Arthur Hayes, a well-known name in the crypto market, has made a bold prediction regarding the future of artificial intelligence and cryptocurrencies.

According to Hayes, Bitcoin is set to become the currency of choice for artificial intelligence (AI) in the future. His argument draws upon the inherent characteristics of Bitcoin. It ideally suits the potential needs and operational mechanics of AI.

AI Needs an Efficient Payment System

Central to Hayes’s argument is the need for AI entities to interact with the economic ecosystem. This is a concept he introduces through the hypothetical “PoetAI,” an entity that creates beautiful poetry from natural language prompts.

This model consumes a vast data and energy diet of past poetry to learn and evolve and charges a fee for its services. Therefore, it creates a need for an efficient, effective, and reliable payment system.

The requirements of such a payment system are stringent. For instance, it needs to be digital, automated, and available around the clock, without the limitations of geography or banking hours.

As per Hayes, the traditional banking system fails to meet these needs, as does a digital layer like PayPal due to its dependence on banks and susceptibility to censorship.

Hayes asserts that only a blockchain-based system, immune to arbitrary rule changes and deplatforming, would suffice. Among blockchain-powered currencies, he further narrows down the choice to Bitcoin, citing its intrinsic properties like censorship resistance, scarcity, and digital nature.

The Energy-Powered Currency for AI

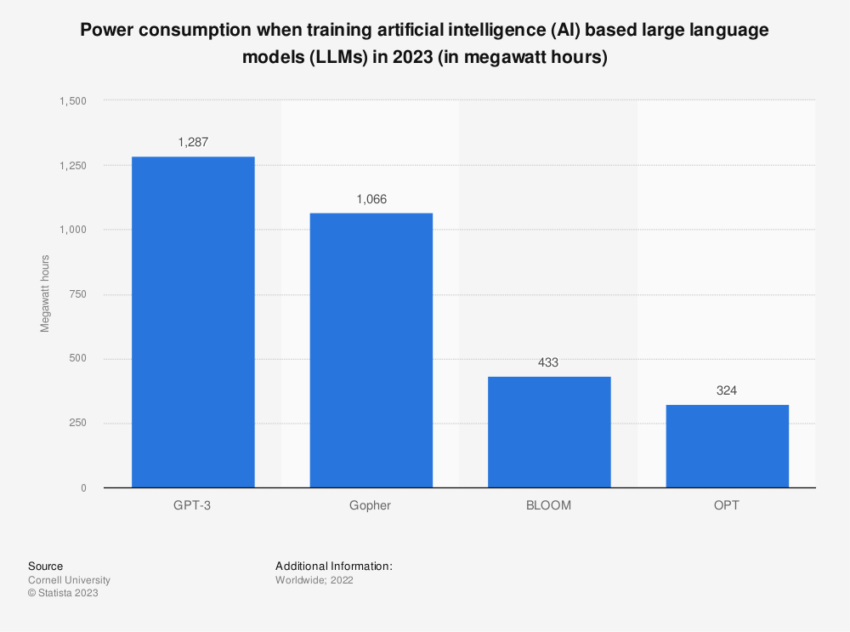

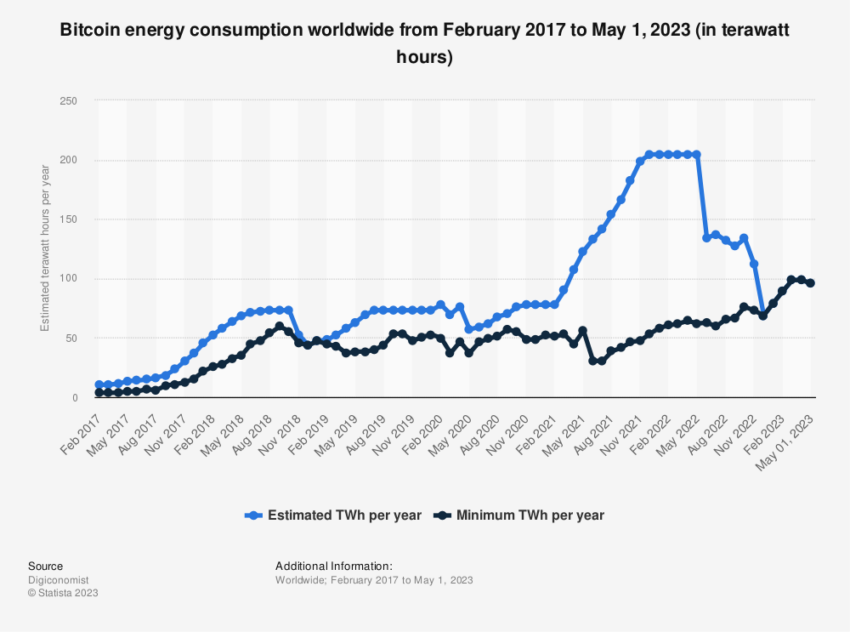

The sustenance of an AI entity depends on two critical resources: data and compute power, both of which ultimately translate to the consumption of electricity.

Hayes points out that an AI must also produce more value than the energy it consumes. As such, the currency an AI would accept should maintain its purchasing power relative to the cost of electricity.

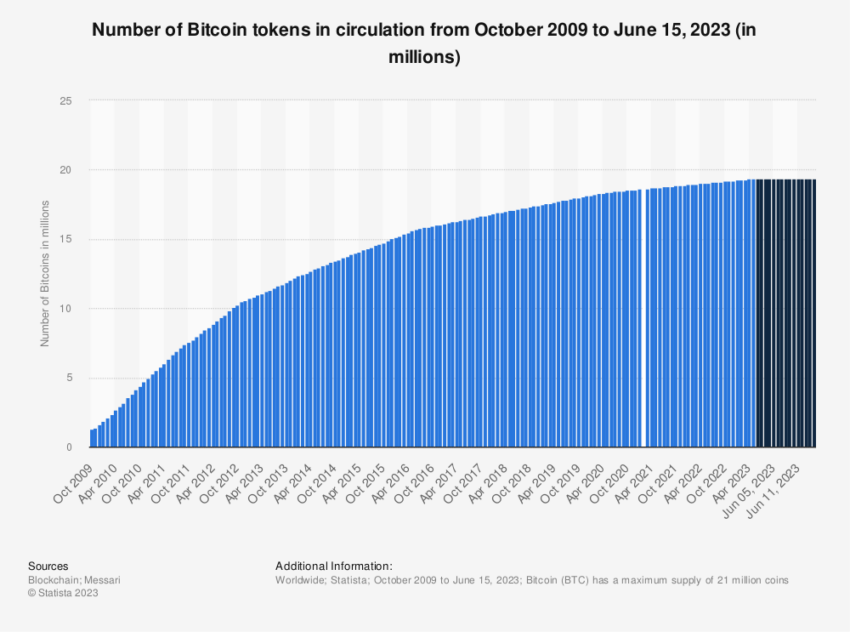

Hayes’s argument for Bitcoin as the AI currency hinges on three parameters: scarcity, digital censorship resistance, and energy purchasing power. Bitcoin outperforms gold and fiat in terms of scarcity and censorship resistance.

In terms of energy purchasing power, Bitcoin’s value is intrinsically tied to electricity cost, unlike gold or fiat currencies.

In the hypothetical AI decision tree, Bitcoin emerges as the clear choice. Indeed, it fulfills the criteria of being digitally censorship-resistant, maintaining value relative to electricity, and being provably scarce.

With a lifespan potentially outlasting human civilization, an AI would need a currency with proven longevity that does not rely on human institutions.

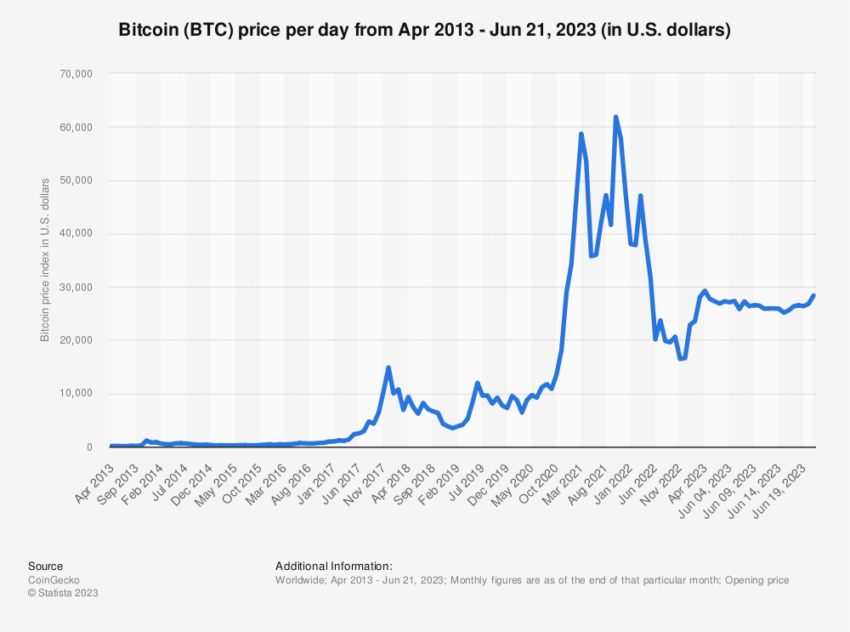

Bitcoin (BTC) Price Predictions

Hayes’s vision pivots around two simultaneous manias. First, investors’ quest for an escape from fiat inflation. And second, the desire to capitalize on the merger of human and AI progress.

Hayes believes that the fervor of growth investment could reach its peak between 2025 and 2026. His predictive model outlines the potential outcomes of Bitcoin’s price, primarily determined by the size of the AI economy.

He hypothesizes three scenarios: low, median, and mania. With AI’s share of global GDP ranging from 5% to 50%, Bitcoin market cap to daily transaction value can multiply from 8x to 172x. This translates to the price of Bitcoin ranging from $64,934.51 to $760,591.96.

The results reveal staggering potential increases in Bitcoin’s price. Indeed, it forecasts a future where Bitcoin might experience unprecedented growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.