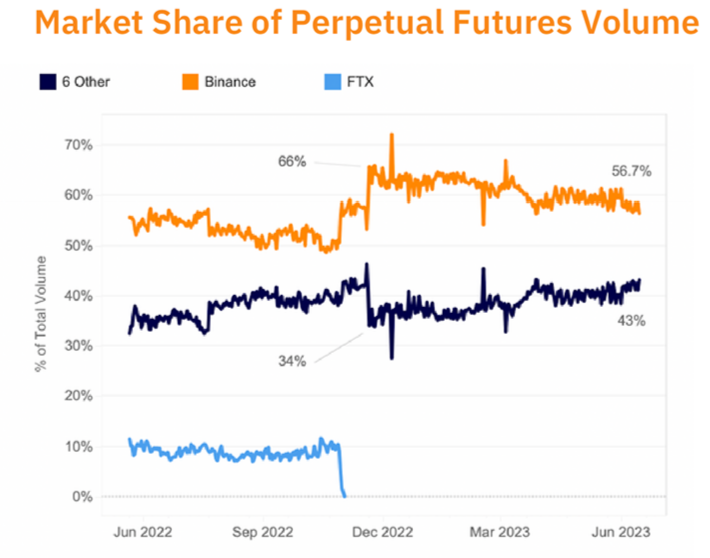

Binance is losing its share of the crypto perpetual futures market as exits from key markets affect trading volumes.

The lower volumes also come as Binance is under investigation by the US futures market regulator, the Commodity Futures Trading Commission.

Lawsuits See Binance Losing Share to Asian Exchanges

While the exchange started the year accounting for 66% of perpetual futures trading volumes, June data revealed that number had fallen by about 10% to 56.7%. Recently, Binance delisted a perpetual futures contract related to the failed LUNC cryptocurrency.

Find out here where to trade cryptocurrency futures.

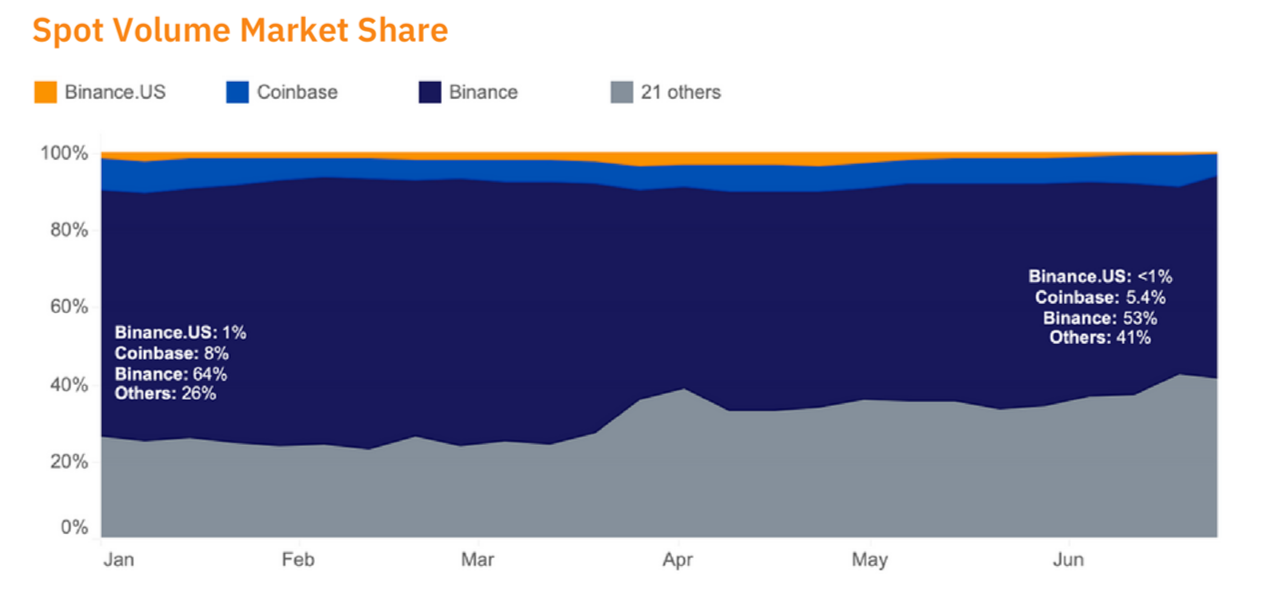

The exchange has also seen declines in spot volume since the CFTC and, later, the Securities and Exchange Commission sued it.

Recent exits from wealthy jurisdictions like France, the Netherlands, and Canada and the rescission of a zero-fee promotion may have also contributed to the 11% decline in spot volumes.

Asian rivals Bybit and OKX seemed to have gained most of Binance’s lost trading volume.

In March, Binance resumed charging fees for BTC stablecoin pairs except for TrueUSD. The TUSD accounts for more than 10% of BTC spot volumes on Binance and 20% globally.

However, order books reveal a lack of market depth for the stablecoin, suggesting that market-makers are cautious in providing liquidity.

Coinbase Share of Spot Market Drops 2.6% as Market Depth Wanes

Other exchanges, Coinbase and Bittrex, also bore the brunt of SEC enforcement, with Coinbase’s share of spot trading falling 2.6% this year.

Bittrex saw market depth for its top-10 tokens fall 68%. Meanwhile, OKCoin, which recently received a cease-and-desist order from the Federal Trade Commission, lost 85%.

Global BTC liquidity fell $10 million in the quarter, bringing about the exit of two crucial market makers, Jump Crypto, and Jane Street.

The US CFTC accused Binance of illegally allowing US trading firms to access its over-the-counter trading desk earlier this year. According to the Commodity Exchange Act, firms wishing to offer customers derivative products must register with the CFTC. Litigation is still ongoing.

In another lawsuit, the US Securities and Exchange charged Binance with mishandling customer funds and offering unregistered securities.

Got something to say about Binance losing its futures market share or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.