If you are an active Axie Infinity gamer, you will have heard of Smooth Love Potion or SLP. But wait, isn’t AXS the native token of the Axie ecosystem? Well, yes. However, the Axie Infinity gaming ecosystem has a dual system, boasting AXS as the governance token and SLP as the utility token. This means SLP is more like an in-game currency that players receive during gameplay. Throughout this SLP price prediction, we will ponder Smooth Love Potion’s future and whether it is a good investment option.

Want to get SLP price prediction weekly? Join BeInCrypto Trading Community on Telegram: read SLP price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

- Smooth Love Potion (SLP) and its fundamental analysis

- Smooth Love Potion price prediction and tokenomics

- Smooth Love Potion (SLP) price prediction 2023

- Smooth Love Potion (SLP) price prediction 2024

- Smooth Love Potion (SLP) price prediction 2025

- Smooth Love Potion (SLP) price prediction 2030

- Smooth Love Potion (SLP’s) long-term price prediction until 2035

- How accurate is the SLP price prediction?

- Frequently asked questions

Smooth Love Potion (SLP) and its fundamental analysis

There isn’t a lot going for in-game tokens like SLP regarding fundamentals. However, the success of SLP depends on the future development of the Axie Infinity play-to-earn ecosystem. The more games people play, the more we will see SLP circulating. Plus, with SLP associated with in-game assets and trades, holding SLP tokens can give users an edge in regards to gaming and, therefore, earning.

But let us consider how the play-to-earn sector — especially Axie Infinity — performed in 2022 and the possibilities going forward.

Messari’s “Crypto Theses for 2022” offers an interesting take on the P2E revolution. Here are the elements that might be relevant to the price of SLP tokens going forward:

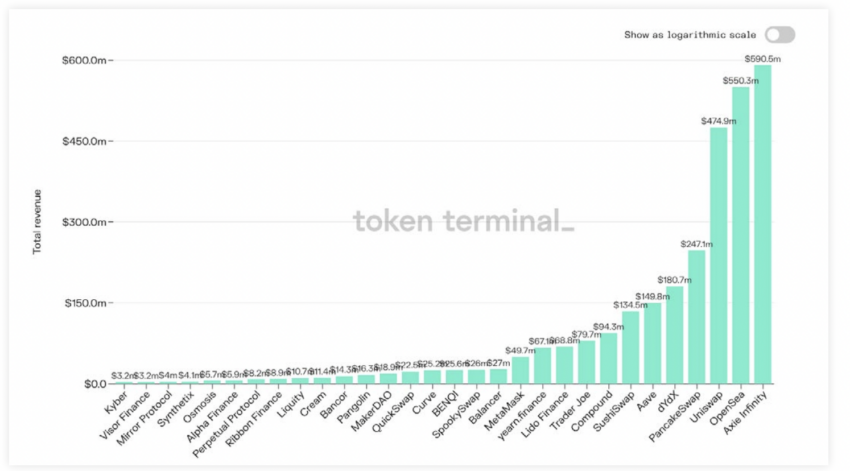

- Axie Infinity was the biggest revenue generator for the Ethereum ecosystem, clocking $590.50 million.

- In 2022, the average earnings of an Axie player seem to have dropped. However, the retention rate or player loyalty has been impressive.

- Play-to-earn gaming is attracting other players, with the likes of a16z already looking at the space, having invested $150 million in a firm called Mythical Games.

- Gaming is already a $120 billion industry, which makes the chances of adoption for blockchain-based versions even more obvious.

Did you know? SLP is an ERC-20 token and, therefore, compatible with most notable crypto wallets, even some of the popular Metamask alternatives like the Rainbow Wallet.

Also, here is an Axie Infinity-specific thread that talks about the current state of the ecosystem.

The more coverage and players the game gets, the more we will see SLP grow.

Smooth Love Potion price prediction and tokenomics

As SLP is an in-game utility token, it doesn’t have a supply cap. There are unlimited SLP tokens to grab. However, the gaming model of Axie Infinity is such that you need to spend — or rather burn — SLP while breeding in-game monsters called Axies. Therefore, as more gamers join the ecosystem, the token supply of SLP is expected to reach an equilibrium.

As of Feb. 28, 2022, SLP has a circulating supply of over 41 billion, over 42 billion in 2022. This shows SLP has a token-burning mechanism in place.

Smooth Love Potion (SLP) price forecast using market cap and trading volume

The market cap of Smooth Love Potion (SLP) peaked on Sept. 3, 2021, reaching $297.28 million.

Do note that the trading volume — $291.74 million — was nearly at par with the market cap. This shows that SLP is more of a daily-use token rather than an investment.

The turnover ratio or the trading volume to market cap ratio at the peak was 0.98.

As of Dec. 26, 2022, the market cap was $91.90 million, and the trading volume was $5.83 million. The turn-over ratio at this level was 0.063.

The higher turnover ratio at the peak shows that SLP was way more volatile at the 2022 levels. A reason why the prices didn’t soar per expectations in 2023.

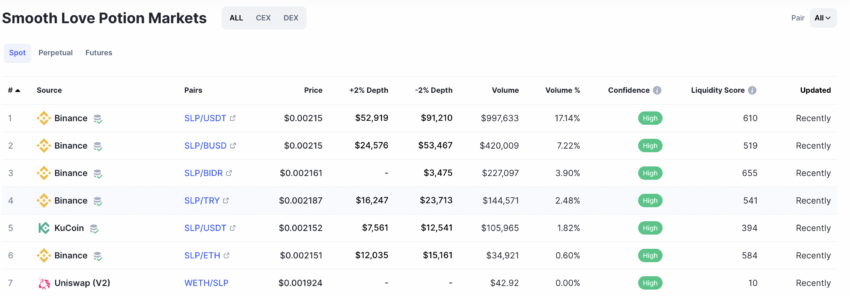

Also, despite being a utility token, SLP has a pretty decent market spread as of December 2022. The Binance-specific SLP-USDT pair is most prominent in terms of volume. The excellent trading spread does instill confidence in SLP as an investment and tradable crypto asset.

On-chain metrics and the future price of SLP

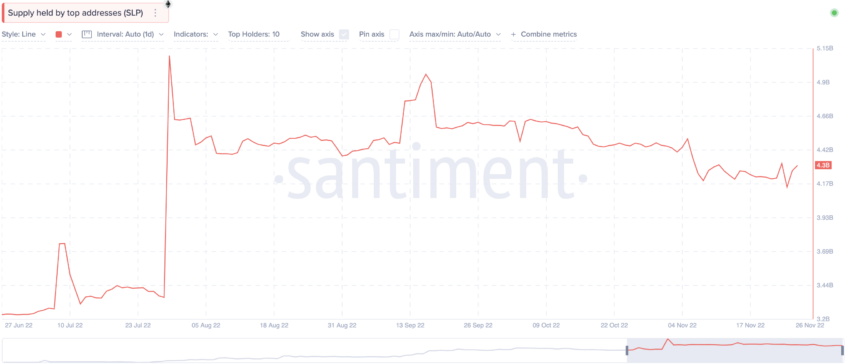

The first metric that comes to mind for a utility token like SLP is token distribution. The chart below from 2022 shows that top addresses holding SLP tokens have maintained a high and steady level since July till late November. This metric needs to be tracked in the future to see if addresses are growing or declining.

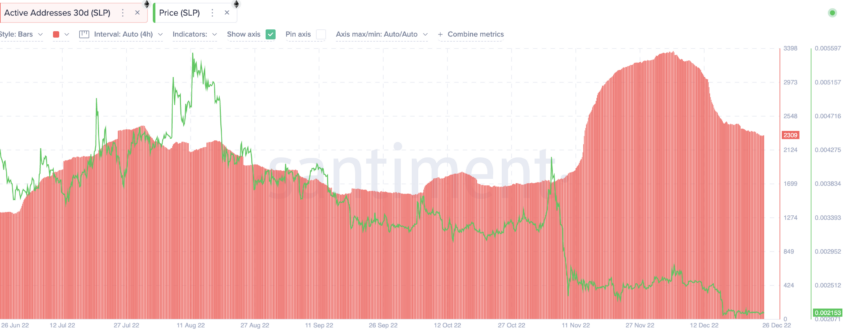

Active addresses holding SLP peaked in December 2022. However, the prices didn’t respond positively. This shows people might be holding SLP to gain an edge in gaming inside the Axie Infinity ecosystem.

Finally, the 90-day MVRV ratio till November 2022 indicated a market bottom for SLP. This might lead to a short-term rally if the low MVRV levels continue for several months. This actually happened as the prices doubled from these levels but didn’t reach the highest expected point.

Do note that low MVRV levels on June 2022 triggered a rally at SLP’s counter. However, for a similar price surge, MVRV needs to drop more.

SLP price prediction using technical analysis

Before we move ahead with the price analysis of SLP, here are a few insights that require attention:

- SLP reached an all-time high of $0.4191 on May 1, 2021.

- SLP’s all-time low price was $0.002076, which surfaced on Dec. 19, 2022.

Below is the daily chart of Smooth Love Potion or SLP, indicating a clear pattern, as identified in 2022:

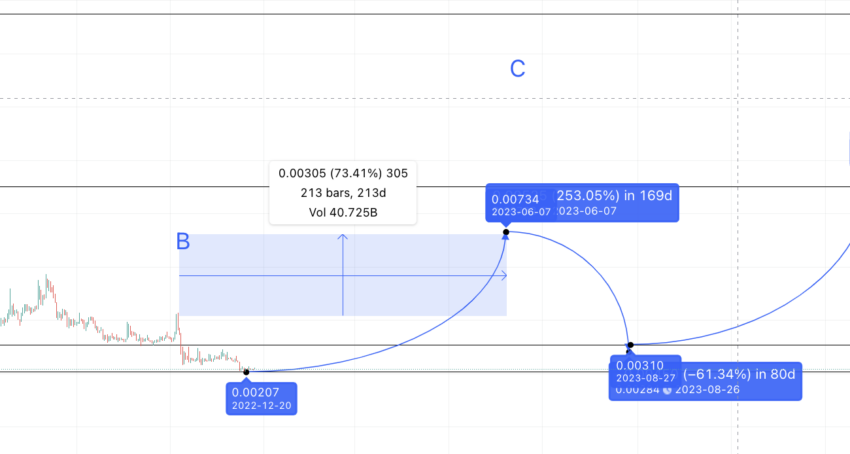

Pattern identification

SLP makes a swing high followed by a rounded bottom or a rounded floor. This is followed by another swing high. Here the peak is lower, and the distances between the lower highs increases. Post that, another range-bound bottom is formed, after which we have another high.

Now our job is to find the next set of highs, assuming that the swing high pattern persists.

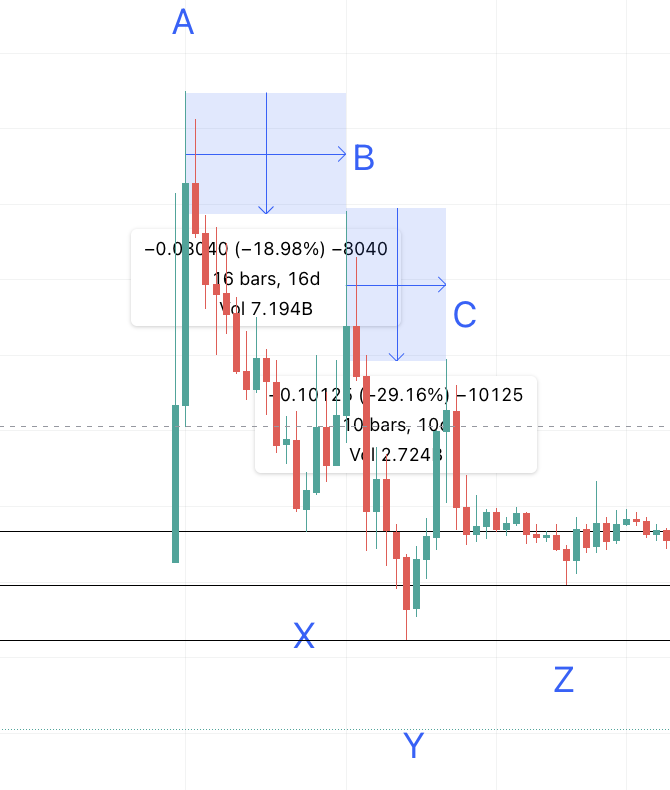

Swing-high pattern 1: price change

Let us mark the first pattern highs and lows as follows:

Now we can mark the distance between any high and the next low, a low and the next high, and the highs, using three separate tables:

- High to low (data set 1)

A to X = 12 days and -68.64% price change; B to Y = 6 days and -82.19% price change; C to Z = 12 days and -60.46% price change.

- Low to high (data set 2)

X to B = 4 days and 158.08% price change; Y to C= 4 days and 304.34% price change

- High to high (data set 3)

A to B = 16 days and -18.98% price change; B to C = 10 days and 29.16% price change

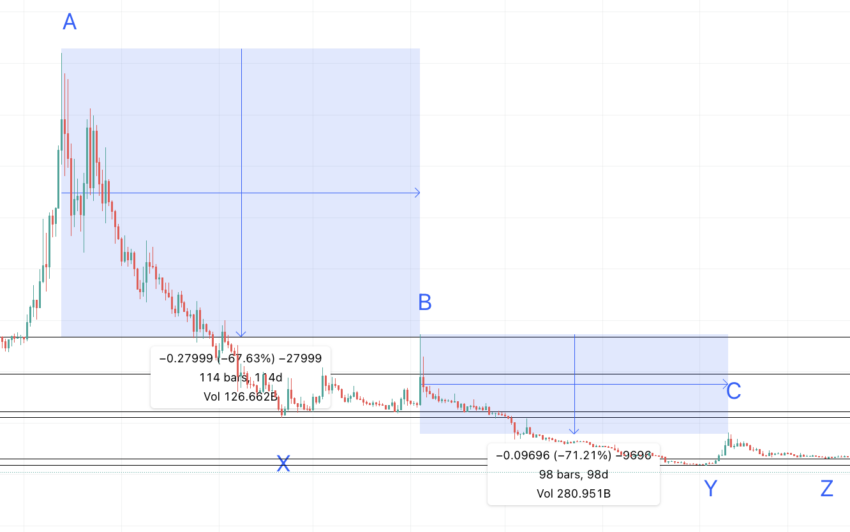

Swing-pattern 2: price change

Now, we move to the second pattern, where the swing highs are placed far from the previous peaks. Note that we have used the same markers (A, B, C, etc.) for a better understanding.

- High to low (data set 4)

A to X = 70 days and -86.77% price change; B to Y = 91 days and 94.93% price change; C to Z = 32 days and -63.12% price change

- Low to high (data set 5)

X to B = 45 days and 150.5% price change; Y to C = 7 days and 400.9% price change

- High to high (data set 6)

A to B = 114 days and -67.63% price change; B to C = 98 days and -71.21% price change

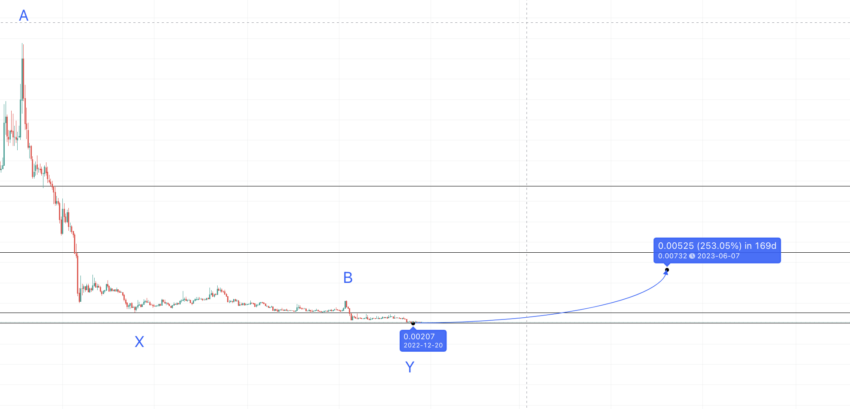

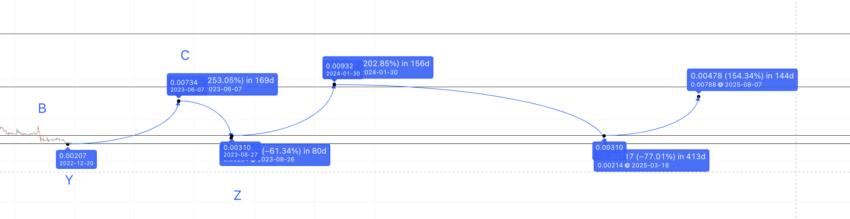

Swing pattern 3: finding the next level

Looking at the third pattern, A, X, B, and Y are clearly marked.

Using the low-to-high tables from pattern 1 and pattern 2, the average low-to-high distance is four days in pattern 1 and 26 days in pattern 2. Hence, the time taken for low to high is growing by 6.5 times.

Therefore, the next low to high, Y to C, should be in 26 x 6.5 = 169 days.

Also, the average price change in pattern 1 is 231.19% and in pattern 2 is 275.47%. Therefore, the average is 253.33%.

So the next point, C, is in 169 days from Y and at a high of 253.33%. The drawn forecast line puts that at $0.0073 and on June 7, 2023.

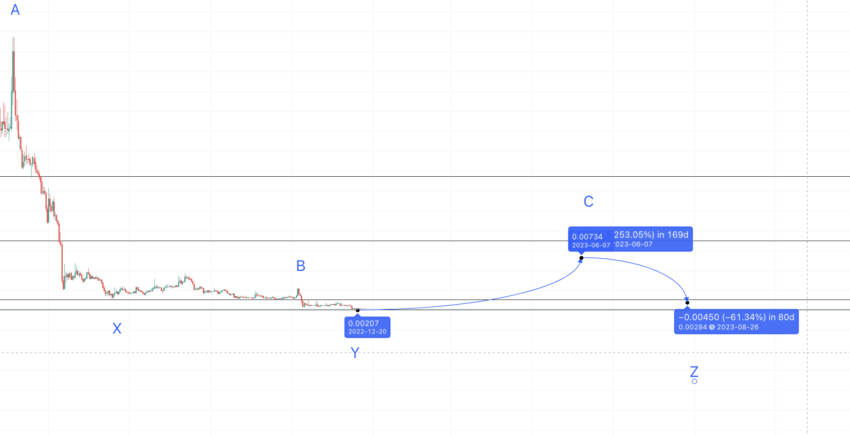

Smooth Love Potion (SLP) price prediction 2023

Read on to know what price levels we predicted for SLP in 2023 and how that sets the theme for 2024, as we expect the bulls to arrive:

The previous Smooth Love Potion price prediction calculation puts the 2023 high at $0.0073. This point should be marked C, as per the previous patterns. Also, note that SLP should defeat the swing high pattern by this time as C is higher than B. This means we can expect a rally of sorts.

Now, we need to locate the next low, using the high-to-low average from the pattern 1 and pattern 2 data sets. We can now find the path from C to Z.

C to Z as per pattern 1: 12 days and a drop of 60.46%.

C to Z as per pattern 2: 32 days and a drop of 63.14%.

The price drop is consistent, but the timeframe increases by 2.5 times. Hence, the next low or the new Z should be in (32 x 2.5) = 80 days and at a low of 61.80%

The forecast line puts the same at $0.00284, which SLP is expected to reach anytime in 2023.

Smooth Love Potion (SLP) price prediction 2024

Outlook: Bullish

The next step is the find the distance from Z to the next A or the last low of a pattern to the first high of the new pattern. Let us see where the levels end.

Z to A (pattern 1 to pattern 2): 35 days and a growth of 315.83%

Z to A (pattern 1 to pattern 2): 21 days and a growth of 91.35%

The average here comes to be: 28 days and 203.59%

Keeping these calculations in mind, and the expected price level for the next high intact at $0.0073, we can expect the SLP price prediction 2024 level to hit resistance at $0.0094.

Projected ROI from the current level: 150%

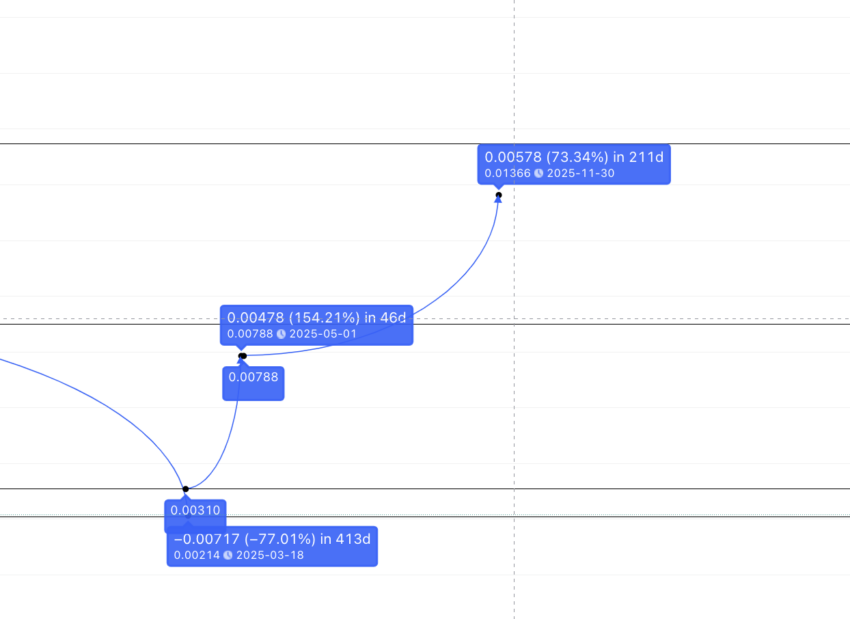

Smooth Love Potion (SLP) price prediction 2025

Outlook: Bullish

Calculation: the low in 2025

So from the low of 2023, the next point can be at $0.00939. Also, as we can expect the bear market to continue, this high can surface in 2024 instead of late 2023. This point can be the new A.

Now, this might start a new pattern. To locate a low, we must refer to the high-to-low data sets from pattern 1 to pattern 2.

A to X (Pattern 1): 12 days and -68.64%

A to X (Pattern 2): 70 days and -86.77%

The time increases by six, whereas the percentage drop is more or less consistent:

Therefore, the next low can be in 420 days (approximately) and at a low of 77.70%. The forecast line places the point at $0.00214 or the new X. However, in an uptrend, SLP tokens can respect the support level of $0.00308. Hence, that can be low as per the SLP price prediction 2025 model.

Calculation: the high in 2025

Now, the next high, or X to B, can be calculated using the data sets from pattern 1 and pattern 2:

X to B (pattern 1): 4 days and a growth of 158.04%

X to B (pattern 2): 45 days and a growth of 150.05%

The distance increased by 11 times. However, that was in the bear market. Therefore, we can take the higher limit of 45 days as the next distance for the high. The average percentage change comes to 154.05%.

The line surfaces at $0.0078 or the new B. Therefore, by this time, we can expect another lower high and some correction by this time. However, after B, we can also expect C.

In pattern 3, C was at a higher level than B, by 73.41%, and in 213 days. If we use the same percentage gain and distance, the high in 2025 can surface at $0.01366.

Projected ROI from the current level: 227%

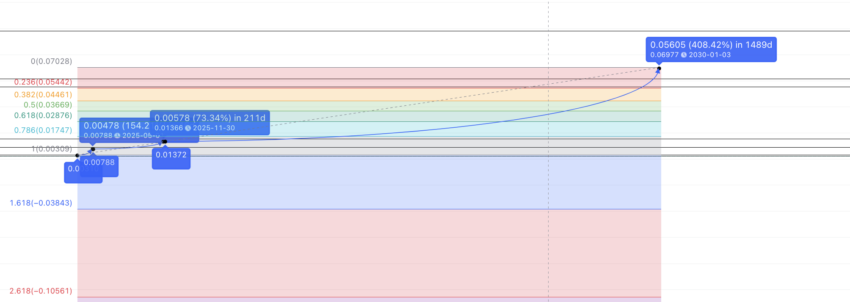

Smooth Love Potion (SLP) price prediction 2030

Outlook: Bullish

If we use the 2025 high and the previous low X, we can find the long-term price of SLP tokens using the Fib indicator.

If the same slope, adoption, and growth in play-to-earn games persist, we can expect SLP to reach $0.069 by 2030.

Projected ROI from the current level: 1542%

Smooth Love Potion (SLP’s) long-term price prediction until 2035

Even by 2030, SLP will not reach close to its all-time high. Therefore, potential investors might want to consider a longer-term Smooth Love Potion price prediction. Below is a table that might help.

You can easily convert your SLP to USD

| Year | | Maximum price of SLP | | Minimum price of SLP |

| 2024 | $0.00939 | $0.00295 |

| 2025 | $0.01366 | $0.00308 |

| 2026 | $0.01912 | $0.00956 |

| 2027 | $0.0286 | $0.0143 |

| 2028 | $0.0430 | $0.0266 |

| 2029 | $0.0516 | $0.03192 |

| 2030 | $0.069 | $0.0427 |

| 2031 | $0.0897 | $0.05561 |

| 2032 | $0.1076 | $0.0667 |

| 2033 | $0.1399 | $0.0867 |

| 2034 | $0.2098 | $0.1636 |

| 2035 | $0.3147 | $0.245 |

How accurate is the SLP price prediction?

This SLP price prediction model doesn’t assume prices will peak immediately after calculation. Instead, it takes detailed price patterns into consideration. It considers current volatility, adoption of play-to-earn games, trading volume changes, and other factors to determine the investment potential of SLP.

Finally, this SLP price prediction piece takes the bullish and bearish cycles of the crypto market to project long-term price levels of this in-game utility token. Hence, we can say that it is as accurate as possible, considering the volatility of the market we are predicting.

Frequently asked questions

Will SLP go up 2024?

Will SLP price go higher?

What will SLP be worth in 2030?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.