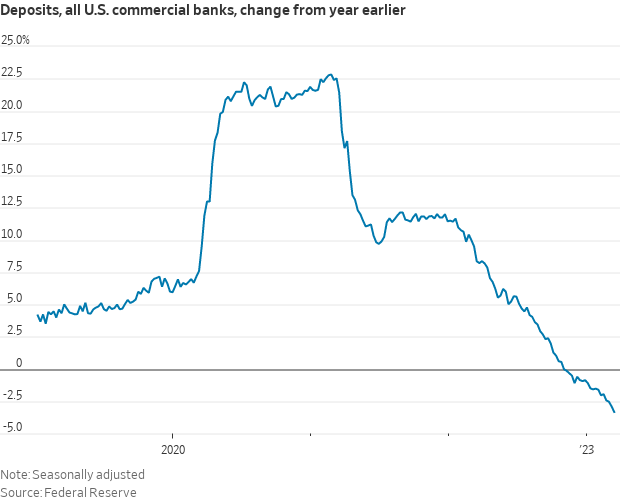

United States banks’ deposits dropped significantly between March 8 and March 15 due to fears of a banking collapse. On the other hand, Bitcoin increased 35% over the last two weeks.

Data from the Federal Reserve showed that deposits at all U.S. commercial banks fell by $98 billion within that week but rose by $67 billion for the top 25 banks in the country. This suggests that customers moved their funds from regional banks to banks considered too big to fail — signaling fear of a banking collapse.

This behavior also underscores the concern that the government might not aid the smaller banks, especially if they are not considered systemically important. Gemini co-founder Tyler Winklevoss described the U.S. banking system as a modern-caste system where people banking with the top banks are protected while the rest are exposed to risks.

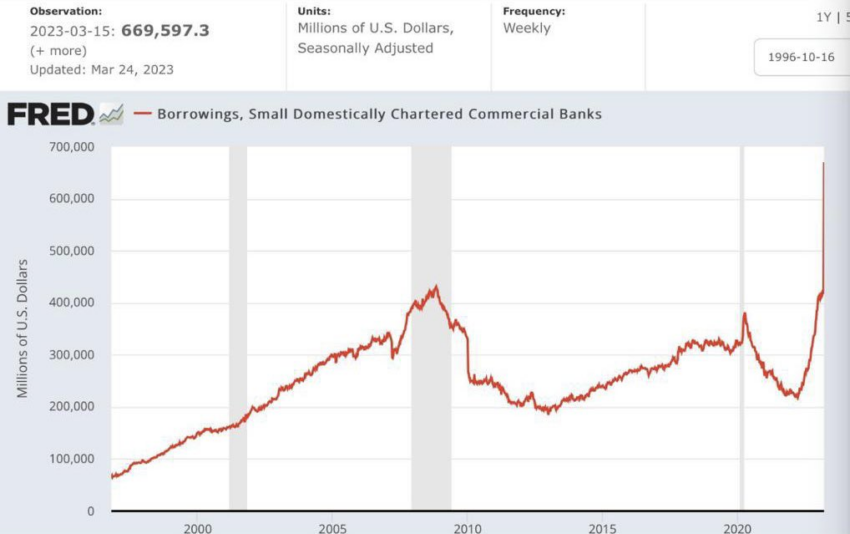

Banks Borrowing at Unprecedented Rates

Meanwhile, the government and major banks‘ move to calm nerves has not wholly eased concerns about a potential crisis in the banking system. Several users are still moving funds out of small banks, leading the banks to borrow at an alarming rate to prevent bank runs.

CNN reported that borrowing by small U.S. banks reached the highest rate since the turn of the century. According to the report, the banks borrowed $669.6 billion this week. But analysts believe this is just an effort by the banks to prepare for any bank run and does not necessarily signal a current problem.

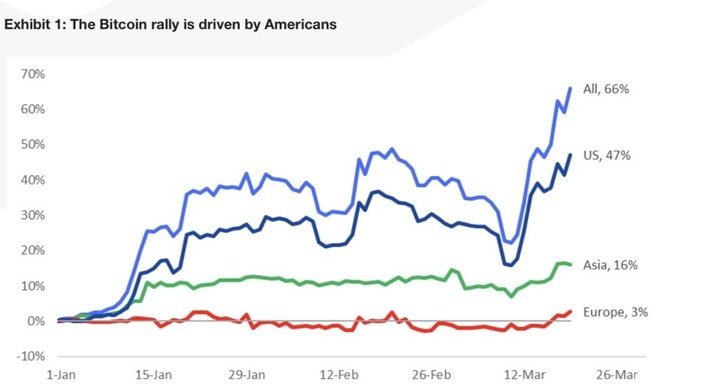

US Investors Pile Into Bitcoin

A look at Bitcoin’s recent rally showed that U.S. investors had played a significant part in the price rise. According to Matrixport’s head of research and strategy, Markus Thielin, “Americans are buying Bitcoin with both hands.” Thielen noted that 47% of the purchases that fueled BTC’s price increase came from U.S. institutional players.

Coinbase former CTO Balaji Srinivasan pointed out that investors usually exit devaluing currencies during distress. According to him, this is where the U.S. Dollar falls into presently, adding that he expects Bitcoin (BTC) to replace it as the global reserve currency.

During this banking crisis, Bitcoin has rallied by 35% in the last two weeks to as high as $27,944. Several BTC bulls have predicted the imminent collapse of the banking system and the possibility of the flagship asset rallying to $1 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.