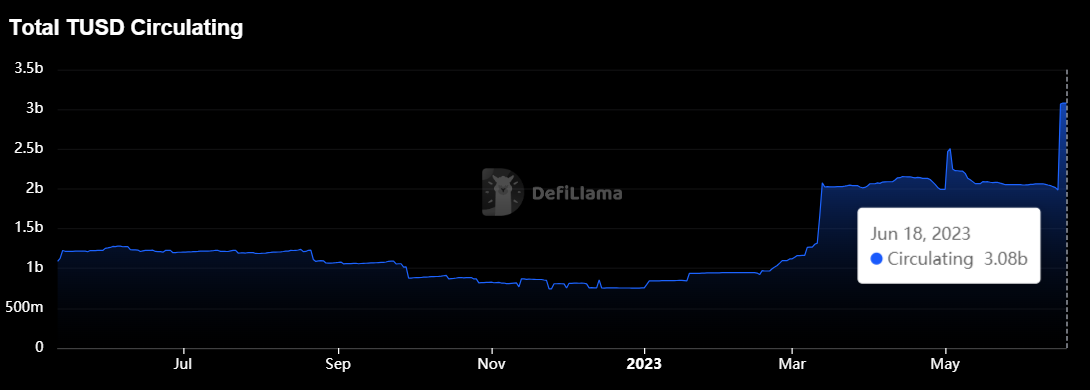

The combined market cap of the top 6 stablecoins increased significantly as TrueUSD (TUSD) reached $3 billion for the first time, according to Santiment data.

Per the data aggregator, this surge in TUSD’s market cap represents the most significant combined increase since March 12. Santiment stated that this could kickstart a turnaround for stablecoins and end the long streak of monthly declines.

Stablecoin market cap has been declining since May 2022 when UST depegged. At the time, the total market cap was $186 billion but has dropped to $128.23 billion, according to Defillama data.

Read More: Top 11 Crypto Communities To Join in 2023

TUSD’s Market Cap Hit $3 Billion

TrueUSD’s (TUSD) circulating supply has more than doubled since the beginning of the year, reaching over 3 billion tokens on June 16. Per DeFillama, the TUSD market cap increased by 51.14% in the past week alone.

During this period, the little-known stablecoin has become the second-largest stablecoin by circulating supply and transfer volume on the Tron blockchain.

Last week, TUSD briefly deviated from its dollar peg after it suspended minting from Prime Trust. Despite these issues, Kaiko data pointed out that the BTC-TUSD pair on Binance is the most traded BTC market in crypto and currently holds 61% of all BTC volume on the exchange.

BUSD Drops Out of Top 3 Stablecoins

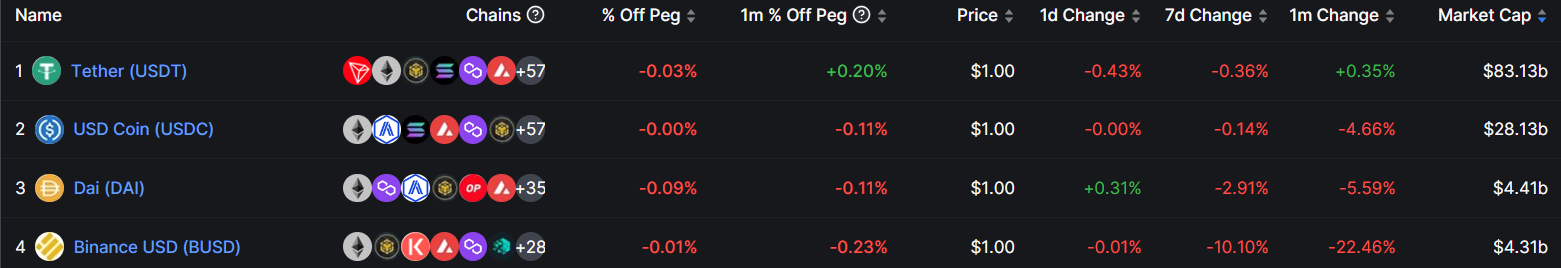

The binance-backed stablecoin, BUSD, is no longer a top three stablecoin as its circulating supply was surpassed by DAI during the past week.

Since peaking at over $22 billion in November 2022, BUSD’s circulating supply has been on a downward trend. In February, New York authorities ordered its issuer, Paxos, to stop other mints. Due to this, Binance CEO Changpeng ‘CZ’ Zhao stated that the exchange would support other stablecoins in the ecosystem. Since then, BUSD’s market share has consistently declined, according to Kaiko data.

USD Coin (USDC) saw confidence in its reserves shaken by the collapse of crypto-friendly banks like Silicon Valley Bank alongside Silvergate and Signature Bank. However, it remains the second-largest stablecoin by market cap at $28.13 billion.

Tether’s USDT remains the largest stablecoin by market cap after reaching an all-time high of over $83 billion. The stablecoin controls around 65% of the market despite the new wave of FUD about its reserves and a slight depeg.

More From BeInCrypto:

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.