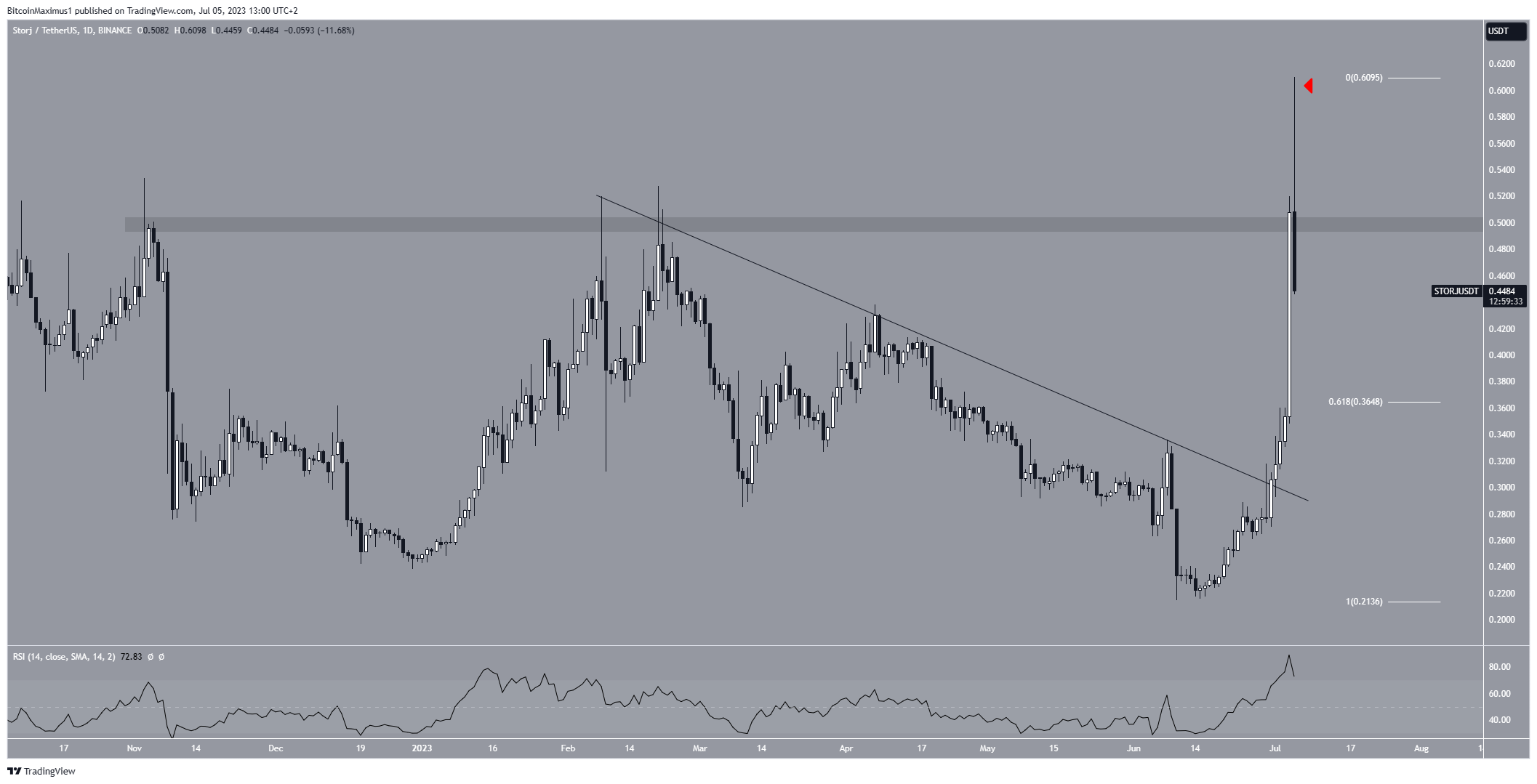

The Storj (STORJ) price has broken out from long- and short-term descending resistance lines, greatly accelerating its rate of increase on July 4. At one point, the price had increased by 70% in less than two days.

While the long-term trend is decisively bullish, short-term readings suggest that an initial retracement could occur before the price eventually resumes its upward movement.

STORJ Price Clears Long-Term Resistance

The weekly time frame outlook for STORJ shows that the price has fallen under a descending resistance line since November 2021. The decrease led to a low of $0.21 in June 2023. STORJ bounced sharply almost immediately afterward and has increased since.

Then, the STORJ price broke out from the descending resistance line on June 18. At the time, the line had been in place for 581 days. While the price reached a new yearly high of $0.61, STORJ is in the process of creating a long upper wick (red icon). Moreover, it is at risk of falling below the $0.48 horizontal area.

It is not yet certain if the area will act as resistance or if STORJ will clear it and validate it as support.

The weekly RSI supports the continuing upward movement. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Bulls still have an advantage if the RSI reading is above 50 and the trend is upward. The opposite is true if the reading is below 50.

The RSI is above 50 and increasing, indicating a bullish trend. Moreover, the indicator has generated a very significant amount of bullish divergence (green line). Divergence in such a high time frame is rare and often precedes long-term bullish trend reversals, as was the case with STORJ.

Read More: 9 Best Crypto Demo Accounts For Trading

STORJ Price Prediction: Retracement Before Continuation?

While the weekly time frame is bullish, the daily one shows mixed signs.

On the bullish side, the STORJ price broke out from a descending resistance line on July 1. The breakout was supported by the RSI, which moved above 50 and is increasing. This increases the legitimacy of the breakout.

However, the price has seemingly failed to close above the $0.48 horizontal area. Rather, it created a very long upper wick (red icon), considered a sign of selling pressure.

Moreover, the preceding breakout is considered a deviation since the price failed to sustain the upward movement above the $0.48 area.

To conclude, the long-term STORJ trend is decisively bullish. However, the direction of the short-term trend will likely be determined by whether STORJ closes above or below the $0.48 horizontal area.

If it closes above, an upward movement to the next long-term resistance at $0.90 will be expected. On the other hand, if the price closes below the $0.48 area, a drop to the next closest support at $0.36 will likely occur.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.