(XTZ) Tezos Price Prediction & Forecast [Updated 09 February 2019]

Thinking of investing in Tezos (XTZ) in February 2019? Here is our honest price prediction and forecast.

Overview

- Fundamental Analysis

- Technical Analysis

- Specialists’ Perspective

- Tezos Price Prediction 2019

- Tezos Price Prediction 2020

- Tezos Price Prediction 2021

- Tezos Price Prediction 5 years

- Our Prediction

Tezos (XTZ) is a new platform that claims to be the world’s first self-evolving blockchain, capable of keeping up with all the latest technological developments through its on-chain governance structure. The basic unit of the Tezos blockchain is the tez, a cryptocurrency which is used to power its growing decentralized application (DApp) ecosystem.

Initially conceptualized in 2014 by Arthur and Kathleen Breitman and launched in 2017, Tezos was designed to be the last cryptocurrency anyone will ever need. Offering a proof-of-stake consensus system, on-chain governance, and secure smart-contracts, Tezos looked like a sleeping giant after concluding its monster initial coin offerings (ICO) in July 2017. After first listing on exchanges several months later, Tezos (XTZ) witnessed an impressive bull run, quickly seeing its value multiply as a huge amount of hype coalesced on the cryptocurrency market as a whole. However, this growth turned out to be incredibly short-lived as XTZ began an almost perpetual decline in Dec 2017 — which has continued up until this present day. During this time, Tezos experienced several delays and challenges which caused it to fall much faster than more prominent coins such as Bitcoin (BTC) and Ethereum (ETH). Since Dec 2017, Tezos has lost more than 97 percent of its value — falling to as low as just $0.35 in December 2018. Because the cryptocurrency market remains in a strongly bearish phase, we at BeInCrypto expect Tezos to continue to fall over the next several months — but it may see a gradual recovery by the end of 2019 as market sentiment recovers. [bctt tweet=”We at BeInCrypto expect the price of Tezos to sink to as low as $0.30 by mid-2019, before beginning its recovery in the second half of the year” username=”beincrypto”]

Fundamental Analysis

To this day, Tezos remains one of the largest and most successful ICOs ever funded — raising a staggering $232 million in its July 2017 token sale. At the time, this was the highest amount ever raised in an ICO, but has since been eclipsed by a small handful of projects. Tezos features on-chain decentralized governance, allowing stakeholders to vote on proposed blockchain updates while ensuring it always conforms to the expectations of its users and community — which should protect it against sudden collapse due to unforeseen competition. Being the first so-called self-evolving blockchain places Tezos at the forefront of a new industry of blockchains that are able to adapt to changing market conditions without needed to fragment through a fork. This means that any changes that need to be implemented can be considered through a community vote, and implemented if it sees a majority vote. Changes that have been voted-in can then be implemented without needing to fork, ensuring the community remains intact and the network remains uninterrupted. In addition to this, Tezos is one of the few projects that offer a bug bounty — helping to ensure that security flaws are identified and addressed quickly before they can possibly damage the network. As of this writing, however, the reward tiers for the bug bounty remains to be announced. Despite its promising foundations, Tezos has been on a rocky road since its ICO concluded. It was hit with several class-action lawsuits from disgruntled investors after there were excessive delays launching its product. Tezos was accused of selling securities without a license. The platform also faced difficulty when the two project co-founders ended up in a feud with Johann Gevers — previously head of the Tezos foundation — who was accused of blocking the project’s development.

Technical Analysis

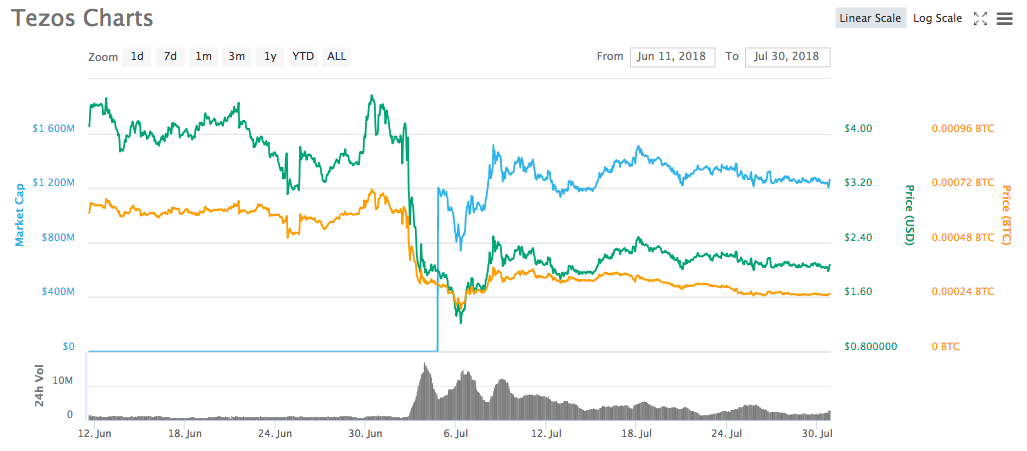

Following the conclusion of its ICO in July 2017, Tezos took several months to become tradable on exchanges. It first started being listed on a major exchange in October 2017. When the token first hit exchanges, it was immediately valued at more than 3x its $0.51 ICO price, hovering between $1.50 and $2.50 until mid-November 2017 — after which it began to see huge growth as the market picked up steam. Over the next month, XTZ rapidly gained momentum on exchanges, spiking to as high as $12.19 each on Dec 17, 2017, while the Tezos market capitalization swelled to enormous proportions. However, Tezos was one of the first digital assets to enter a bearish phase, quickly losing over two-thirds of its value in just over a week. Besides a short climb up to almost $6 between April and June 2018, last year was a poor year for Tezos — as the cryptocurrency consistently fell week after week. Unusually, XTZ crashed in value the same day the platform beta version went live, losing almost half of its value over a two day period as user sentiment waned. By the end of 2018, Tezos had fallen to just $0.47, falling below its ICO price for the first time in November — before continuing to witness heavy losses in Q1 2019.

Specialists’ Perspective

Although Tezos was initially met with extreme demand and positive sentiment, it is safe to say that this has largely dissipated in 2019. Beginning the year with a market capitalization of around $300 million, things continued to decline for Tezos as the platform failed to attract developers to build out its DApp ecosystem. As of writing, there are still only a small number of DApps built on Tezos — with the majority of these having very low usage. When looking at experts’ price predictions for 2019 and beyond, the Tezos forecast looks bleak — with the vast majority of predictions expecting Tezos will continue to fall for the foreseeable future. WalletInvestor — a website that specializes in predicting trends and market movements — paints a worrying image for the future of Tezos. It predicts XTZ will lose the great majority of its value over the next year, falling by more than 76 percent to reach just $0.086 during this period. TradingBeasts, on-the-other-hand, is bearish for the short-term prospects of Tezos but predicts the coin will see a turning point in mid-2019 — at which point it will begin to grow in value. TradingBeasts predicts this reversal will occur in August 2019, with the coin climbing to as high as $1.33 by year-end. Using its price-prediction algorithms, Cryptoground has attempted to ascertain how Tezos is likely to move over the next several months, and the results are somewhat surprising. Cryptoground’s neural networks predict Tezos will continue to fall in the very near term, but will make a drastic recovery by mid-2019, with almost an almost 400 percent price increase expected within a year. These predictions all run in stark contrast to those made in early 2018, most of which projected Tezos would achieve several hundred-fold growth at the very least. For example, Crypto Asset Valuations on Twitter predicted Tezos could reach more than $20,000 if it manages to capture 10 percent of the global payments market.Can any #cryptoasset capture 10% of a ~$155 trillion #payments market? BKCM CEO Brian Kelly (@BKBrianKelly) seems to think so! Here are our projections if so:#XBT: $907,771.84#ETH: $155,206.50#XRP: $394.99#LTC: $272,736.44

— crypto asset valuations (@cavaluations) June 4, 2018

…#cryptoassetvaluationshttps://t.co/2j31cfvfS2 pic.twitter.com/OlBNO8GJvT

Tezos Price Prediction 2019

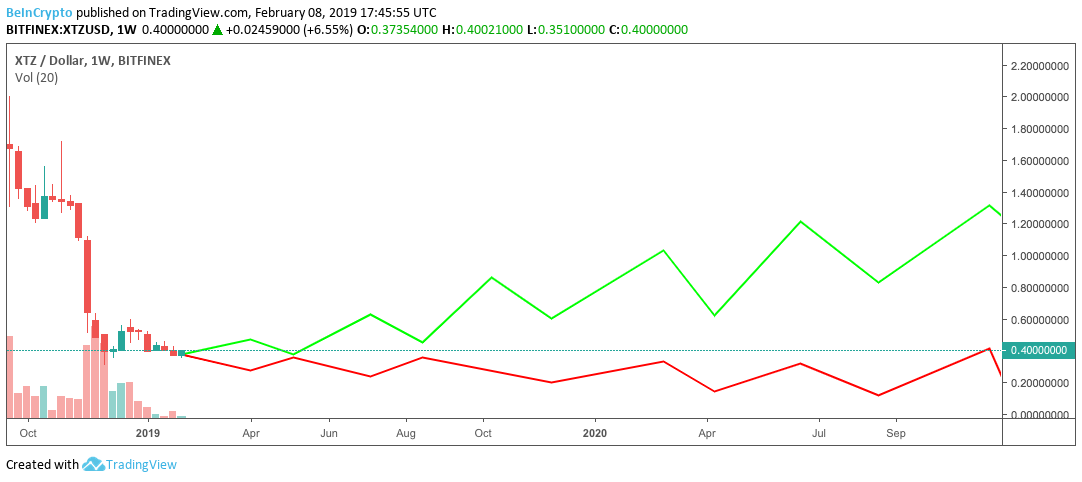

As it stands, practically the entire cryptocurrency market is in a slump, with all major digital assets experiencing considerable losses over the past year. Due to its past performance in previous months, it is very likely that Tezos (XTZ) will continue to fall in early 2019, falling to sub $0.30 by May. As of February 2019, XTZ appears to be consolidating around $0.37, after previously touching this value in early December 2018. Whether it breaks up or down after consolidation remains to be seen, but previous movements indicate XTZ is likely to continue falling after failing to hold $0.37. Compared to Bitcoin (BTC), which has also experienced significant losses since November 2018, Tezos has fallen much faster — losing value almost twice as fast over the same period. If Tezos continues to fall at the same rate, it could fall to as low as five cents by the end of 2019, though continuing to hover around $0.37 is the more likely scenario. However, since Tezos only recently concluded its beta stage in September 2018, the blockchain can still be considered relatively new — meaning there is definitely potential to turn things around if good progress is made.

Tezos Price Prediction 2020

Since the success of the project is almost wholly driven by its community, Tezos (XTZ) might find it difficult to compete with other projects that maintain a dedicated marketing effort. Although Tezos is likely to improve its position in 2020, it is unlikely to exceed $1.30 unless it begins bringing significant value to the industry. If Tezos continues its 2019 bearish trend, then it is highly unlikely to end 2020 any higher than $0.40. Tezos also appears to suffer from a severe case of inadequate information, with very little in the way of technical documentation, guidance information, or supporting materials for developers looking to build on Tezos. Since the innovation needed to help drive Tezos adoption must come from within, this lack of developer support may hurt its long-term prospects. Additionally, because Tezos has no official roadmap, it is much more difficult to use upcoming developments as a predictor for future success. However, looking at the small numbers of DApps currently being built on Tezos, there are some innovative developments in the pipeline — including OrchestrumOS, an interoperable operating system designed to allow DApps to operate across multiple blockchains. In addition to this, Tezos’ first layer-two solution looks poised for release sometime in 2020 — which may generate some traction for the project. Marigold is based-on the Plasma concept and aims to reduce the computational burden associated with operating smart-contracts, shifting much of this burden off-chain. If Marigold does indeed come to fruition, then Tezos may quickly become the go-to choice for smart-contract development.

Tezos Price Prediction 2021

2021 is likely to be the year when competition between smart-contract capable blockchains really heats up. Because of the increased focus on smart-contracts predicted in 2021, we expect that Tezos (XTZ) will see significant gains this year, potentially retaking its all-time high of over $12 if it can deliver some killer DApps of its own. However, since many blockchains already have a head-start on Tezos, the platform will need to demonstrate superior technology and a hospitable environment for both DApp developers and users to ensure it remains competitive. Despite facing stiff competition from the likes of Ethereum (ETH), EOS (EOS), Stellar (XLM), and over a dozen others, it is unlikely that a single platform will dominate the market. Instead, it is likely Tezos will eventually carve out its own niche within the decentralized application (DApp) industry — allowing it to grow despite being unlikely to become the first and foremost DApp platform. Since the great majority of these smart contract platforms are working towards the same goals — namely, developing a diverse repertoire of DApps, refining the efficiency of the blockchain, and pushing to implement one or more solutions to improve scaling — it is likely that most projects will have approximately the same level of sophistication by 2021. With all that said, there is a RSI similarity that could assist us in determining the XTZ price on Dec 31, 2021. While the daily RSI has generated bullish divergence several times throughout the price history of XTZ coin, only twice it has done so in oversold territory, on Nov 2018 and Sept 2020. While the price action around these dates has a similar shape, the rate of increase and time are nothing alike. In 2018, the difference between the two bottoms measured 39%, while the time between them only 12 days, while the same values stood at 6.5% and 37 days in 2020. Therefore, we can make the assumption that the price movement in 2020 is three times slower and six times smaller than that in 2018.

Tezos Price Prediction 5 years

With the DApp industry set to explode over the next several years, Tezos (XZT) developers and its users certainly have a lot to gain if Tezos can capture even a small percentage of the market. If it can grow with the market, and truly maintain its decentralized governance and development when doing so, we may see XZT reach as high as $24 by 2023. Tezos (XZT) is likely to change dramatically over the next five years. Since the blockchain is able to adapt to practically any change in the market environment or user demand, it should (theoretically) be able to evolve into the platform that users need in the future. However, while Tezos’ self-governing features may allow it to morph and grow with the market, solving the technical challenges required to do so will require extensive collaboration from its community and a sense of direction that hasn’t yet been demonstrated by the project. Whether Tezos manages to fend off what will almost certainly be increased competition over the next several years will likely determine how much growth XTZ experiences in this time. If Tezos remains one of the smaller DApp platforms, then significant growth is still expected — but it will not be on the same fantastical levels more capable platforms experience.Our Prediction

BeInCrypto prides itself on its comprehensive forecasts, using all available data to make realistic predictions about the future of digital assets. Based on the current situation with Tezos (XZT), we predict that a minimum near-term goal of $1.30 is certainly possible, while in the medium-term, Tezos may reach as high as $24 as the blockchain DApp industry explodes over the coming years. Since Tezos is in the very early stages of its development, there remains a great deal of work to be done in developing its use-cases and demonstrating the potential of the technology. However, with DApp development beginning to pick up, and some genuinely promising features on the way, it may not be long before Tezos hits a turning point. Based on our prediction, Tezos will achieve at least some degree of success over the medium-term and is unlikely to completely fail as a project since there appears to be enough support to keep the platform running long-term.| Period | Tezos Price Forecast | |

| Best Case Scenario | Worst Case Scenario | |

| 2019 | $0.70 | $0.30 |

| 2020 | $1.30 | $0.40 |

| 2021 | $3.00 | $2.40 |

| 5 years | $24+ | <$0.40 |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.