Analysts at JP Morgan believe U.S. regulators might target short selling to prevent a contagion amid the rising banking crisis.

With several U.S. banks collapsing recently, industry players have argued that short sellers are scaring people to think the crisis would ensnare more banks. JP Morgan analysts noted that this argument might temporarily force regulators to halt short-selling activities.

Short selling is a form of investment that looks to profit from a decline in the price of a security.

Why Short Selling Might be Banned

On May 4, the American Banker Association (ABA) wrote the U.S. Securities and Exchange Commission (SEC), expressing worry that short sellers might be manipulating the market. ABA’s Chief Policy Officer Naomi Camper noted that some shares trading defy the underlying fundamentals.

Meanwhile, JP Morgan highlighted this concern in its note. According to the banking giant, it has never seen a situation where a “perfectly healthy bank” ends up in the hands of the FDIC [Federal Deposit Insurance Corporation] within a very short period.

The bankers further noted that the pressure affected even banks in good financial positions as more Americans now worry about their money in these banks. Short Sellers have been blamed for stoking fears leading to the significant price swings in shares of several regional banks. Pacific Western in Los Angeles and First Horizon in Tennessee have significantly declined in share value over the two months.

Shorters Swim in Profit From Banking Crisis

While three major regional banks holding $532 billion in deposits have already failed, short sellers appear to be swimming in profits. Data firm Ortex reported that sellers had made $1.2 billion betting against these struggling stocks.

For context, shorters reportedly made $379 million by shorting First Horizon, PacWest, and Western Alliance shares on May 4.

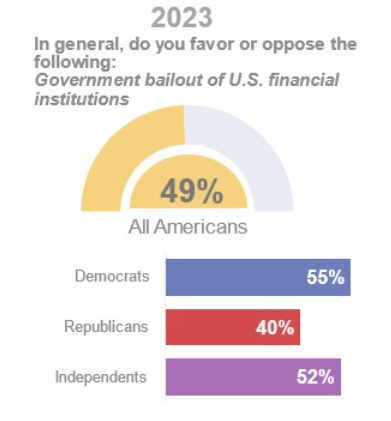

Despite the crisis, public polling firm Ipsos reported that most Americans still trust their banks. According to the survey, most Americans have a fair amount or a great deal of confidence in the stability of their bank and the safety of their deposits at their bank.

Besides that, about half of the respondents support government bailouts for these struggling financial institutions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.