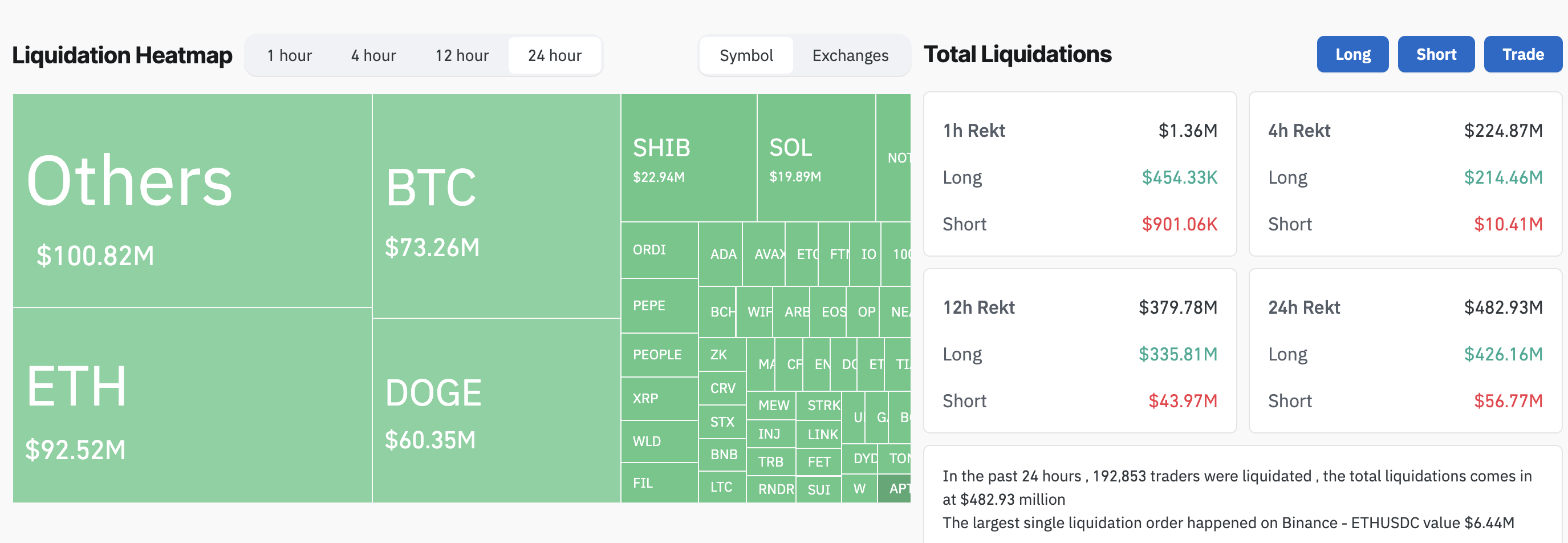

In a dramatic 24-hour period, the crypto market saw a severe downturn, erasing nearly half a billion dollars from traders’ portfolios due to forced liquidations. Bitcoin (BTC) plummeted to $64,569, and Ethereum (ETH) dropped to $3,355, triggering over $482 million in liquidations.

This impact was most severe on long positions.

Crypto Traders Speculate That it is The Final Dip

During this market upheaval, mainstream and emerging digital assets alike suffered. The total number of traders affected reached 192,853.

Data from CoinGlass showed Ethereum as the hardest hit, with liquidations totaling $92.52 million. It was followed by Bitcoin and Dogecoin (DOGE), with $73.26 million and $60.35 million in liquidations, respectively.

Read more: How To Trade Crypto on Binance Futures: Everything You Need To Know

In an interview with BeInCrypto, Matteo Greco, the Research Analyst at Fineqia, discussed that crypto miners’ selling might have caused the recent market drawdown.

“Mining activity has been impacted by the recent Bitcoin halving, which reduced block rewards from 6.25 to 3.125 BTC. This event forces miners to optimise their capital efficiency to maintain profitability, initially causing a significant decrease in profitability as rewards are halved from one block to the next,” Greco told BeInCrypto.

The largest single liquidation event took place on Binance, where a trader lost $6.44 million on Ethereum long trade. This highlights the volatile and speculative nature of the crypto market, especially in times of market stress.

Despite these challenges, Bitcoin demonstrated resilience, slightly recovering to $65,500. Ethereum also showed some recovery, trading at $3,440. This quick bounce-back is characteristic of the crypto market, reflecting its volatility and the swift actions of its investors.

Analysts and traders have mixed views on the market’s direction. Crypto Rover, a noted analyst, suggested that a surge to $73,000 for Bitcoin could liquidate over $10 billion in short positions. Meanwhile, trader ChimpZoo predicted a major market reversal.

“This is the final dip. This is the dip to bait every bear into the market. What comes next will be a liquidation candle to send bears back into the shadow realm,” ChimpZoo boldly stated.

Bitcoin ETFs Recorded $146 Million in Outflows

Outflows from Bitcoin exchange-traded funds (ETFs) further complicate the market scenario. According to Farside Investors, notable outflows were recorded from several funds. Fidelity’s Wise Origin Bitcoin Fund recorded outflows of $92 million, and the ARK 21Shares Bitcoin ETF recorded outflows of $50 million.

Conversely, the Bitwise Bitcoin ETF managed a modest inflow of $2.9 million, showcasing a mixed investor sentiment across different investment vehicles. Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) reported 0 flows. All the ETFs recorded a combined outflow of $145.9 million on Monday.

In an interview with BeInCrypto, Jag Kooner, the Head of Derivatives at crypto exchange Bitfinex, shed light on these ETF outflows.

“We had consecutive outflows for the past 3 trading days with over $550 million in outflows last week and $146 million in outflows on the first day of the current trading week.,” Kooner told BeInCrypto.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Kooner attributed these outflows to two main factors – ETF investors selling below their cost basis during periods of uncertainty and the unwinding of basis arbitrage trades. Moreover, significant outflows coincided with a $1.2 billion decline in CME futures open interest for BTC over the past 10 days, highlighting shifts in investor strategy amidst negative funding rates.