) catalyzed a sharp fall that led to a low of $0.96 on June 11.

However, the price has been increasing since. After an initial deviation, TON reclaimed the $1.35 horizontal area, validating it as support.

TON is attempting to break out from the descending resistance line. The price will likely move to the next horizontal resistance at $2.60 if successful. This would be an increase of 50%, measuring from the current price.

However, the bullish TON price prediction will be invalid if the price fails to break out. In that case, the most likely outcome will be a 22% drop to the $1.35 support.

Read More: 11 Best Crypto Portfolio Trackers in 2023

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.