Friday is Bitcoin options expiry day and there is more than half a billion dollars worth of contracts poised to lapse. Moreover, BTC prices are at a six-week low as market volume and volatility remain suppressed.

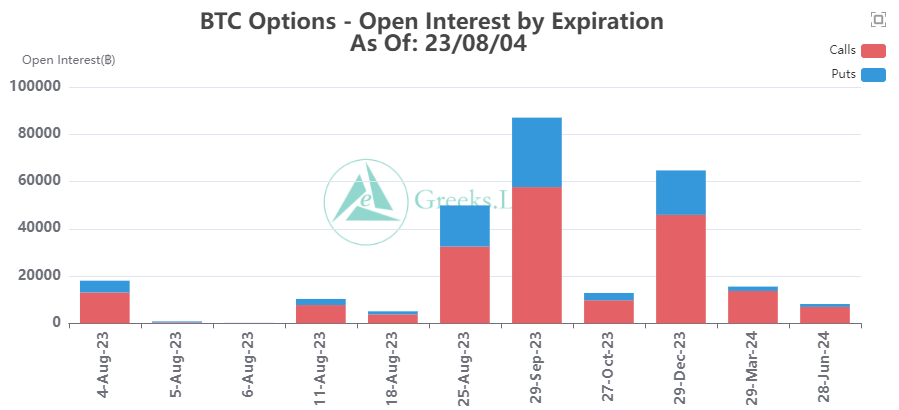

Around 18,000 Bitcoin options contracts are set to expire on August 4. They have a notional value of around $530 million which is considerably lower than last week’s expiry event.

Bitcoin Options Expiry

The half billion dollars worth of expiring contracts has a max pain point of $29,500. Max pain refers to the price level with the most open contracts. It is also the level at which most losses will be made when the contracts expire.

Moreover, today’s expiring tranche of BTC options contracts has a put/call ratio of 0.38. This means that there are a lot more call or long contracts being sold as puts of shorts.

Greeks Live explained that the low market volatility was a factor:

“Low volatility has held up for 6 weeks, with major term implied volatility in a nearly unilateral downtrend since March, which has kept Expiration Prices close to the max pain point for an extended period of time.”

With weekly option implied volatility (IV) still only at 25%, the bear market is still not signaling an end, it added.

Find out where to trade Bitcoin derivatives here.

ETH Options and BTC Price Outlook

Furthermore, there are 217,000 Ethereum options contracts expiring today with a notional value of $400 million. The ETH contracts have a put/call ratio of 0.69 and a max pain point of $1,850.

The low volatility has also impacted companies such as Coinbase, which recently reported a slump in trading volumes. “This is the lowest volatility we have seen in many years,” remarked Coinbase chief financial officer Alesia Haas.

Bitcoin markets have done very little this week, with asset prices at exactly the same level they were this time last Friday. BTC is currently trading at $29,212, having done very little over the past 24 hours.

Bitcoin prices are currently hovering around a six-week low after trending down since June 22. It is still up 76% since the beginning of the year, but the bear market is likely not over yet.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.