The MATIC price appreciated by over 5% in 24 hours, but the $1 resistance remained a key turning point that still has to be overtaken.

Fresh gains reignited the crypto market’s hopes for a recovery, with altcoin price action turning green on the daily charts. Polygon (MATIC), the tenth-ranked cryptocurrency by market cap, traded at $0.9176 at the time of press, a gain of 5.41% in the past 24 hours.

The recent MATIC gains have left Polygon investors yearning to break back above the $1 level that it lost last month. Will MATIC be able to reclaim the crucial $1 level before the end of 2022?

Polygon NFT sales spike

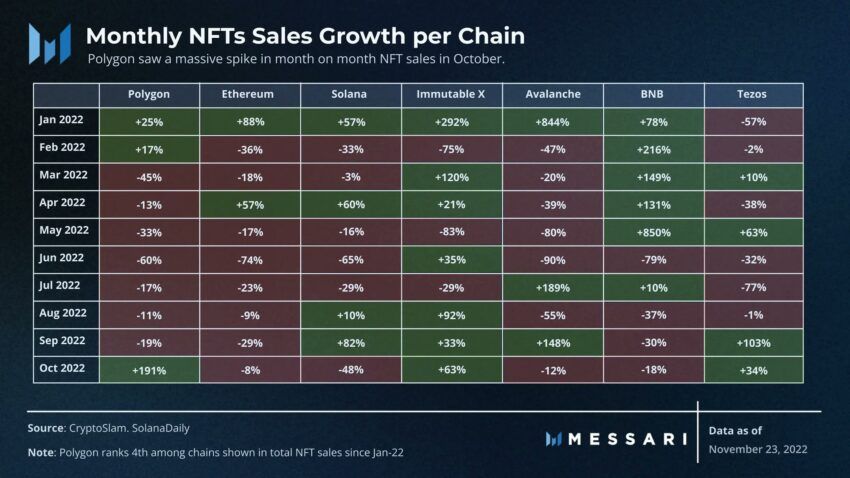

Crypto analytics firm Messari recently pointed out that Polygon saw a 191% increase in NFT sales since the end of September. Starbucks, Reddit, and Meta, began integrating Polygon, and this aided the growth of the platform’s NFT landscape.

Polygon’s NFT growth overshadowed similar metrics from most of its competitors like Ethereum, Avalanche, and Solana.

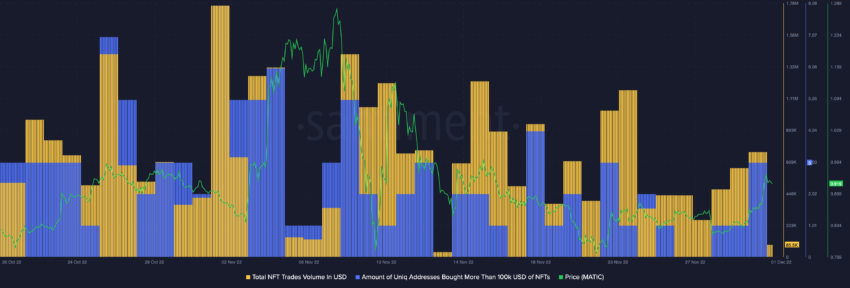

A look at the Polygon NFT indicators suggested that NFT trade volume was witnessing growth. The past three days saw a slight rise in the NFT trade counts while the number of unique addresses that bought more than $100,000 worth of NFTs was also rising.

Assessing the odds of a MATIC rally

In November, the price of Polygon declined below the $1.00 support zone after making a multi-month high of $1.30. However, as December kicked off, daily trade volume pumped by 92% to $511 million.

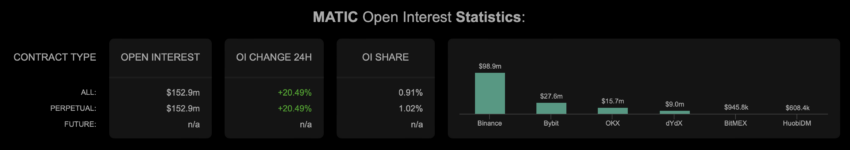

At the time of press, the MATIC price had broken above the $0.85 support zone and the 100-day simple moving average, suggesting a bullish outlook. Furthermore, MATIC’s open interest jumped by over 20% in the last 24 hours.

Despite the spike in open interest, funding rates were still negative, which could spell trouble for bulls. However, $1.2 million MATIC short liquidations took place so far today. This might dissuade bears from opening up further risky shorts positions.

According to the In/Out of Money Around Price metric, MATIC has strong support at the $0.89 mark, where 22,330 addresses hold over 680 million MATIC.

Furthermore, there didn’t seem to be many supply barriers ahead until the $1.04 mark, meaning that a move back over $1 is probable. However, a short-term reversal may first take MATIC to retest the IOMAP level at $0.89.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.